You could be a click away from information on metal prices. An API is a great tool for enhancing your ability to predict the price of precious metals. Read this article and know how you could work with one.

Over the recent few decades, trading has become increasingly common and has become quite important to the economy. Spot trading is a common practice in the metals market since it allows buyers and sellers to trade actual metals in a quick and efficient manner. Since it facilitates the flow of metal between buyers and sellers and guarantees that sufficient amounts of it available to meet the requirements of various sectors, it is an essential component of the whole global metals market.

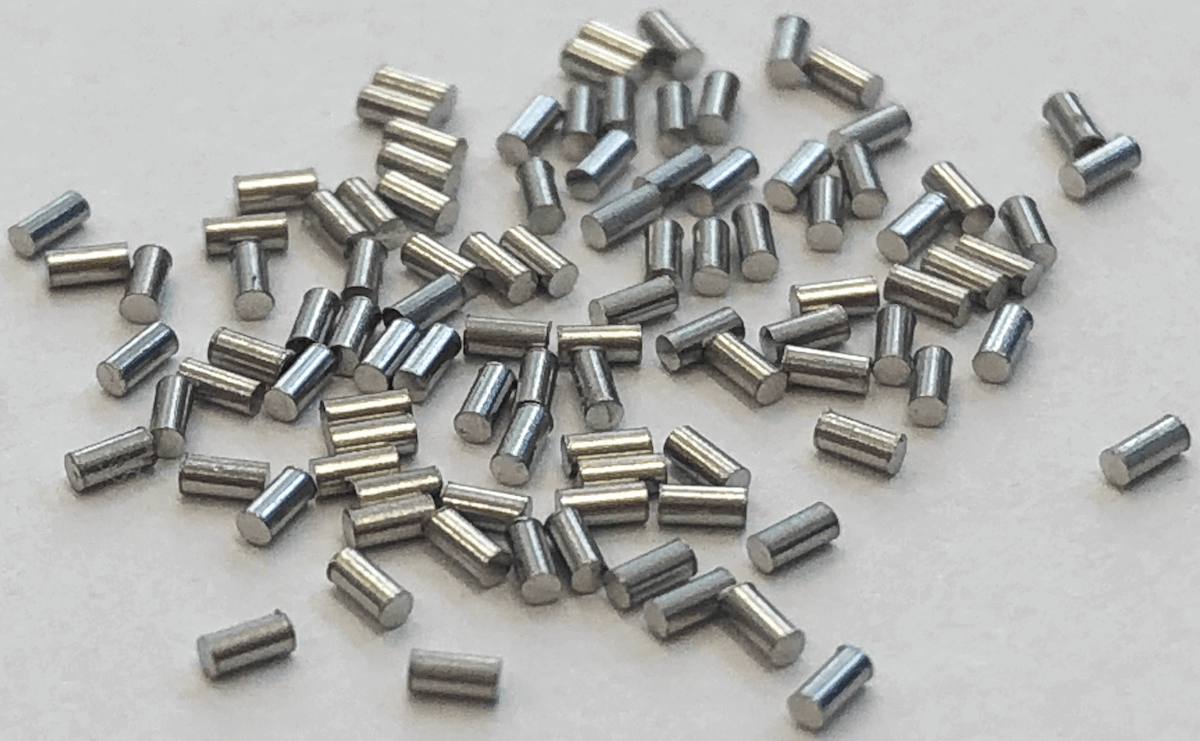

Iridium is considered a precious metal, and it is often included in investment portfolios as a hedge against inflation and other economic risks. It is also used as a store of value in times of economic uncertainty, as it has a long history of maintaining its value over time. The price of iridium varies depending on market conditions and other factors. It is typically priced based on the current market price of other precious metals, such as gold and platinum. Iridium is traded on commodity exchanges around the world, including the London Metal Exchange and the Shanghai Futures Exchange.

