If you want to invest in metals most economically, here we got a recommendation. With the data provided by this API, you will be an expert in the metal market.

The war in Europe has once again become precious metals, the investment of preference for traders who want to safeguard their capital due to the collapse in financial markets, the increase in inflation, and the deterioration of the world economy. Since this circumstance, several gold and silver dealers have asserted purchases of precious metals have increased by more than 200%.

It confirms the role of gold and silver as resources that could be securely hidden away during times of conflict. The conflict has hurt the global economy and raised the price of necessities like steel. This situation threatens productivity expansion and drives up inflationary pressures.

Gold Scenario

The present predicament, according to specialists, is enticing people from everywhere in the globe to save assets like gold. This year, it has seen a sharp increase in price, reaching $2,070.44 for an ounce, a level quite comparable to what was witnessed during the pandemic in the summer of 2020.

This year already, the price of metal has climbed by around 10%. This is a result of Europe’s sharply rising gold consumption as a preservation asset. This increase in demand comes after a year in which Western countries’ consumption of the actual metal was especially strong. 1,124 tons of gold bars and coins were required in this respect last year. The most in the ten years prior. The value of the material has increased as a result of this requirement.

Situation With Other Metals

Palladium’s index increased more than 7% in the interim, reaching $2,665.99 per ounce, the highest level since August of last year. Russia is a big metal supplier, therefore it seems to sense that palladium prices will increase. The only thing that may stop it is the chance of a downturn, especially in Europe and Germany, which is a significant vehicle maker.

Russia is third in the globe for gold output, and Nornickel, a palladium and platinum manufacturer, is located in Moscow. Among other precious metals, silver increased 4.2% to $25.56 per ounce and platinum increased 2.7% to $1,121.10.

Consider Investing In Metal

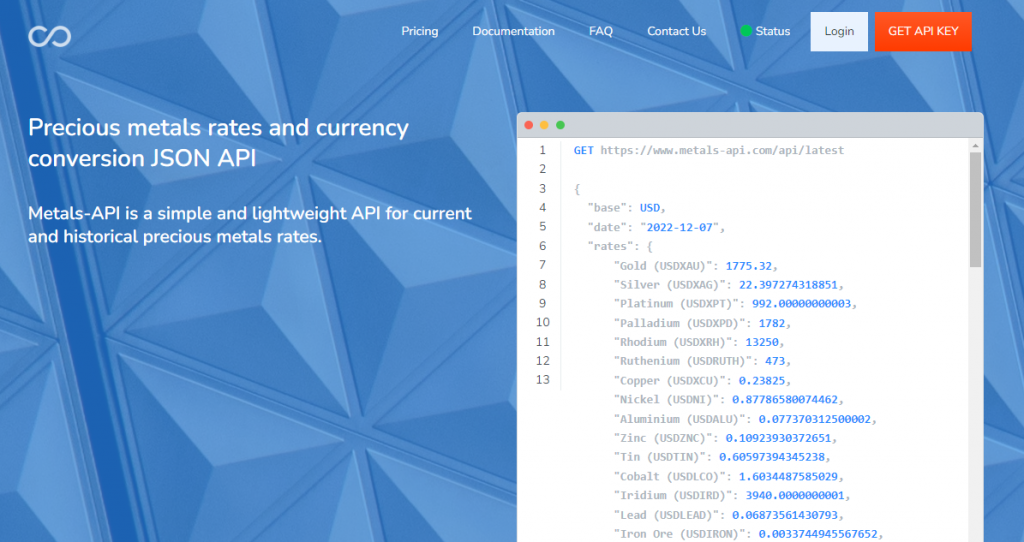

Given this complicated situation, it is best to acquire the necessary tools to develop into an authority in the metals industry. We wish to assist you here by providing an API that, due to its features, will be capable of updating instantly with the values of several metals.

For instance, you will be capable of considering every aspect that affects the metal sector thanks to Metals-API. You will be capable of gathering a sizable amount of information and providing the greatest analyses and reports. You as a trader can benefit from this, but you can also assist other traders and academics who are experts in the field. This is a form of API reply.

Why Metals-API?

For a variety of metals, Metals-API offers current pricing in addition to past rates and price volatility information. These facts are crucial if you intend to invest right now or in future deals in the international metals market.

It’s simple to incorporate in websites and mobile applications using a variety of programming languages. If you wish to create platforms that offer advice to investors worldwide, this is incredibly helpful. This API will help your metal company expand for this purpose.