This post will explain an API that will supply you with silver prices from the major exchange market Nasdaq.

In 2022, the silver sector will build on the excellent foundation created last year, when silver demand grew across all major industries. This year’s growth will be broad-based, following the pattern set in 2021, with gains expected from the majority of main demand aspects. The global total year 2022 is predicted to reach a new high, increasing by 8% to 1.112 Boz.

Silver industrial demand (which accounts for more than half of total silver demand) is predicted to rise further, reaching a record high in 2022. Persistent worldwide economic expansion will encourage silver industrial usage, reducing near-term concerns from supply chain constraints and the present COVID epidemic in specific regions.

The application of silver in the solar industry appears to have a bright future. As a result of government claims of carbon neutrality, green energy projects are fast developing, and silver is required for them.

Given the ongoing worldwide chip shortage, silver demand in automotive and 5G-related applications is projected to continue robust this year. The former is aided by growing vehicle electrification, which results in higher silver loadings per vehicle.

However, the latter has profited from increasing infrastructure construction for 5G networks, as well as growing demand for mobile devices. Moreover, with chip manufacturing limitations forecast to ease greatly in 2022, silver consumption for these and another computer / electronic applications is predicted to rise.

Jewelry demand is predicted to climb by 11% this year. India remains the driving driver, helped by increased consumer sentiment. Even though the Omicron wave-influenced Indian demand in early 2022, a forecast easing of COVID-19 laws and efforts by jewelry merchants to advertise silver to urban clients will improve jewelry sales in India.

Following a strong rebound in 2021, jewelry sales growth in the United States is expected to decrease. This year, silverware output is predicted to expand by 21%, with India making up the majority of the growth in silverware and jewelry. Nasdaq is one of the most dependable providers of this sort of information.

How Do I Get Nasdaq Silver Prices In JSON?

To participate in this firm, you should use an API. It is software that connects with a variety of devices. Several of these may be found on the internet. Nonetheless, not all of them function or provide the same data in the same way.

To work in the gold industry, you must provide the most dependable information to research price fluctuations over time and keep current with pricing. Nasdaq should offer you data via an API. Only the New York Stock Exchange (NYSE) has a bigger stock and securities exchange than the Nasdaq.

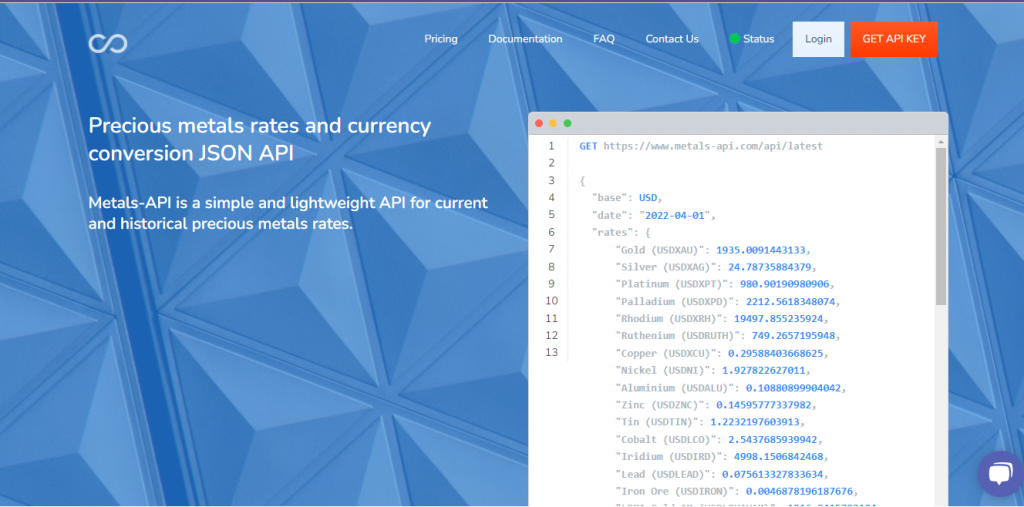

Silver imports are only possible if you have access to current information. As a result, they must keep current on its price and market trading to choose the best time to invest. We recommend using the Metals-API service to acquire this information on the Nasdaq which is one of the world’s biggest trade platforms for metals and technology.

More About Metals-API

Metals-API is the best available API (Application Programming Interface). This is due to its ability to give metal rates quickly, safely, and easily. Its system includes a variety of precious and non-precious metals, such as lithium, gold, platinum, palladium, copper, and silver. All of this with digits of precision and update rates of less than one minute!

That is, depending on its qualities, you will be able to choose the optimal time to invest in this metal. Metals-API, for example, will show you data from the previous 19 years, such as the fact that the price of palladium fell by 17.12 percent in 2021. This sort of knowledge might help you save a lot of cash.