Do you want to verify the VAT number from Norway? You should use an API. We explain here how to verify it with an API

A VAT number is used in all types of economic activities, including trading, importing, and exporting items. It is a one-of-a-kind identifier made of numerical symbols that allow authorities to distinguish between taxpayers or businesses and non-taxable entities.

These are significant because they aid in determining the tax status of the necessary parts, as well as the location and rate of tax, and are sometimes needed on invoices. A VAT number, which is primarily applicable and significant in EU nations, can go by a variety of names.

VAT tax number, VAT identification number, or VAT registration number are all terms for the same thing. VAT would also vary according to the legislation of each EU nation, each of which issues its VAT number.

As a result, businesses providing goods to several EU nations cannot utilize a single VAT number for all transactions. They would instead have to register for VAT in each of these nations. A simplified registration is provided for enterprises that provide services in electronics, broadcasting, and telecommunications to make the procedure more efficient and quick.

According to Article 214 of the VAT Directive, the following individuals must be identifiable with an individual VAT number: businesses that offer VAT-charged products and services, and businesses that make purchases within the EU.

Some firms receive services for which they must pay VAT and companies that give services for which the customer must pay VAT. If their VAT turnover exceeds £85,001, these businesses must apply for a DPP VAT number.

Use An API

An application programming interface (API) is software that combines pre-existing business processes. APIs enable various systems to communicate and cooperate on information, allowing parties to access data via a user interface. In other words, this solution serves as a transparent intermediary, delivering orders and replies to and from the user.

APIs enable businesses to not only link processes but also construct extra applications if necessary. APIs, when properly documented, enable developers to easily design applications that map to system functions rather than having to write a script from scratch.

Instead, they may utilize the platform to identify which system processes are required and then implement the functionalities in the API design. In this case, if you want to verify VAT numbers from Norway, a VAT Validation API will be very useful to you. For this reason, we recommend it in this post.

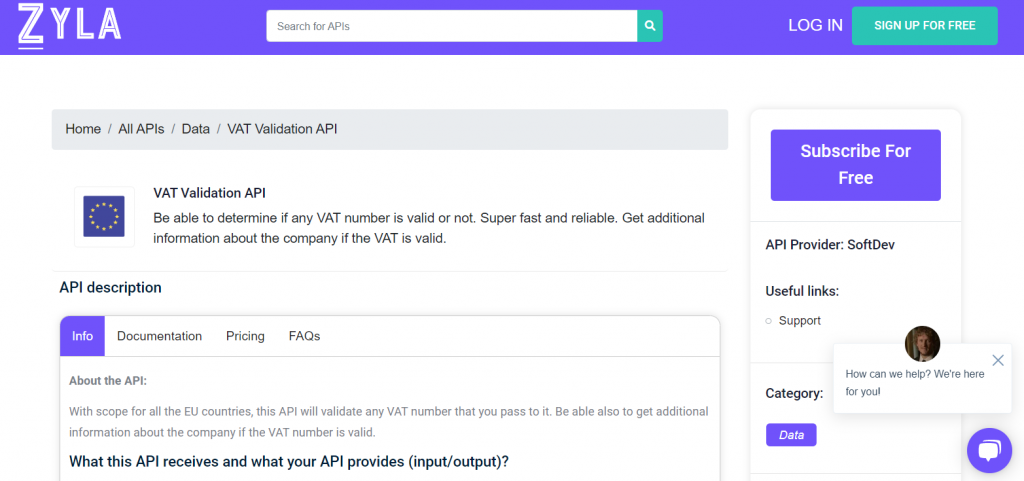

About VAT Validation API

VAT Validation API is one of the most popular APIs to ensure a transparent tax process. It is used by both companies and government offices to be able to check the correct payment of taxes and most importantly: to be able to avoid tax evasion that many companies commit around the world.

In addition, this type of API will help you automate the task to obtain results in a simpler and faster way. In this way, the entire office that is dedicated to checking this data will be able to have a more immediate response since by quickly verifying the data in case of falsity, they can act quickly to reverse the situation.