If you want to know the daily metal prices, in this post we explain how to do it and why an API is an answer to this.

Nowadays, the US currency is essentially the only truly significant factor affecting the price of precious metals. Despite being in full throttle, the USD might last. There will finally be excessive resistance to the USD.

Considering that the Dollar was indeed the cross-market driver that pulled metals down in 2022, the complete opposite can happen in 2023. These cross-market tendencies serve as the basis for the solution to the question of which precious metal to purchase in 2023.

There is a bad correlation between valuable metals and financial regulation. In 2022, officials put in place a very rigid fiscal system. As a consequence, precious metals may have a great deal of stress. In March 2022, just as gold and silver were about to start a tremendous breakout, authorities pulled their finances more swiftly. The impact on precious metal prices has ended.

Predictions for inflation have a significant impact on precious metal prices. The impact of monetary policy restrictions is to suppress inflationary pressures as long as it is in place. Nevertheless, as the reduction settles down, the window will open for higher inflationary pressures.

Condition Of Metals In 2023

Gold has previously assisted silver in changing from a bearish trend to a bullish trend. Despite its propensity to delay, silver has incredible power once a pattern develops. Palladium is unusual since platinum is typically associated with gold.

The US dollar will certainly top in the early months of 2023. As a consequence, predictions of higher inflation will increase. Furthermore, it is predicted that the real industry will be competitive. The longest-lasting sales premiums in silver history as well as growing wholesale physical demand in China and India have occurred without any obvious increase in the real supply.

Over the recent six months, to a level never previously seen, the sharpest contrast between rising physical requirements and a swift and very paradoxical historical reduction in costs has been seen. Because many people want to engage in metal bullion as an investment to conserve money in the face of the world’s financial crisis, this scenario is probably going to happen.

For Daily Metal Prices, Use An API

As you’ll see, the metals industry will see significant price fluctuations throughout this year. This is the purpose you can follow the metal costs every day to comprehend the variables that affect this sector. Everyone who desires to engage in this market, whether as a resource or as an investor in any sector, must pay attention to this.

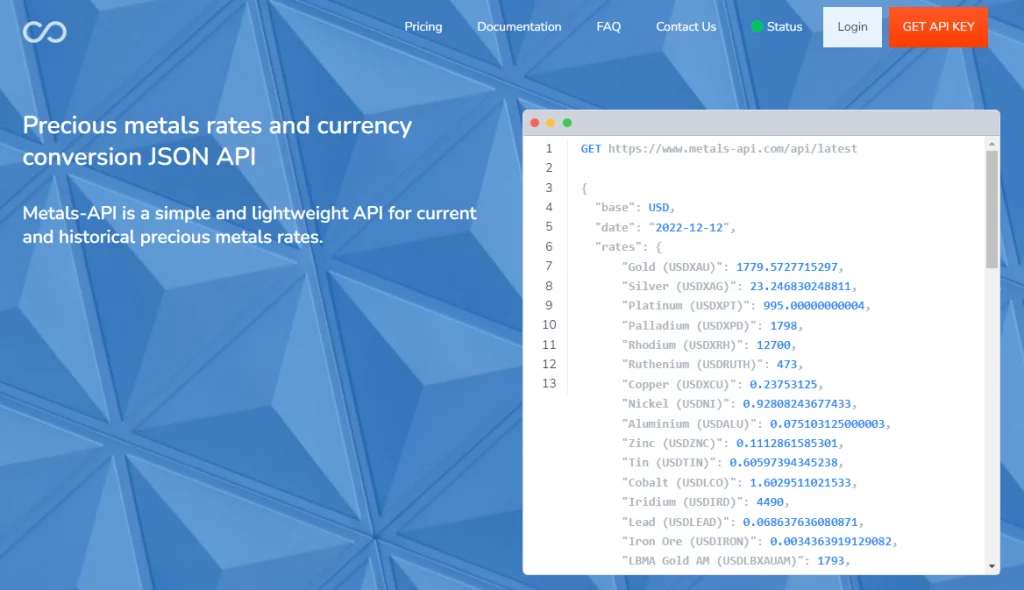

Not everyone faces this issue. Numerous businesses strive to counsel millions of investors globally. They must thus attempt to revise the metal values each day. This is a significant task, but it may be time- and energy-consuming. You should utilize the Metals-API to view all of the metal levels each day in this case. One example of a reply is this:

Why Metals-API?

You may view the daily metal prices in addition to their variable cost per unit using Metals-API. You may arrange publications, studies, and industry trends analyses in this manner. By doing this, you would be best prepared to counsel financiers, authorities, and various major industries that either directly or indirectly engage in this industry.

They can receive this data from you along with any supporting paperwork you deem necessary. Because you can utilize the API replies in whichever programming language you wish, you won’t have any issues.