Are you new to the cross-sales industry? Surely you have heard about VAT numbers, the kind of tax that the EU asks you. But it is time to stop worrying about financial issues! In this article, you will find useful insights about the best VAT validator in the easiest programming code.

Why should you get your VAT number as soon as possible? In the first place because if your business belongs to the EU and you want to sell or buy from another EU country, you must have it. It’s a sine-qua-non financial condition. Secondly, VAT is a major source of revenue for governments all over the world. And if you don’t pay it regularly, your business income will be in danger. They can charge you with higher penalties and your final customers will be affected.

Thirdly, it can be a valuable source of information about the people you are transacting with. By validating this fiscal ID, you can track their financial activities in real-time. Last but not least, you can also learn about the VAT rate you have paid previously in the supply chain. This will allow you to adjust your rate and avoid paying extra or less to the VAT authority.

Nowadays, you will find a reliable online VAT validator that can help you to validate VAT numbers simply. But what nobody tells you is that the more you simplify the programming code, the more accurate your result would be. Ruby, to name one scripting language, is the most chosen for developers because it lets them build easy-to-understand applications. It’s an open-source object-oriented program created in the middle-90 by a Japanese computer scientist.

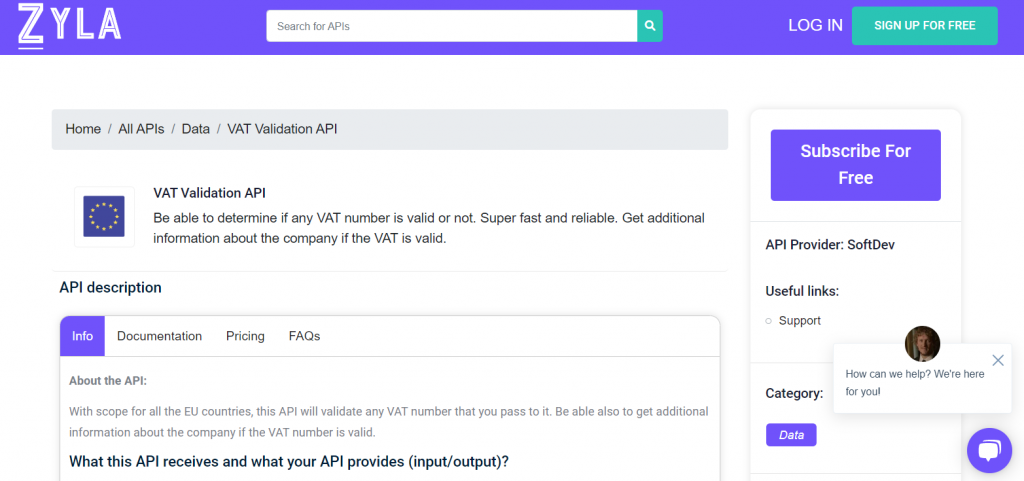

In this line, VAT Validation API is an application programming interface that works with a similar programming language. It provides you with a full list of information about the current state of the number you provide. In this manner, you can ensure that your consumers’ data is always comprehensive, correct, and up-to-date. This VAT validator fast verification feature detects missing or inaccurate numbers automatically. Also, it eliminates them from your system if you want it.

This VAT validator is the best solution for determining the validity of a VAT number. It’s the simplest of all the VAT validators online! You won’t have problems with any European currency agency or administration. It’s good for collecting data about your clients too, in case the VAT is correct. For example, you may find the business name (if you don’t already have it), the city, the address, the code, and so on.

What do you have to do to start using it? First and foremost, you must register in ZylaAPIHub and subscribe to the VAT Validation API. After that, you provide the VAT or the country code in the supplied field. Press the check button and wait for the response. If it is authentic, you will receive a “true” answer with a sequence of data such as the company’s name or address. If it is invalid, the platform will return a “false” result. Use this API to check your VAT numbers and not only pay your taxes but also save money and time!