In this article, we’ll explore a resource to get the current price of iridium. If you’re asking how to get it, this API is for you.

Businesses require iridium for the manufacture of deep-water pipelines, automobile catalysts, and aircraft engines. This is a result of its extraordinary resistance to extremely high heat and corrosion. In addition to watches and directions, other items now use it, such as spark plugs, machinery, and smart gadgets.

In 1803 among the insoluble imperfections of natural platinum, iridium was first discovered. It is one of the rarest elements on our planet. Only three tons serves in production annually.

Although it isn’t widely available, it’s commonly required in specialty products like the temperature-resistant crucibles used to grow synthetic crystals. Additionally, electrical and communication infrastructure utilize it.

Iridium Production

It is, nevertheless, both uncommon and hardy. As a consequence, its cost is rapidly rising. It occasionally experiences rises of more than 100%. Iridium is more than three times as expensive as gold, with one ounce costing over $4,900. Industry observers think it will continue to grow.

Manufacturing pauses in 2020 have made this developing trend more pronounced. partly as a consequence of the rise in metal consumption, especially for use in display devices. Investors believe it will be used to produce hydrogen rather than fossil fuels, a component that is increasingly desired as a renewable energy source.

As a consequence of production bottlenecks, the value of iridium has risen and reached all-time highs, joining other platinum-group metals like rhodium and palladium. This knowledge is very important since between 80 and 85 percent of the iridium global production is in South Africa.

Compared to around 10 million ounces of palladium and 8 million ounces of platinum, businesses only manufacture 250,000 ounces yearly. Due to the small size of the industry, any interruption in production might have a big impact on the item. Due to its scale, very few individuals engage in the buying and selling of metal.

To Find The Current Price Of Iridium, You Need An API

You must be capable of tracking industry trends if you intend to participate in the iridium sector. Either as a financial instrument or since you are at the cutting edge of technology. This is because a variety of factors, including economic and geopolitical ones, have an impact on the price of precious metals. These circumstances cause various price swings, therefore you must monitor them to determine whether to invest.

It could take quite a while to look up the price day after day, analyze how it changes, confirm that it is the same price across all global marketplaces, and do other tasks. Therefore, we wish to assist you with a unified API.

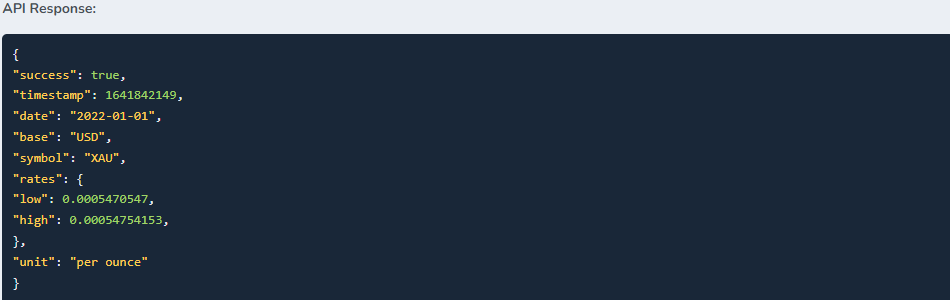

You may use Metals-API to view current prices, analyze historical pricing and volatility information, and get information from financial regulators including the World Bank and LBMA. An example of a reply might be as follows:

Why Metals-API?

If you wish to counsel clients from around the globe or if you are a trader yourself, Metals-API is the finest. Whatever kind of data from the API can be used in any programming language you want.

It includes a wealth of material that you may use on your website, including data on various metals, in various currencies, and at various periods. You may compare many pieces of data in this manner to provide clients with quick access to a market study. As a result, you will gain the trust of your clients, who will turn to you for reliable and accurate data.