Do you wish to locate an API that gathers data from the Eurex Exchange? We’ll explain how to acquire it in this post.

But first, let’s take a look at the state of the metals market. In 2021, industrial metals had a strong year, with the Base Metals Index rapidly rising and reaching new highs until mid-October.

We anticipate that 2022 will be favorable as well, albeit not as satisfactory as last year, with greater differentiation among metals going to benefit from energy transition megatrends (copper, nickel, and aluminum) and those more connected to plateauing steel production (iron ore, zinc, and coking coal), whose prices should come back to more “standardized” rates this year.

Fluctuation should remain above average as geopolitical and pandemic threats make the pace of global economic recovery unclear. We find reasons to be bullish about industrial metals at both the global and micro levels. Global GDP growth should remain robust, with rising industrial output and infrastructure spending in Europe supporting metal demand.

These developments are expected to keep the supply/demand balance tight for most industrial metals and keep their prices high for an extended length of time, contributing to stickier high inflation. Large mining companies would benefit the most from such an environment.

As you’ve seen, it is a very active market, and if you would like to invest in any of these businesses, you must stay current on metals prices. Not only are current prices displayed, but so are historical values, allowing you to monitor the factors that impact the value of the metal of interest. However, you should obtain data from a reputable source, such as Eurex Exchange.

How To Get Rates From Eurex Exchange?

They provide a wide range of worldwide benchmark products and manage one of the globe’s most liquid fixed income markets, with open and low-cost electronic access. The volume of trading at Eurex reaches 1.8 billion contracts per year, making it the market of choice for the derivatives community globally, with financial markets linked from 700 locations worldwide.

Since its founding in 1998, Eurex has consistently established a strong track record in electronic trading and clearing, demonstrating the effectiveness of its business model year after year by offering extremely efficient liquidity pools. To get this data you should use an API

What Is An API?

An Application Programming Interface (API) is extremely useful for sending and gathering data between numerous devices. You may use it to construct your app or website by copying and pasting it into numerous computer languages.

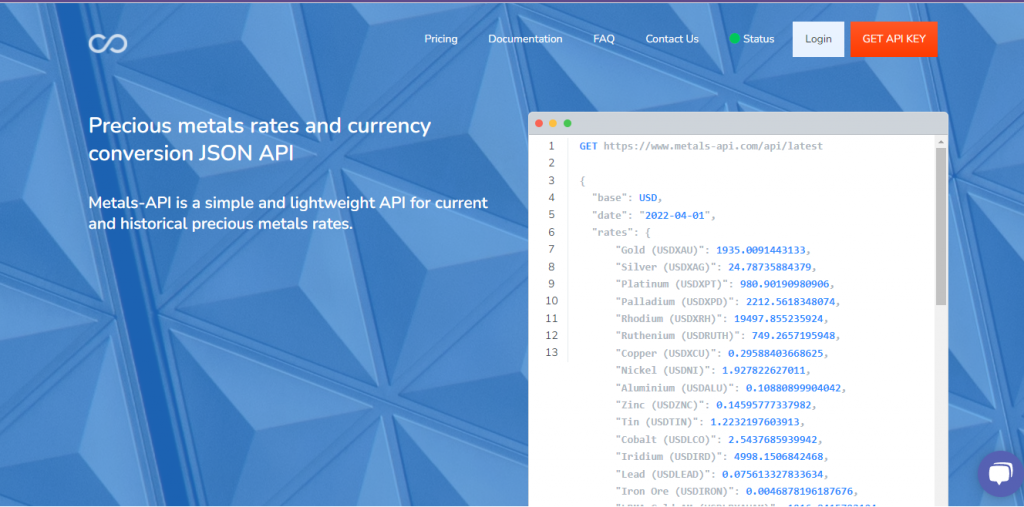

Because not every API on the internet is trustworthy, you’ll need one that gathers data from major financial institutions. Metals-API is a Eurex Europe rates API, but also a CME Group rates API, that gets data from NYMEX/COMEX, or ICE, or various markets across the globe, and more.

About Metals-API

Metals-API is software that provides real-time metals pricing data. You have access to over 170 currencies. It is acceptable whether the data is in the form of real statistics or historical rates.

Price changes may also be used to determine the primary causes of change and the optimum time to buy. It contains COMEX/Nymex rates as well as data from other financial organizations. To include the data in your website or app, you may utilize a variety of computer technologies, including PHP, JSON, and Python.