Tracking the metals market is easier than ever before. Find out about the APIs available for tracking precious metals for your business by reading this article.

The price at which a commodity or asset can be bought or sold at the present moment is referred to as its spot price. It is influenced by various factors such as economic conditions, political events, and market trends, and reflects the current supply and demand. The spot price, also known as the “cash price” or “spot rate,” is often provided in real-time in financial markets. It differs from futures prices, which represent the price at which a commodity or security can be purchased or sold at a future date.

Spot prices are used in a variety of contexts, including the stock market, the foreign exchange market, and the commodities markets for items like oil, gold, wheat, and shares of individual companies. The spot price, which can fluctuate significantly over time, is generally the most recent and relevant price for a specific commodity or investment.

Iron is a metal that is abundant in the Earth’s crust and is essential in the formation of many minerals. It is a strong, durable, and long-lasting metal that is used in the construction of buildings, bridges, and other structures, as well as in the production of products such as tools, appliances, and automobiles. Although it is not considered a precious metal like gold or platinum due to its relative abundance and lower rarity, iron is a critical industrial metal that is widely used in a range of applications and has a significant impact on the world economy.

The price of iron is influenced by numerous variables including global demand, supply, and monetary conditions. The cost of iron ore, the primary ingredient used to make pig iron, has fluctuated significantly in recent years. In general, the supply and demand for metals, as well as the state of the world economy, politics, and other factors, all have an impact on the price of iron. This is why many companies use a Metals API to access real-time data.

Why Should Businesses Use A Precious Metals API?

An API, or application programming interface, is a set of guidelines and protocols that enables information exchange and communication across different software systems. These rules make it possible for various software programs to share information and features, allowing for faster data transfer and communication between platforms. For example, a financial software program might use an API to retrieve real-time stock market data and display it.

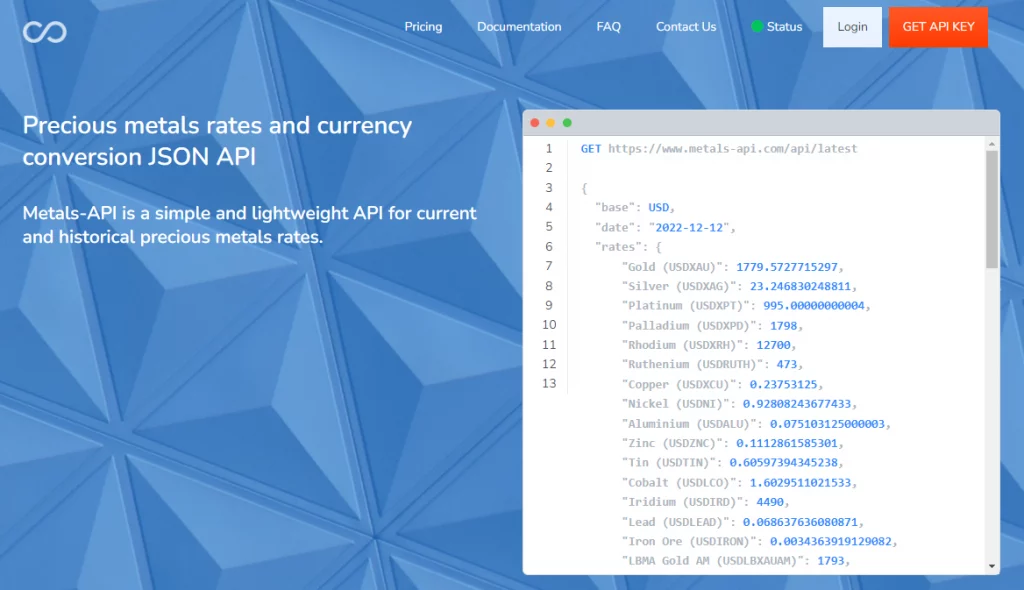

Many businesses whose revenue is affected by the price of certain metals use APIs to access real-time data and integrate it into their platforms. This data can be used to provide more detailed information and can be accessed through graphs with some APIs, such as MetalsAPI.

More About MetalsAPI

MetalsAPI is a platform that is designed to make trading in precious metals easier. It offers access to a range of data sources, including historical market data, spot prices, and pricing for major precious metals. This API is useful for businesses that trade in precious metals, work in the industry, or simply have an interest in this market. It was created using programming languages and has a restful interface, allowing businesses to use it as a starting point for their own data service or incorporate it into more complex business applications.

This is a wonderful tool, that works with AI providing excellent performance. It is compatible with most programming languages like JavaScript, JSON, or Python, among others.

Don’t hesitate and try MetalsAPI!