The Indices API offers an invaluable tool for traders, providing real-time, accurate market data that is crucial for developing effective trading strategies. This API gives access to comprehensive indices data, empowering traders to make informed decisions based on up-to-the-minute information.

How to Use the Indices API for Accurate Market Data

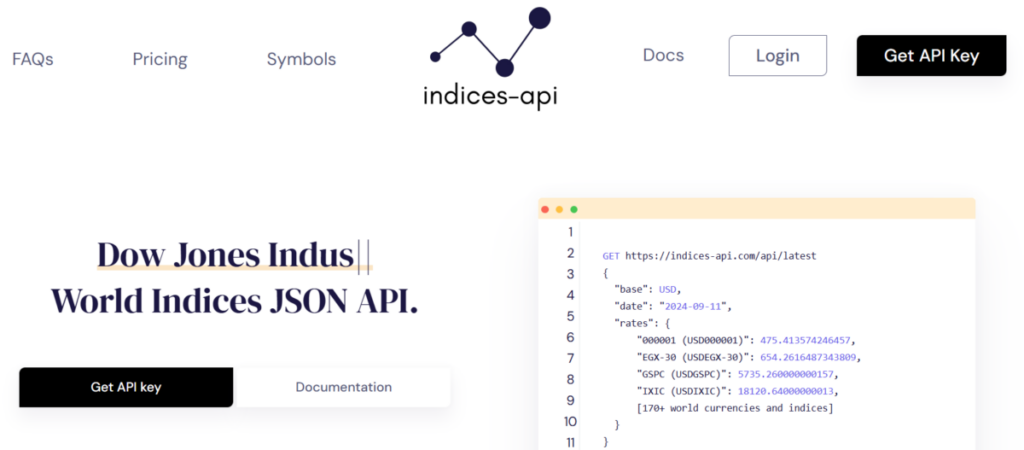

The Indices API is designed to provide seamless access to market indices from various exchanges. To use it, traders simply need to integrate the API into their trading platform or software. The API offers endpoints that deliver real-time data on major indices like the S&P 500, Dow Jones, and NASDAQ, along with global market indices from Europe and Asia. The data provided includes live market prices, historical data, and performance metrics, which traders can use to analyze market trends and make informed trading decisions.

The API is easy to implement, with clear documentation and sample code provided to guide developers through the setup process. Once integrated, traders can pull data into their trading tools, providing them with the most accurate and up-to-date information available.

The Importance of Real-Time Market Data for Traders

Real-time market data is critical for traders who need to make quick decisions in a volatile market. For example, stock prices can change in an instant, and without access to live data, traders may miss key opportunities or make decisions based on outdated information. The Indices API solves this problem by offering real-time access to the performance of key market indices, allowing traders to react to market movements as they happen.

With accurate, real-time data, traders can create and adjust their strategies on the fly. They can analyze index performance trends, spot patterns, and adjust their positions accordingly. The ability to access live indices data helps traders minimize risk and maximize their chances of success in the market.

Benefits of the Indices API for Enhanced Trading Strategies

The Indices API provides several key benefits that can significantly enhance a trader’s strategy:

Timely Decision-Making: With real-time data, traders can make decisions based on current market conditions, rather than relying on outdated or delayed information.

Comprehensive Market Coverage: The API covers a wide range of global market indices, including those from major stock exchanges in the U.S., Europe, and Asia. This helps traders stay informed about international market movements and diversify their portfolios.

Historical Data for Analysis: The API also offers historical market data, which is valuable for backtesting trading strategies and analyzing past performance. Traders can use this data to fine-tune their strategies and make more accurate predictions.

Improved Accuracy and Reliability: The Indices API provides reliable, accurate data sourced from reputable exchanges, ensuring that traders have access to the most up-to-date and trustworthy market information available.

Automation and Integration: The API can be integrated into automated trading systems, allowing traders to develop bots that execute trades based on real-time market conditions. This reduces the need for manual intervention and increases the speed and efficiency of trading strategies.

Conclusion

For traders who rely on accurate, up-to-the-minute market data, the Indices API is a game-changer. With its real-time data access, global market coverage, and ease of integration, it offers a powerful tool for enhancing trading strategies. By using the Indices API, traders can make informed decisions, improve the accuracy of their strategies, and stay ahead of market trends.