Do you want to use a site protected by JSON? It’s commodities rates API, it will help you get monetary exchange!

First off, lets talk about Aluminium. This metal is a very versatile metal that offers a lot of benefits, including being lightweight and flexible. It can be cast, melted, moulded, machined, and extruded, allowing it to be molded into a variety of forms and then built to fit a wide range of applications.

Aluminium is becoming increasingly popular due to its incredible adaptability and strength, as well as the benefits it provides. Aluminium extrusion enables it to be provided in more complicated patterns. This extrusion is available in a number of finishes, including anodized, milled, and painted, and may be machined or manufactured further.

The London Metal Market (LME) is a futures and options exchange that trades in metals. It is the world’s largest exchange for base metals options and futures contracts, including aluminum, zinc, lead, copper, and nickel. The exchange also allows traders to trade precious metals such as gold and silver.

The LME is based in London, England, although Hong Kong Exchanges and Clearing has owned it since 2012. The prices found on the LME are considered standard worldwide basic metals pricing. The London Metal Exchange (LME) is one of the world’s most important commodity markets. The LME lists futures and options contracts on metals such as gold, silver, zinc, and copper for trade. Hedgers and speculators are both active on the metals trade, with hedgers using futures and options to reduce risk and speculators looking for quick returns by taking on risk.

The LME is Europe’s last surviving physical commodities trading exchange, since the trend has been slowly shifting away from open outcry and toward electronic trading. The LME’s options and futures contracts are standardized in terms of expiration dates and size. Traders can pick between daily, weekly, or monthly contracts when it comes to expiration dates. Meanwhile, contracts are exchanged in lots that range in weight from 1 to 65 metric tons. Due to this, you have to be provided with precise exchange data. The Metals-API platform will help with this.

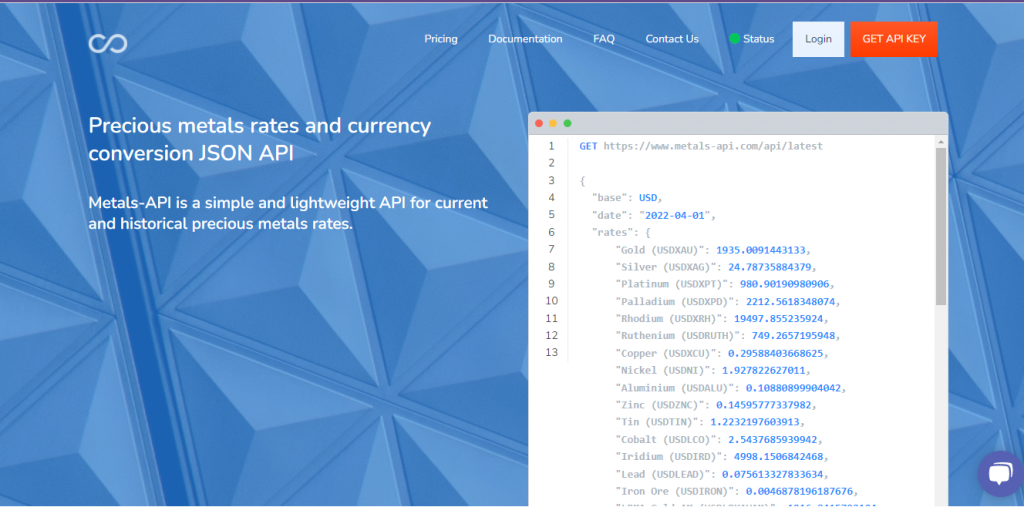

What Is Metals-API?

Metals-API It’s a platform that pulls information from roughly 15 reliable sources. Among them are banks and financial data providers. As a result, you’ll obtain a very precise price. This website is the most complete resource available to investors, traders, and anyone else interested in buying, selling, or trading metals since it allows you to locate current global market prices for any metal quickly and efficiently (including lead and gold).

How Does The Platform Works?

Metals-API is unique in that it is quite simple to use. The following requirements must be satisfied in order to do so:

– Sign up for an account on the website.

– Look for product symbols that correspond to the data you want.

– Create an API based on the currency and product you provide.

– Look for an API call to the system, then wait for the API response.

Is Really Secure?

Metals-API uses 256-bit SSL encryption to safeguard the connection from one side of the internet to the other. This sort of encrypted communication is commonly used by financial organizations. This technique protects the connection by encrypting data transit between a web browser and a website (or between two web servers).

Does It Have Benefits Being Part Of The Platform?

Metals-API provides you with unrestricted access to a team of professionals who are solely liable for any faults or issues you encounter when developing or using the API. Check out the following resources if you’re still not convinced if the Metals-API API is correct for you:

• Customer Service and Sales

• API Documentation

• Plans and Features