Access to real-time inflation statistics via an API provides decision-makers with a full picture of the current economic situation. This involves being able to assess the possible impact of inflation on their portfolios, make changes, and locate opportunities across many markets. Inflation data is used by businesses to influence pricing strategy, estimate expenses, and manage risks connected with price swings.

Furthermore, policymakers and central banks may depend on the API’s reliable inflation statistics to establish efficient monetary policies and promote economic stability. Decision makers obtain the required insights to understand the intricacies of inflation and make data-driven decisions that drive success and reduce risks in an ever-changing economic climate by using the power of an Inflation Rate API.

Using An Inflation Rate API: A Guide To Making Informed Decisions

- Investment Strategy Optimization: By using the API to receive real-time inflation data, investors may assess the possible impact of inflation on their investment portfolios. This allows users to change asset allocations, diversify investments, and select assets that have historically performed well during inflationary periods. Furthermore, the API makes international comparisons easier, allowing investors to examine inflation differentials and uncover lucrative possibilities in other regions.

- Pricing and cost management: Businesses may use inflation data from the API to influence pricing strategies and estimate expenses. Companies can alter product prices to retain profitability and market competitiveness by monitoring inflation rates. Furthermore, the API aids in planning and resource allocation by revealing how inflation impacts various cost components, allowing organizations to reduce possible risks connected with growing costs.

- Personal Financial Planning: The Inflation Rate API is critical for people’s financial planning. Individuals may alter their budgeting and savings methods to safeguard their buying power over time by understanding current and expected inflation rates. It enables people to make educated decisions about investing, retirement planning, and negotiating wage increases to account for increased living costs.

- Risk Mitigation and Insurance: The Inflation Rate API may be used by insurance firms and risk managers to analyze inflation-related risks and design effective risk mitigation methods. Insurers can alter rates, coverage, and policy conditions to offer appropriate protection for policyholders against the erosion of buying power caused by inflation by factoring inflation data into their models.

- Policymakers and central banks rely largely on reliable inflation statistics to establish successful monetary policies. The Inflation Rate API gives them real-time insights into inflation patterns, allowing them to make more educated decisions about interest rates, money supply, and other policy measures. This allows policymakers to preserve price stability, manage inflationary pressures, and promote long-term economic growth.

What Is The Best API For Inflation Rate?

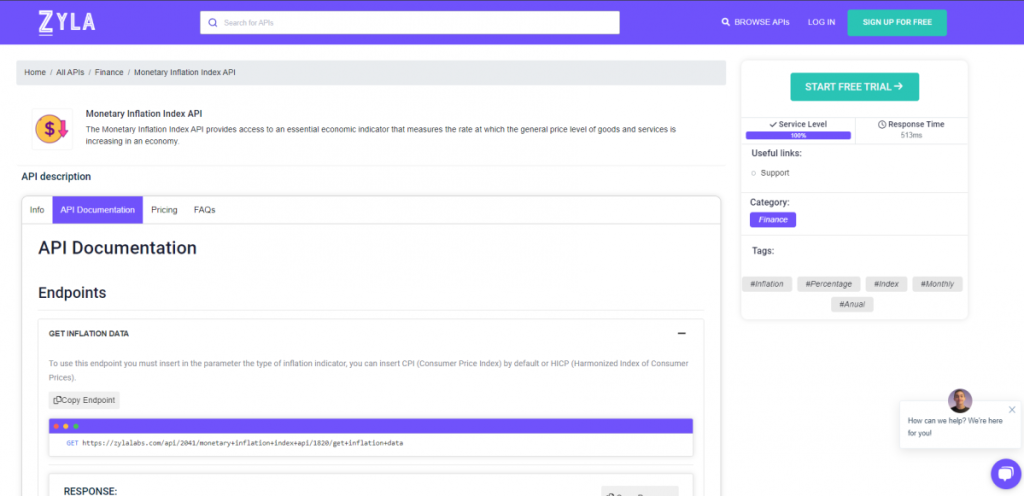

After experimenting with a variety of options, we can safely claim that the Zylalabs API is the most user-friendly and produces the best results: The Monetary Inflation Index API

Furthermore, the results are delivered in JSON format!

Entering CPI (Consumer Price Index) or HICP (Harmonized Index of Consumer Prices) into the “Get Inflation Data” endpoint, for example, will provide the following response:

[

{

"country": "Austria",

"type": "HICP",

"period": "may 2023",

"monthly_rate_pct": -0.023,

"yearly_rate_pct": 8.704

},

{

"country": "Belgium",

"type": "HICP",

"period": "may 2023",

"monthly_rate_pct": 0.217,

"yearly_rate_pct": 2.722

},

{

"country": "Czech Republic",

"type": "HICP",

"period": "april 2023",

"monthly_rate_pct": -0.135,

"yearly_rate_pct": 14.253

},

{

"country": "Denmark",

"type": "HICP",

"period": "april 2023",

"monthly_rate_pct": 0.255,

"yearly_rate_pct": 5.635

},

{

"country": "Estonia",

"type": "HICP",

"period": "may 2023",

"monthly_rate_pct": 0.04,

"yearly_rate_pct": 11.169

},

{

"country": "Europe",

"type": "HICP",

"period": "april 2023",

"monthly_rate_pct": 0.646,

"yearly_rate_pct": 6.976

},

{

"country": "Finland",

"type": "HICP",

"period": "may 2023",

"monthly_rate_pct": 0.227,

"yearly_rate_pct": 5.193

},

{

"country": "France",

"type": "HICP",

"period": "may 2023",

"monthly_rate_pct": -0.116,

"yearly_rate_pct": 5.967

}

]Where Can I Find The Monetary Inflation Index API?

- To get started, navigate to the Monetary Inflation Index API and click the “START FREE TRIAL” button.

- You will be able to use the API after joining Zyla API Hub!

- Utilize the API endpoint.

- Then, by selecting the “test endpoint” button, you may make an API request and see the results shown on the screen.

Related Post: How To Use A Monetary Inflation Index API To Improve People’s Financial Intelligence