Iridium is a metal that is traded on the metals market together with other industrial and precious metals. A priceless, shining, silvery-white metal with excellent corrosion resistance is iridium. This metal has a wide range of important industrial applications. It is used to create electrical contacts, engine components, and other electrical components as well as a catalyst in the manufacture of sulfuric acid. Iridium is also used to build alloys such as the iridium-platinum alloy, that are employed to produce high-temperature furnaces and other industrial gear.

This metal is widely used as a type of investment during challenging economic times due to its consistent value. Many firms need up-to-date information on these metals’ prices for trade or investment purposes. These days, technical developments like the Precious Metals API have substantially streamlined this procedure.

What Are The Precious Metals APIs?

Software development interfaces, sometimes known as digital tools, are APIs. The purpose of an interface is to connect two software applications. This is the way integrating an API makes a lasting connection to an alternative data source. It doesn’t take long to locate reliable information. Depending on the API, you might access far more and fewer categories and historical data.

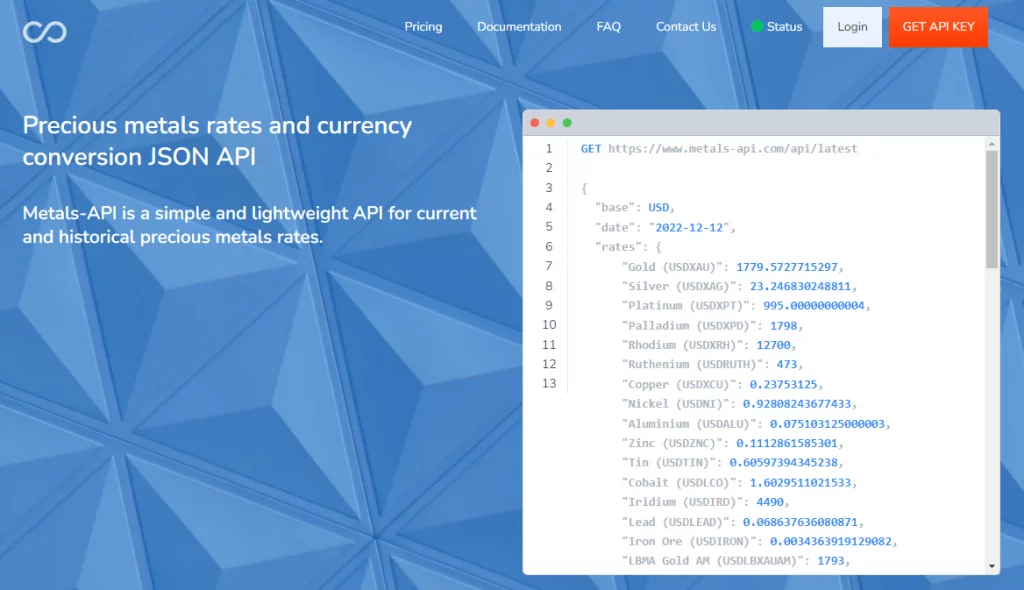

Precious metals APIs enable connections to financial institutions and markets all around the world. They are crucial for making well-informed decisions and for having access to up-to-date information for investing. As you may anticipate, there are numerous APIs available, each of which is distinct. Following a search, we recommend MetalsAPI, a specialist tool with information from the most important markets worldwide.

More About MetalsAPI

MetalsAPI is a tool that is often used in the financial business. Thanks to this application, getting factual info about the spot prices in the metals market is now easier. Thanks to its incredible database, you can receive information from significant global markets like the LBMA and the World Bank. There will be a large variety of metals available for consultation, including Nickel, Iridium, Copper, Gold, Platinum, and Titanium, among many others.

This API is fairly easy to use. Because it is consistent and works with most computer languages, integrating it into any platform will be simple. Additionally, it offers perfect performance that is continuously improving because it makes use of the most cutting-edge AI technology. You’ll be amazed by the outcomes once you apply it. Why wait to find out the most recent metals market information? Try out MetalsAPI!