Do you want to get data safely and quickly? Use this metals rates API! Read this article and learn how to do it!

Precious metals are regarded to be an excellent portfolio diversifier and inflation hedge; however, gold, the most well-known of these metals, is not the only one available to investors. Silver, platinum, and palladium are all precious metals that may be added to your portfolio, and each has its own set of risks and rewards.

Investors can acquire access to actual metal through the futures market, metal ETFs and mutual funds, and mining company equities, in addition to owning real metal. There are a variety of ways to purchase precious metals such as gold, silver, and platinum, as well as a number of compelling reasons to join the treasure hunt. So, if you’re new to precious metals, keep reading to understand more about how they function.

Precious metals provide unique inflationary protection due to their inherent worth, lack of credit risk, and inability to be inflated. That implies you won’t be able to print any longer. They also provide true “upheaval insurance” for financial and political/military disruptions.

Precious metals have a low or negative correlation to other asset classes such as stocks and bonds, according to investing theory. This means that even a modest amount of precious metals in a portfolio can minimize risk and volatility.

Every investment has its own set of dangers. Investing in precious metals carries considerable risk, despite the fact that they provide a certain level of security. Due to technological inconsistencies, metal prices may fall (more sellers than buyers). With that said, we highly recommend you Metals-API

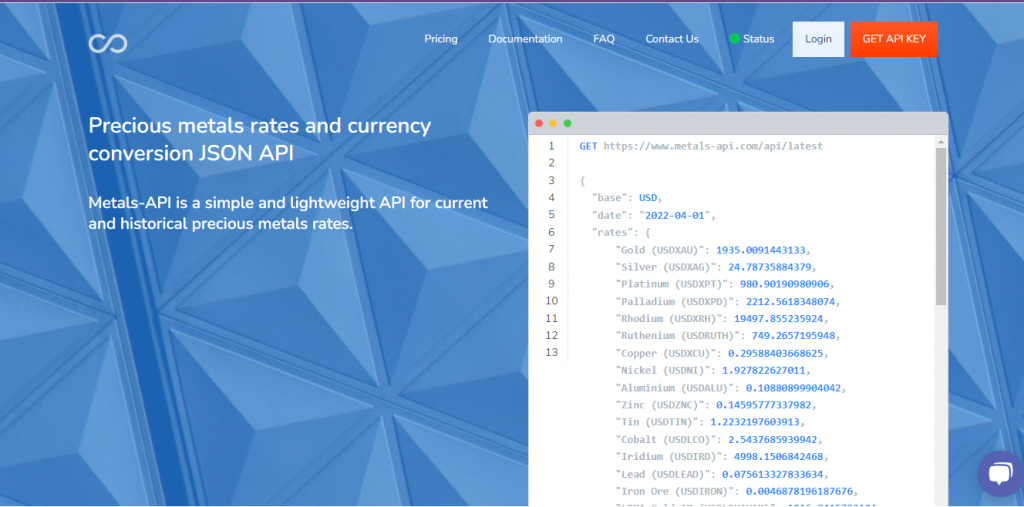

Get To Know Metals-API

It’s a simple program that allows you access to historical and contemporary precious metals prices from banks. The Metals-API, which is developed on top of a strong back-end architecture, can provide precious metals exchange rates, convert single currencies, and provide Time-Series and Fluctuation data.

How Does The Platform Operates

Metals-API It is simple to work with. All that’s left for you to do now is to follow the steps below:

• Go to the website and create a user account.

• Decide on a currency and metal to check

• Make an API request from the dashboard, and the app will respond with an API response, and you’re ready to go!

A Safe Platform

Metals-API uses 256-bit SSL encryption for security. This sort of encrypted communication is commonly used by financial organizations. The 256-bit SSL encryption security level encrypts and decrypts data transferred between the user’s browser and the website server using a 256-bit long encryption key. It was formerly thought to be the safest route.

Credible Data

The API from Metals-API can offer real-time commodity data with a granularity of two decimal points and a frequency of up to every 60 seconds. The site may offer exchange rates for almost any commodity, precious metals, single currency conversions, Time-Series data, and volatility information, among other things.