Gold has been prized for ages because of its innate beauty and brightness. As a result, gold has come to symbolize the sun in many civilizations.

Pure gold is extremely long-lasting. It’s the least reactive of all metals, it won’t corrode, rust, or deteriorate when exposed to oxygen or most chemicals. This makes it ideal for usage in jewelry and high-status goods where the value and polish must last indefinitely.

Gold can take on a variety of colors depending on how it’s alloyed with other metals. The purest gold (24-carat gold) has a brilliant, rich, and warm tone that no other metal can equal.

Higher Karat, Purer Gold.

The “Karat” is a measuring unit for the amount of gold in a piece in comparison to other metals present. A higher Karat indicates that your piece contains more gold.

Of course, the higher percentage of gold makes a piece more expensive.

Here’s how they are broken down:

- 24K: the purest form of gold (99.9%)

- 22K: it has around 91.6% gold, still very high-priced

- 18K: with 75% gold, it’s mixed with any other metals to make it more resistant

- 14K: 58.5% gold, it has a yellowish hue

- 9K: has 37.5% pure gold, making it the most common one in jewelry affordable pieces

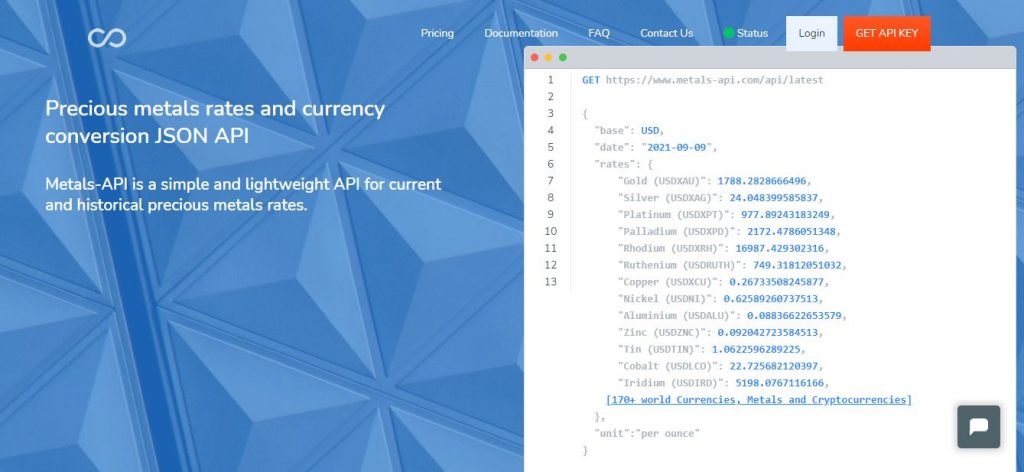

There are multiple APIs available online if you want to know about Gold Karat prices or any other metal. One of the most popular is Metals-API. It offers live and previous precious metals rates in an easy-to-use interface. This API obtains rates and quotes for precious metals like Gold, Silver, Palladium, Zinc, and other base metals in a range of currencies.

Metals-API.com gives API access to live precious metals market data with a resolution of 2 decimal points and a refresh rate every minute

Significant Advantages

- Hundreds of companies in the sector use this trusted API to get institutional-quality real-time precious metal pricing.

- Integrate real-time Gold and other metal prices into your spreadsheets, websites, mobile apps, and other business applications with minimum effort.

- Significantly reduce the time to market for apps that demand precious metal prices.

- You may avoid the difficulties and complexities associated with old feeds by using cloud APIs.

Main Characteristics

- Historical, immediate, and tick-by-tick API

- Precious and base metals real-time prices in many currencies

- Daily and past charts

- Spot and forecast prices of gold, silver, palladium, and platinum throughout history

Metals-API obtains market data prices from a variety of trade sources and global banks, with different types and frequencies. Commercial sources, particularly for major currencies and metals, are given a larger weighting because they more precisely reflect market exchange.

The “validation and fallback” mechanism assigns different priorities to each data source and validates each metal/forex rate to achieve the maximum level of coverage and correctness. If one source for this currency pair fails to get a trustworthy quote, the next highest provider is consulted. This helps to eliminate inconsistencies and deliver precise spot exchange rates to six decimal places for the great majority of currencies.