Are you worried about the international crisis? Do you feel that investing in the spot market is a bad idea? Well, it probably is. Therefore, we suggest you change your strategy and bet on the futures market using this precious metals API.

Precious metal prices fluctuate constantly based on supply and demand in world markets. They are used for different purposes depending on their properties. These are the nine most valuable and expensive metals in the world that accompany gold in the international ranking. The metal that stands out the most after gold is Rhodium, a rare, ductile, silver-colored transition metal that continues to rise in price. In fact, it is the most expensive precious metal in the world, much more than gold. Another metal is palladium, which is a transition metal of the Platinum group, soft, ductile, malleable and not very abundant. Its symbol is Pd and the atomic number is 46.

In addition to these, there are many more precious metals to highlight such as Iridium, Platinum, Osmium, Rhenium, Germanium, Ruthenium and Gallium. Although each one has very different characteristics and very different uses, absolutely they all share one characteristic, volatility. Many things can happen in the world, often unpredictable, that can affect the value of precious metals. Therefore, the futures market is an excellent idea. This is trading on future production of products at a price fixed in advance, risking on the real price that the specific product will obtain at the time of obtaining it. It is a risky bet but one that could be very useful.

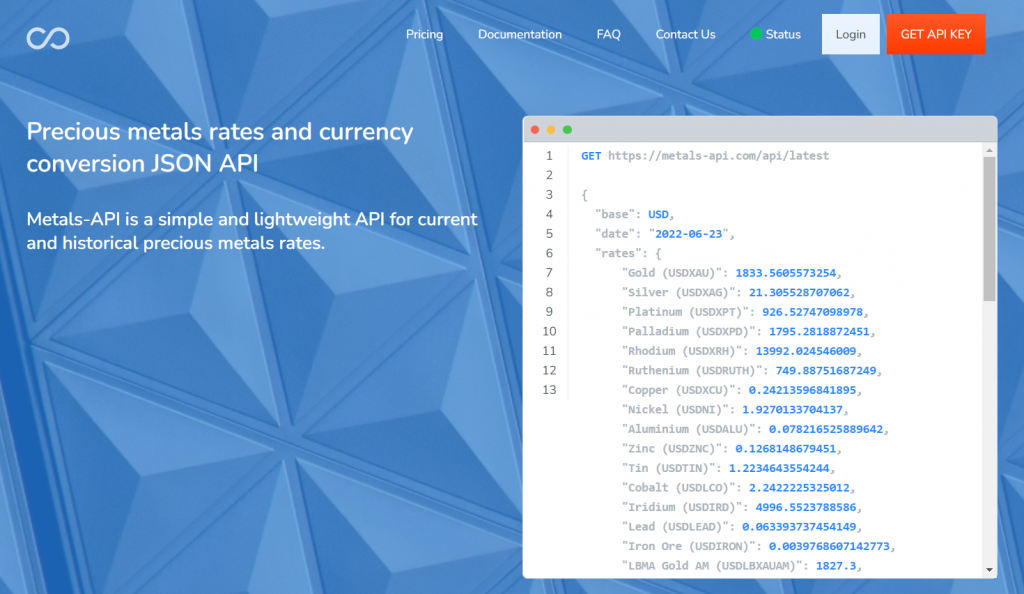

If you are looking for a platform to get precious metal prices, Metals-API is definitely your best option. Although it specializes in offering spot market prices for metals, it also offers futures prices.

Why Metals-API?

The fastest and most comprehensive service available is Metals-API. This is because to its quickness, dynamic interface, and ease of use (prices in real-time, with a precision of 2 decimal places and a frequency of up to every 60 seconds). However, the best thing that sets Metals-API out from the competition is its first-rate informational resources. Use reputable resources, such as the London Metal Exchange, CME Group, and, of course, the London Bullion Market Association (LMBA). And don’t worry about the legal tender; this API provides a system that allows you to view the prices in your own legal tender, such as the British pound, USD, Euro, Indian Rupees, Australian Dollar, etc.

Jewelers Mutual Group, Injective Protocol, and Metex are a few of its clients, among others. Precious metal exchange rates, time series data feedback, fluctuation data, and the lowest and highest price of any day are just a few of the capabilities of this amazing digital platform.

The cost is another intriguing aspect. Surely you think that you will have to spend a lot of money on this system, but it is not like that. You will be able to obtain the future prices of precious metals at fully accessible costs for all budgets. In fact, they offer 7 plans, each with different advantages and disadvantages, designed for each budget. Remember that prices are in US dollars and that all types of payment methods are accepted.