In the realm of modern finance, exchange traded Funds (ETFs) have gained prominence as versatile investment vehicles, providing investors with exposure to various asset classes and strategies. Among the diverse range of ETFs available, the FT Cboe Vest Gold Target Income ETF stands out as an innovative option that aims to provide investors not only with the potential for returns but also a consistent income stream. This article delves into the process of obtaining FT Cboe Vest Gold Target Income ETF prices using an Application Programming Interface (API), shedding light on the advantages of this approach and guiding investors on how to effectively harness API capabilities.

Introduction to FT Cboe Vest Gold Target Income ETF

A. Understanding Target Income ETFs

Target Income ETFs represent a distinct category within the broader spectrum of ETFs. Unlike traditional ETFs that primarily focus on capital appreciation, Target Income ETFs are engineered to deliver a predictable income stream to investors. These ETFs employ various strategies to achieve this, often combining dividend payments, interest income, and options strategies to generate consistent returns over time.

The Role of APIs in Accessing Metals Prices

Application Programming Interfaces (APIs) have revolutionized the way financial data is accessed and utilized. APIs serve as bridges that connect investors with real-time and historical data from various sources, including ETFs. The advantages of using APIs include speed, accuracy, and the ability to retrieve specific data points, enabling investors to stay updated with the latest market information.

The integration of APIs into investment strategies opens doors to data-driven decision-making. By accessing these prices via an API, investors can gain insights into price trends, historical performance, and income distributions. This data integration empowers investors to make informed choices aligned with their risk tolerance and income objectives.

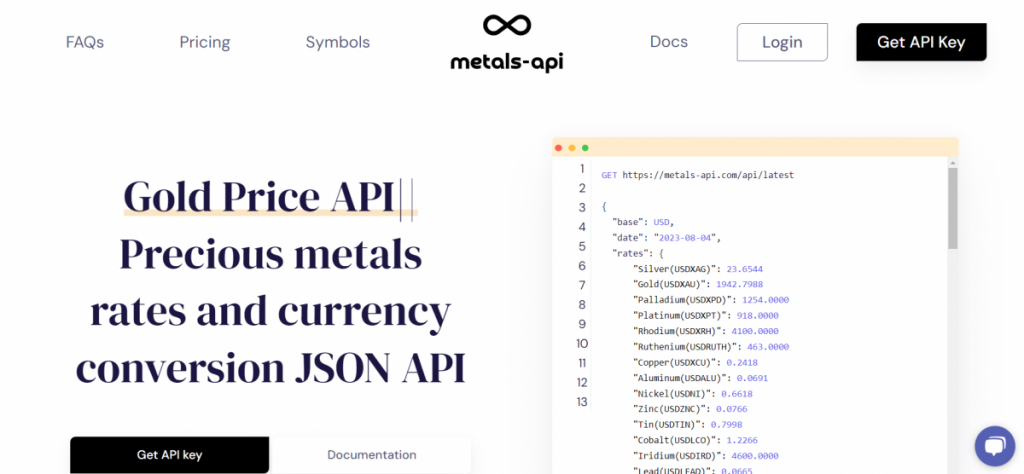

Try The Metals-API!

Metals-API is an open-source API that provides real-time and historical precious metals data. It can be used to obtain prices for gold, silver, platinum, palladium, and other precious metals. The data is delivered via JSON API at an accuracy of 2 decimal places and a frequency of up to every 60 seconds.

Metals-API offers a variety of features, including:

-Real-time precious metals prices: Metals-API provides real-time prices for all supported precious metals. This data can track the latest market movements and make informed trading decisions.

-Historical precious metals prices: Metals-API also provides historical precious metals prices. With this data, you can analyze market trends and make informed investment decisions.

-Exchange rates: The tool can convert between different currencies. It’s helpful for traders and investors who want to track the price of precious metals in their local currency.

-Currency conversion: The API can convert between different precious metals. This can be helpful for traders and investors who want to compare the prices of different metals.

-FT Cboe Vest Gold Target Income ETF Prices: The tool can obtain this information. This ETF tracks the performance of gold bullion and provides investors with a way to gain exposure to the gold market without having to physically own gold bars or coins.

Watch this video:

In conclusion, the FT Cboe Vest Gold Target Income ETF presents investors with an innovative opportunity to combine the potential for returns with a regular income stream. By leveraging the capabilities of APIs, investors can access ETF prices, historical performance data, and income distributions, enhancing their decision-making process. The integration of Metals-API into investment strategies reflects the evolving landscape of finance, where data accessibility and informed choices play pivotal roles in achieving investment success.

Read this post: Top Rated API To Get FT Cboe Vest Gold Strategy Quarterly Buffer ETF Rates