Are you looking for an API to get the current price of platinum? In this post, we discover one and explain how to get this info with it. Take a look and start getting prices.

Platinum has a reputation as an investment metal and is offered in the form of bars and coins in complement to its various industrial applications. Purchasing platinum bullion or jewelry as an investment is relatively new and less well-known than classic gold and silver purchases. This makes it exceedingly difficult for shareholders to do their jobs, together with the scarce availability of investment items in actual platinum.

Furthermore, during the past 40 years, market turbulence and speculation have hurt the price of platinum. Being rare has contributed to its price rise since geological investigations indicate that platinum deposits are not very abundant. According to experts, it is more lucrative to purchase platinum ingots rather than coins when investing in this metal because they are more affordable when purchased.

Prospects For Platinum

In 2023, the platinum market will see a 303,000-ounce shortage in supply. This is because, compared to this year, the demand for this precious and industrial metal is predicted to rise globally by 19%, to 7.7 million ounces, while supply is only predicted to increase by 2%.

Various experts claim that China’s import levels remained extraordinarily high throughout the third quarter of 2022. Despite the worldwide excess, this circumstance led to ongoing stress in the physical market. Similar to earlier this year, these imports were much greater than the identified Chinese demand.

By 2022, the world’s platinum supply will result. 10% YoY and his performance will hardly improve during the following year. It is anticipated to increase by just 2% to 5.7 million ounces for this.

Due to a combination of increased passenger car production, stricter emissions regulations for high-end vehicles in China and India, as well as factors like the growing substitution of platinum for palladium, which will reach 200,000 ounces this year and 500,000 in 2023, the demand for platinum from the automotive sector will increase by 12% this year.

Around 1.9 million ounces of demand for jewelry will continue to be present in 2022, and this amount is also anticipated for 2023. Compared to the record-high levels of demand in 2021, global supply will decline by 14% in 2022. Nevertheless, at 2.1 million ounces, 2022 will see the third-highest industrial demand for platinum in history.

With a 10% increase to 2.3 million ounces by 2023, this trend is predicted to continue, making that year the second-strongest commercial demand year ever. Lastly, in 2022, the demand for platinum bars and coins will increase by 2%, reaching 340.00. This won’t cancel out the ETF liquidations and delistings, which will leave a net divestment of 525,000 ounces for the year.

Use An API To Get the Current Prices Of Platinum

As you will see, investing in the metal market is very complex. That is why people look for reliable sources every day to obtain information. They also look for up-to-date information to be able to monitor prices.

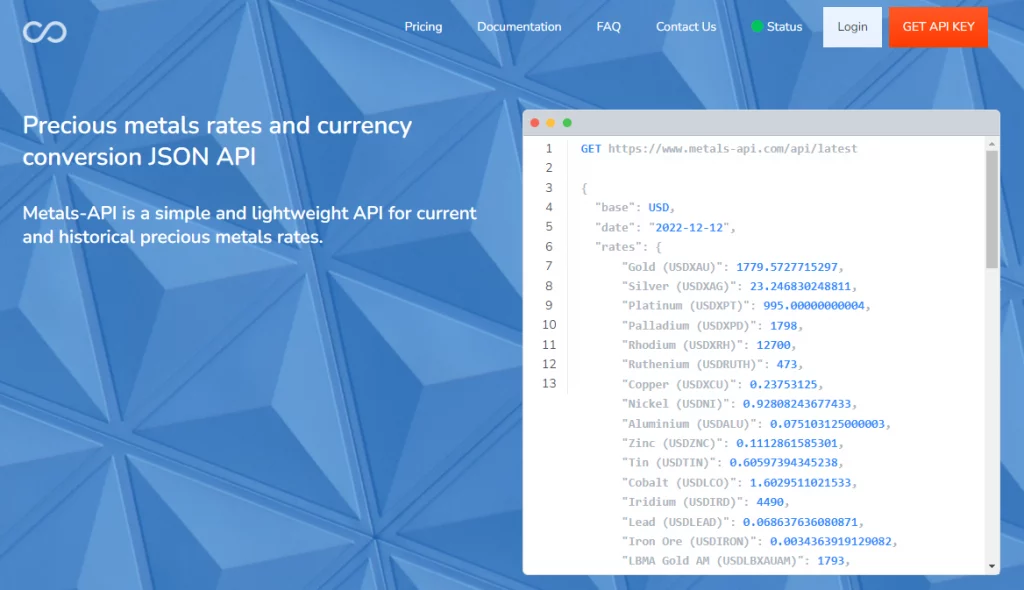

This way they get a better idea of when to invest. Therefore, if you are an investor or advise them, you must include this updated information in your digital media. Here we want to help you with cutting-edge technology, that is, with an API. With Metals-API you will be able to get all current platinum prices in seconds. Look at this type of response:

About Metals-API

Metals-API includes vast information on different types of metals. You can find current prices as well as historical and fluctuation data. In this way, you can be much more expert on the investment of the metal market.

You can integrate all kinds of information about this market without problems on your site. The API integrates with various programming languages that can be very useful for you as a developer.