Businesses can no longer afford to overlook the connections between the dynamics of sales growth and fraud reduction. The likelihood of fraudulent acts likewise rises while sales are increasing. An API’s capacity to create a symbiotic relationship between these two elements is what makes it so beautiful. Fraud is reduced as sales increase, starting a positive feedback loop that improves the bottom line.

At the core of this transformation lies a Bank API, a technological shield that goes beyond mere transaction validation. It acts as a guardian of financial interactions, enhancing the security of transactions while enabling businesses to tap into new horizons of growth. This API isn’t just about numbers—it’s about enhancing the very fabric of online commerce.

Exploring the API’s Features for Maximum Impact

This type of API is more than a tool for basic validation; it’s a powerhouse of functionalities that can revolutionize the way transactions are processed. It offers a deep dive into the realm of security, employing cutting-edge mechanisms to ensure that each transaction is not just validated, but transformed into a secure, frictionless experience. The level of precision it achieves is nothing short of remarkable.

Implementation and Integration for Seamless Transformation

Integrating the API isn’t just a technical process; it’s a journey towards a seamless transformation. From the initial steps of integration to the moment decisions are made based on the validated data, this process holds the potential to uplift sales while building a robust defense against fraud. It’s a guide that businesses can follow to navigate the path of progress.

To truly harness the potential of the Credit Card Validator API, businesses need more than just technology—they need strategies. Crafting queries that ensure maximum sales conversion while detecting and preventing fraud is an art. It’s about finding that delicate balance where validation and revenue growth go hand in hand.

Credit Card Validator – BIN Checker API

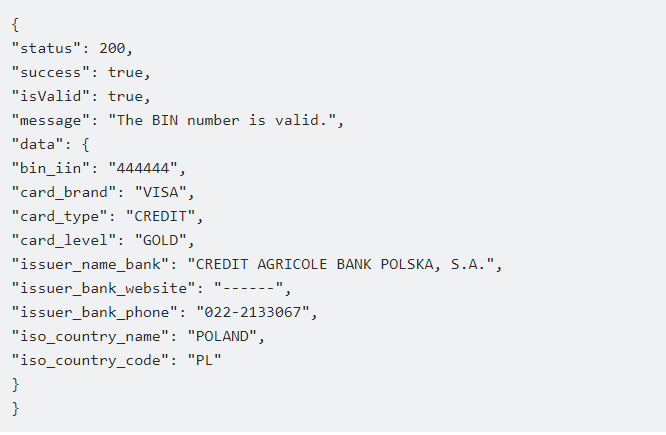

You can identify unauthorized credit card transactions by using this API. Utilizing BIN numbers, begin searching for each piece of information on credit and debit cards. To view all the information, the user must enter the BIN (Bank Identification Number) or IIN (Issuer Identification Number) of their credit or debit card.

To access all of this BIN/IIN information in JSON format, you must provide a BIN (Bank Identification Number), which is the first six numbers on a credit or debit card. You will be informed of the card’s type (Visa or MasterCard), expiration date, bank, and issue location.

The customer’s credit card information will be available to you, including the issuing bank, the issuing institution (AMEX, VISA, MC), the location of the card, and whether or not it is a valid credit card.

having the first six digits of a credit card’s BIN number available to validate any credit card. You will receive information regarding the Credit Card, CC Issuer, Card Type, Card Level, Card Brand, Issuer Country, and more. When determining whether to approve the payment or run a promotion, this API only considers the legitimacy of the credit card in addition to the bank and business information. The “BIN Checker” endpoint will reply to your query with the following statement following your API call:

Learn more about how to use the API by watching the video below!

It is simpler to determine the issuing bank or institution thanks to this CC Checker API. Therefore, whether you have special agreements with a certain bank may or may not affect your capacity to authorize the transaction.