Do you want to increase your customer satisfaction? If the answer is yes, we have the perfect API for you!

Customer satisfaction is extremely important for any company. This is because it can have a significant effect on their revenues and profits. In other words, the happier customers are, the more likely they are to buy from the same company again and again. However, not all companies have the same level of customer satisfaction. This is because some are better at satisfying their customers than others. For this reason, they are able to retain their customers more easily and increase their revenues.

Change is a constant companion in the business world, and a Bank API understands this dance. Its integration is seamless, adapting to the rhythm of existing operations without disrupting the flow. The API becomes a versatile tool that complements business processes, enhancing rather than hindering.

Preventing Fraud and Chargebacks: Safeguarding Your Business

In the shadowy realm of financial transactions, the specter of fraud and chargebacks looms large. This API stands as a sentinel, guarding businesses against these threats. It’s not just a preventive measure; it’s a strategic defense that safeguards the integrity of financial exchanges.

Chargebacks are the unwelcome guests of the financial world, draining resources and eroding profits. An API counteracts this menace by minimizing chargebacks, thereby safeguarding both money and reputation. It’s a proactive strategy that strengthens the financial fortress of businesses.

Time, the elusive commodity, finds its ally in the form of real-time validation. It thrives in the realm of immediacy, validating transactions in the blink of an eye. This real-time validation not only ensures accuracy but also accelerates transactions, saving precious moments in the whirlwind of business.

Credit Card Validator – BIN Checker API

Using this API, you can spot fraudulent credit card transactions. Start looking for each piece of information on credit and debit cards using BIN numbers. The user needs to input the BIN (Bank Identification Number) or IIN (Issuer Identification Number) of their credit or debit card in order to view all the information.

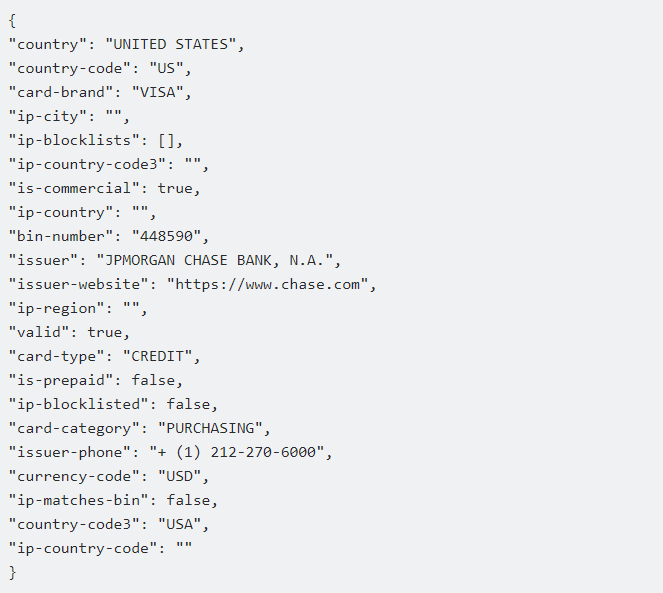

You must input a BIN (Bank Identification Number), which is the first six numbers on a credit or debit card, in order to access all of this BIN/IIN information in JSON format. The card’s type (Visa or MasterCard), expiration date, bank, and issue location will all be disclosed to you.

You will have access to the customer’s credit card details, including the issuing bank, the issuing institution (AMEX, VISA, MC), the card’s location, and whether or not it is a legitimate credit card.

The first six digits of the BIN can be used to secure credit card information. There won’t be any security holes as a result. This API only takes into account the legitimacy of the credit card along with the bank and business information when deciding whether to approve the payment or run a promotion. Following your API call, this endpoint will respond to your inquiry with the following message:

Watch the video below to see how to use the API:

This CC Checker API makes it easier to identify the issuing bank or institution. Therefore, you may or may not be allowed to approve the transaction depending on whether you have certain arrangements with a given bank.