In this article, we’ll learn about how to know with an API the closing price of gold and silver. Keep reading to explore it.

Electrical and electronic equipment consumption may expand. As expenses grow and customers’ disposable money declines, the picture for the market for mobile phones is bleak for 2023. Many users may be hesitant to replace their devices.

The prognosis for consumer technology sales in China should improve if Covid-19-related regulations become less severe and the economy improves. Notwithstanding the worsening financial outlook in Europe and the US.

Industries Related To These Metals

From the low base of 2022, smartphone sales might rise by 5% to 1.3 billion units in 2019. Nevertheless, this number could be optimistic given the revision of growth predictions for developed economies. In the second quarter of 2022, 146 million 5G devices were shipped. It was taking a 51% market share worldwide and, for the first time, overtaking 4G devices.

In 2023, this pattern may persist. The average silver content per device should rise as 5G devices gain market penetration. A nationwide 5G network in India began to spread in Q4 2022. And it can reach the entire country by Q1 2024. As customers start to utilize the new network, a jump in sales of 5G-capable gadgets will happen in 2023, which will increase demand for silver.

Additionally, as module costs decrease, photovoltaic demand will increase. In 2022, the PV need for silver may reach a record 150 million ounces, and it will likely continue to expand rapidly over the following 12 months.

After reaching record highs this year, the price of polysilicon, which significantly affects the price of solar cells, probably drop by around 50% by 2023. This would enable China to start up additional manufacturing capacity. Notwithstanding other rising inflation, this should lower costs, supporting the market for PV cells. On the other hand, the market for silver jewelry may decline annually.

The output of mining by-products from the manufacture of lead-zinc and copper, which may expand by 2.7% and 5.3%, respectively, in 2023, will lead to a rise in the provision of silver in mining.

Watch The Price Of Gold And Silver With An API

Due mostly to the strength of the US dollar, silver prices have remained muted this year. Up till the Federal Reserve changes its monetary strategy, the dollar can stay strong and put pressure on the price of silver. Silver futures speculation is at an extremely reduced rate, which traditionally corresponds with price lows.

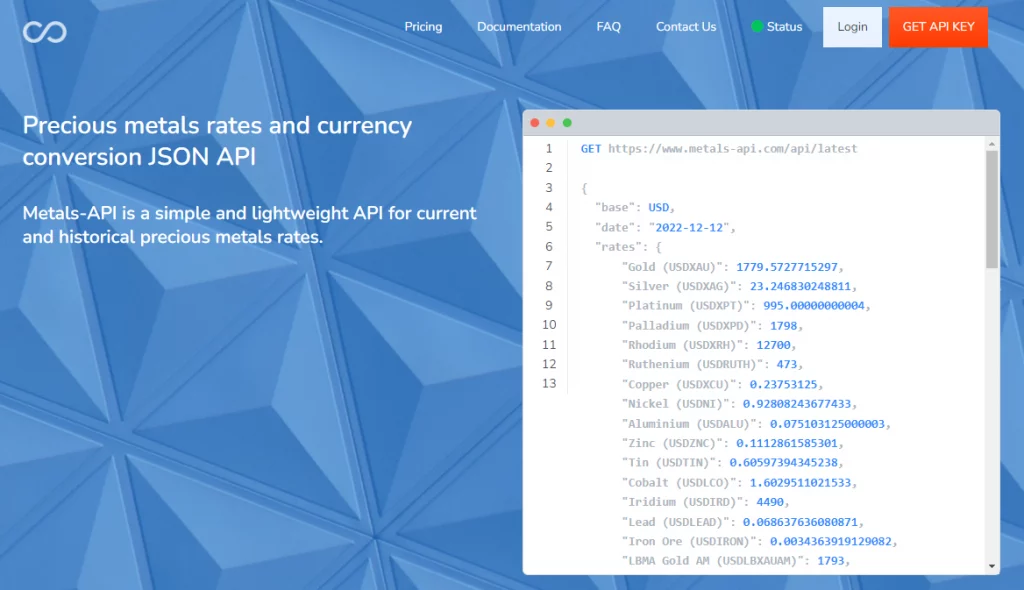

Because of high rates of interest and a strong dollar, gold’s desirability will decline in 2023, with average prices falling to $1,745 per ounce, somewhat below present levels. The US dollar’s supremacy and rising real US bond rates are depressing the gold market. If you keep up with the pricing, you will be much better able to comprehend the dynamics of both markets. This is possible using Metals-API. Below is a sample API reply:

Why Metals-API?

Metals-API will keep you up to date second by second on the price of the metals you are looking for. You can see its current price, as well as various historical prices and fluctuation data that will help you better understand the market dynamics.

It’s the perfect API for those who want to invest, or who help others who do. You can include this information in your digital media thanks to the fact that the API responds in various programming languages. You can make professional evaluations of the metal market, whichever you want, looking at the values in the national currency that you prefer.