If you want to get the country code of a company by using the VAT Number Validation API in this article we say how to get it.

A VAT number is required for all economic operations, especially trading, importing, and exporting goods. It is a unique identification made up of numerical characters that allow officials to differentiate between taxpayers or companies and non-taxable organizations.

These are essential to help determine the tax status of the required items, as well as the region and tax level and are occasionally required on bills. A VAT number, which is largely crucial in EU countries, can be known by several different titles.

VAT tax number, VAT identifier, and VAT number plate are all interchangeable words. VAT would also differ depending on the laws of each EU member state, each of which provides its VAT number.

As a consequence, enterprises selling products to multiple EU countries cannot use one VAT number for all operations. Consequently, they would have to apply for VAT registration in each of these countries. To make the process more effective and quick, firms capable of providing services in technology, broadcasting, and communications can register using a streamlined form.

Personal VAT numbers are needed for the following persons, as per Article 214 of the VAT Directive: companies that offer VAT-charged items and services, and enterprises that buy items within the EU.

Some businesses require products for which they have to pay VAT, while others provide services for which the consumer must pay VAT. These enterprises must register for a DPP VAT number if their VAT revenue exceeds £85,001.

Use An API

An application programming interface (API) is a system that links previously separate operations. APIs give multiple technologies to share and collaborate on data by enabling individuals to access information through a user interface. In other terms, this uses such as a visible middleman, providing orders and responses to and from the client.

APIs allow firms to not only connect operations but also build additional apps if needed. When correctly described, APIs allow developers to quickly construct apps that map to functionality instead of having to create a script from start.

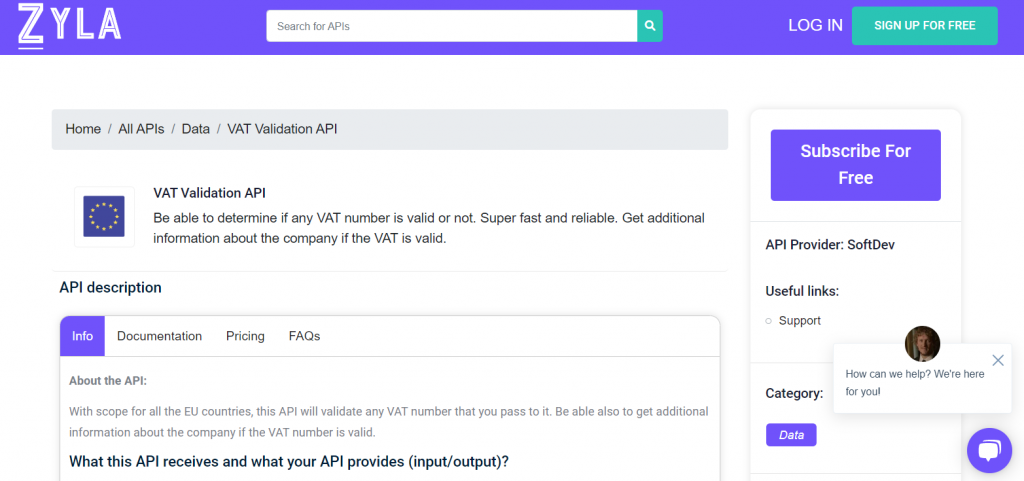

Alternatively, they could use the system to determine which design centers are necessary and then incorporate the functionality into the API architecture. In this instance, a VAT Validation API will come in handy if you need to check VAT numbers and obtain company codes. As a result, we propose it in this article.

Why VAT Validation API?

VAT Validation API is a common API for ensuring a transparent tax transaction. It is used by enterprises and office buildings to ensure accurate tax payment and, more crucially, to evade taxes evasion, which many businesses conduct throughout the globe.

Furthermore, this form of API will assist you in automating the operation to achieve results in an easier and faster manner. As a result, the whole office committed to reviewing this data will be capable of reacting more swiftly because by immediately confirming the data in case of untruth, they will be capable of acting quickly to correct the problem.