An API can help you in the task of saving your money and time. In this post, we explain how a vat validation API is very useful for this purpose if you need to check a payment process.

If you are employed in the technology or coding sector, you have undoubtedly heard the term API several times. Application Programming Interfaces, or simple API, is a formal term that designates how one software system communicates with another.

APIs are a group of protocols, features, and instructions that enable developers to develop unique operating system applications. When it comes to expediting program programmers’ work, APIs are crucial since they open them from having to write code from scratch.

The computer can interface with the operating system and other applications by using a set of predefined functions provided by an API. Another significant feature of an API is that it only functions as a software interface. Without the user needing to become engaged, this enables several programs to interact, which is undeniably extremely useful.

Entrance to APIs undoubtedly leads to more flexibility in all facets of data and service delivery. An API can be utilized to create an application layer that might be used to send data to new consumers.

Building on-demand improving accessibility is made possible by the ability to customize services and information for both organizations and private individuals. The options for customization that APIs offer make this feasible.

How Can An API Save You Time And Money?

Organizations can modify procedures to improve productivity thanks to the conventions, characteristics, and instructions of the APIs, with IT specialists managing the work. In the instance of VAT numbers, it could be advantageous to verify each code instead of having to double-check each one manually because the API will do it for you and with a significantly less margin of error than the human eye. Moreover, you have to waste money employing people for many hours. This tool helps you to do the same task in less time.

The developed content is automatically posted and made accessible through a variety of channels because of the APIs, which improves the efficiency of the distribution chain. The data may also be quickly and simply included from any website thanks to the APIs, guaranteeing fluidity in the computer processing operation.

Why Validate Your VAT?

A VAT number, which acts as a unique identification number, is given to every business that accounts for VAT. Only companies that have registered for VAT are issued a VAT number, which is utilized for taxation.

The VRN, or VAT registration number, is another name for a VAT number as a consequence. In this manner, even though some firms consciously strive to avoid paying taxes, numerous companies pass off their numbers as errors. To ensure that all necessary taxes are paid, a sound fiscal system must be in place. To verify these numbers more quickly, it is essential to employ services like the VAT Validation API.

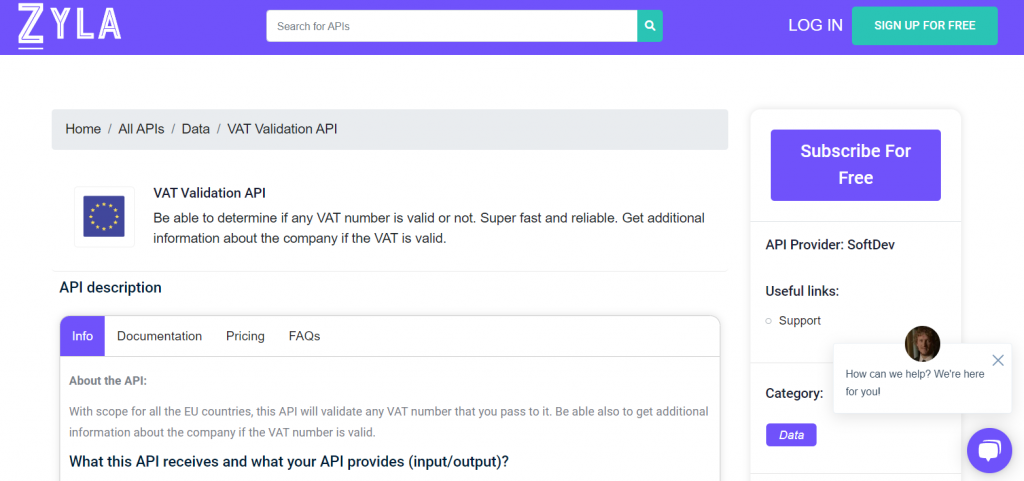

About the VAT Validation API

VAT Validation API is one of the best you can get on the web since it works with many different computer systems. Furthermore, it offers a variety of information that you could use to confirm if a company is making timely tax payments.