In this article, we explain how companies in Greece can verify the VAT Number API to check it.

The VAT is the tax identification number required to conduct business with clients from other European Union nations. The EU’s planned effort intends to encourage and support commerce between member nations, giving them a competitive edge over international enterprises.

To acquire it, you must first contact the Tax Agency, which must first evaluate your request. Once you have secured this VAT, your number will be included in the Register of Intra-Community Operators, and you will be allowed to conduct intra-community transactions with it.

The fundamental benefit of invoices sent or received with clients in the EU, where both the customer and the issuer have VAT, is that this tax is not added there. In this view, it is tremendously beneficial to both parties and, above all, considerably easier to account for because no withholdings are required.

Having the VAT, on the other hand, involves being registered in the Registry of Intra-Community Operators. But what exactly is it? It is essentially a public register that you may check to see if your customer’s VAT number is activated.

If the intra-community VAT number is correct, you may check it via the VIES system or the Registry of Intra-Community Operators. It is critical to double-check this ahead of time to prevent difficulties with the Tax Agency.

If you can not find the desired VAT number in the register, it might be because it does not exist, is not active, or the registration is incomplete. If you work in a firm and wish to demonstrate the openness of your accounting, or if you work in a tax office, you will have several VAT numbers to verify each day. To make this process speedier, we propose that you use an API.

Use An API

The Application Programming Interface (API) is a collection of processes and functions that enable applications and programs to communicate with one another. APIs are an integral component of every application’s development process.

However, this portion of the content is intended for consumption across channels rather than for the end user. This concealed character is what makes it unknown to many people, except the developer community, which is the sector of professionals that utilize them regularly.

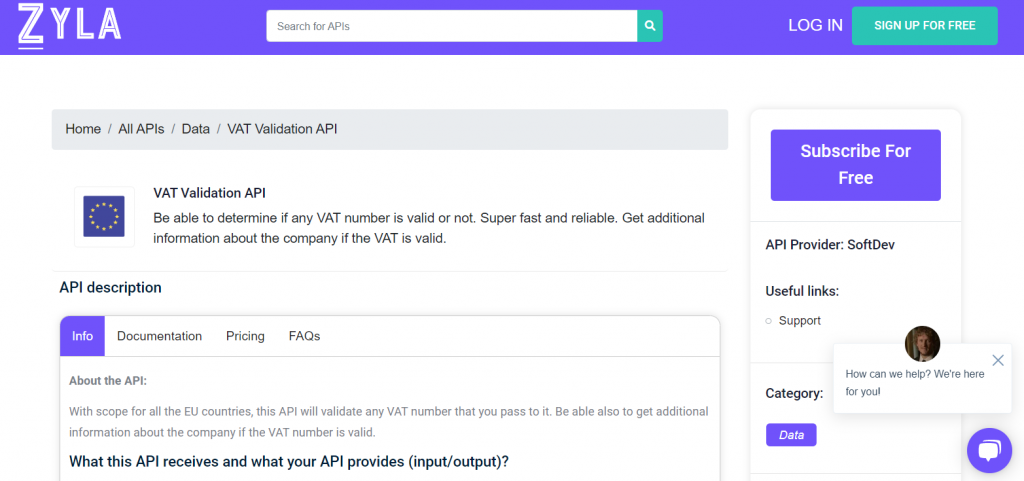

In this case, we are looking for an API that allows us to quickly check all the information about whether or not a VAT number is valid in any EU region, such as Greece. Therefore, here we recommend using the VAT Validation API to effectively check its validity.

About VAT Validation API

VAT Validation API is one of the most popular for its speed when it comes to returning results on the truth or falsity of each number. It will also give you information on the companies to which this number belongs. With this API you can guarantee a clean fiscal process. Besides, if you are a developer, you will be able to integrate it in your website or in your application thanks to this API is available in different programming languages such as JSON, PHP, Curl, Ruby and others.