Do you need to find the price of XauUSD and all that you need about metals? You can discover it with a single API! Here we talk about it.

XauUSD reffers to gold in dollars. One of the most well-known precious metals is gold. It is a non-reactive element. It belongs to the chemical group known as “transition metals.” Nuggets of gold are typically discovered underground in alluvial deposits. Additionally, there are tiny concentrations that are found and used for mining purposes, either alone or in combination with other minerals in alluvial deposits.

Given that it represents wealth, it plays a vital part in human civilization. Additionally, it has a significant symbolic function in various countries, like India, one of the biggest importers of this metal.

Because of this, it has been used to sustain many national currencies, whose value was initially determined by the gold reserves of the Central Bank of that nation. In addition for awards, jewelry, and patriotic symbols people employ gold.

Current Gold Situation

The price of gold has fallen by almost 1.6% since the start of the week to reach $1,770 per troy ounce. The primary precious metal is showing signs of weakness after a failed retest of the $1800 resistance level, and more loss is likely.

It is important to remember that the decrease in gold prices started in December. It happened immediately following the release of an unexpectedly positive report on the US labor market for November. In contrast to the forecasted 4.6% rise, annual pay growth came in at 5.1%.

In other words, the positive US job market statistics should have made the local US currency stronger, which would have placed pressure on gold prices. However, the US dollar will continue to expand over the long run as the sustainability of the country’s low inflation rate is once more called into doubt.

The yield on ten-year US government bonds increased significantly from 3.47% to 3.63% as soon as the US job market figures were released. Due to the stronger US dollar, gold will likely experience a pullback to the lows of last week of $1730–1740 per troy ounce. Unluckily, such a pullback might portend a deeper decline to the support level of $1690-1710 per troy ounce for the market in precious metals.

Why Must You Use An API?

As we can see, this metal is included among the most important businesses and assets in the world. That is why it is very necessary to keep track of their behavior and the factors that influence it. For this reason, any investor or who needs it for their industry must take all this data into account. Likewise, you must daily contemplate its value.

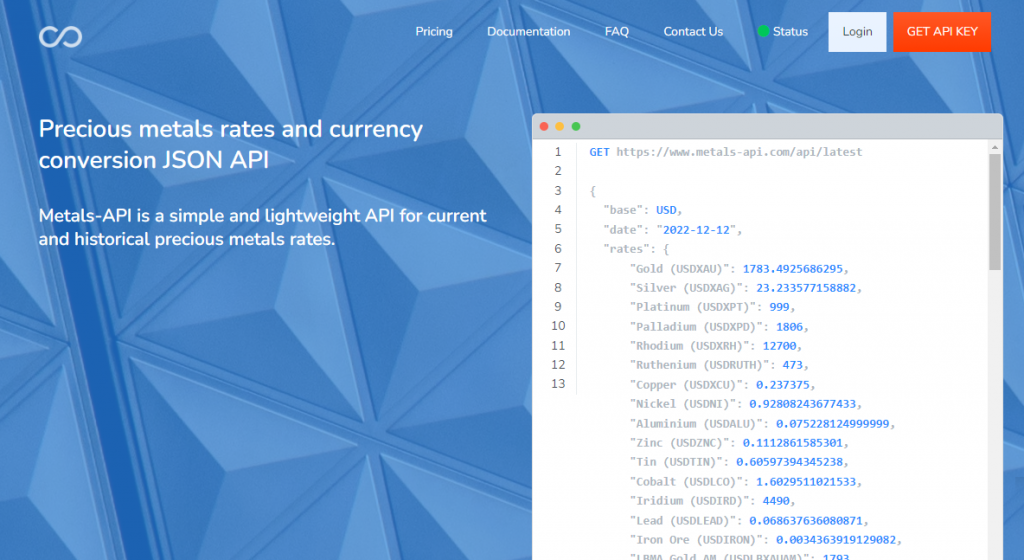

For this very reason, we want to recommend the use of an API. Both because it can update data constantly, and because of its ability to include data in web pages and apps. An API connects software to transfer data. Metals-API updates information on this and other metals daily and also allows you to see historical prices so you can evaluate the behavior of the metal. An example of the API response is something like this:

About Metals-API

The metal and mining market is one of the most important in the world. That’s why there are investors and also millions of investor advisors around the world. If you are an investor or advise them, you must stay informed with the most up-to-date prices.

With Metals-API you can see the metals you want in the currency you want, like the US dollar. Also, it draws your information from the most legitimate sources in the world like LBMA and the World Bank. You can integrate it into any programming language in your app or website. By sharing this information, your clients will feel confident with you for demonstrating transparency.