When you need to access complex information about metals, it has never been easier. Discover why you should use a metal pricing API to power your market data feed.

In recent years, trading has become a prevalent activity and has played a significant role in the economy. One form of trading that is commonly seen in the metals market is spot trading, which allows for the immediate exchange of actual metals between buyers and sellers. This type of trading is important for the global metals market because it ensures that there is a sufficient supply of metal to meet the demands of various industries.

Iridium is a valuable metal that is often included in investment portfolios as a way to protect against inflation and other economic risks. It is also used as a stable asset during times of economic uncertainty due to its ability to maintain its value over time. The price of iridium can fluctuate based on market conditions and other factors, and it is often priced based on the current market value of other precious metals such as gold and platinum. Iridium is traded on commodity exchanges globally, including the London Metal Exchange and the Shanghai Futures Exchange.

Iridium is a metallic element that is traded on the metals market along with other industrial and precious metals. It is a rare, shining, silvery-white metal known for its excellent corrosion resistance. This metal has a variety of important industrial uses, including the production of electrical contacts, engine components, and other electrical components, as well as serving as a catalyst in the manufacture of sulfuric acid. Iridium is also used to create alloys such as the iridium-platinum alloy, which is used to make high-temperature furnaces and other industrial equipment.

Due to its consistent value, iridium is often used as an investment during times of economic uncertainty. Many companies need up-to-date information on the prices of these metals for trade or investment purposes. In recent years, technological advancements such as the Precious Metals API have greatly streamlined this process.

What Are The Precious Metals APIs?

Software development interfaces, also known as digital tools, are APIs. Their purpose is to connect two software applications by creating a lasting connection to an external data source. APIs make it easy to access reliable information, and the amount of data available can vary depending on the API.

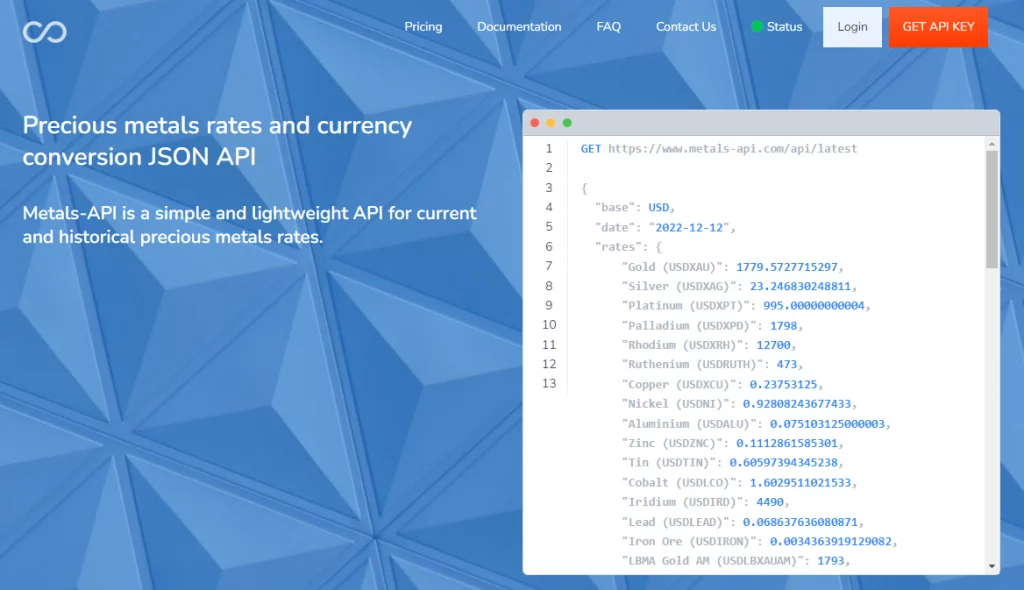

Precious metals APIs allow connections to financial institutions and markets around the world, making them essential for making informed investment decisions and staying up-to-date on the latest information. There are many APIs available, each with its own unique features. One highly recommended API for precious metals is MetalsAPI, which offers information from major markets worldwide.

More About MetalsAPI

MetalsAPI is a widely used tool in the financial industry that allows for easy access to accurate spot prices for various metals in the market. Its extensive database allows users to retrieve information from major global markets such as the LBMA and the World Bank. A wide range of metals are available for consultation, including Nickel, Iridium, Copper, Gold, Platinum, and Titanium, among others.

This API is user-friendly and easy to integrate into any platform, as it is compatible with most programming languages and boasts excellent performance that is constantly improving thanks to the use of advanced AI technology. With MetalsAPI, staying up-to-date on the latest information in the metals market has never been easier.