Do you want to find an API that collects Nasdaq metal historical data? This page will explain how to obtain it.

But first, consider the situation of the metals market. Industrial metals had a solid year in 2021, with the Base Metals Index climbing quickly and reaching new highs until mid-October. We predict that 2022 will be favorable. Albeit not as favorable as last year, with the disconnect between metals that will advantage from decarbonization megatrends (copper, nickel, and aluminum) and those that will benefit from plateauing steel production (iron ore, zinc, and coking coal), whose prices should return to more “normalized” rates this year.

As geopolitical and pandemic concerns make the speed of global economic recovery uncertain, volatility should continue above normal. At both the global and local levels, we see grounds to be positive on industrial metals. Global GDP growth should continue strong, with increased industrial production and European infrastructure expenditure sustaining metal demand.

These changes are projected to keep most heavy metals’ procurement equilibrium tight and their prices artificially high for a lengthy period, adding to stickier inflationary pressures. Such an atmosphere would favor large mining firms the most.

As you can see, it is a highly busy market. So if you want to invest in any of these companies, you must keep up with metals prices. Not only are current prices shown, but so are historical values, allowing you to keep track of the variables influencing the value of the metal of interest. You should, however, collect data from a credible source, such as Nasdaq.

How Do I Get Nasdaq Historical Prices?

You should utilize an API to engage in this company. It is software that communicates with many devices. Several of these are available on the internet. Nonetheless, not all of them operate or supply data in the same way.

To operate in the gold sector, you must supply the most reliable information to analyze price swings over time and stay up to date on pricing. Nasdaq should provide you with data via an API. The only larger stock and securities exchange than the Nasdaq is the New York Stock Exchange (NYSE).

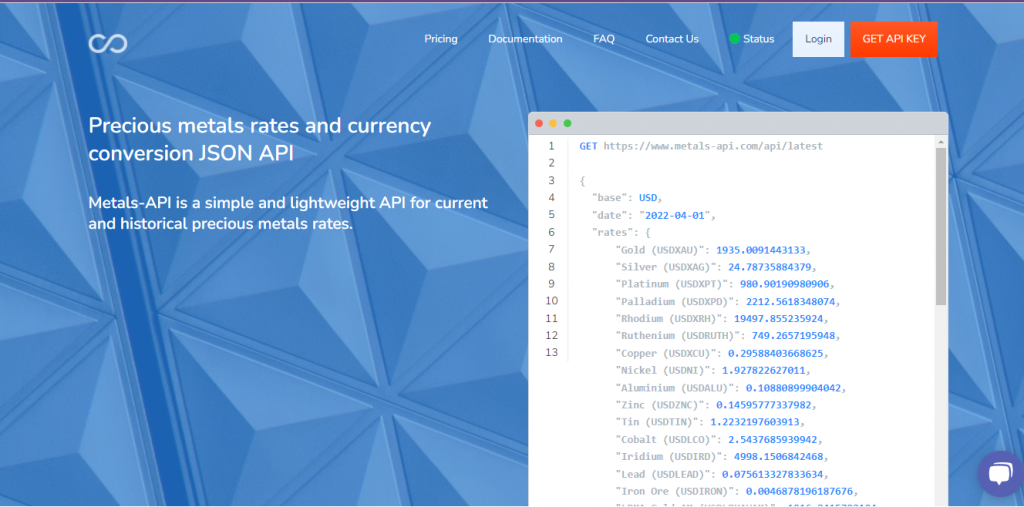

Importing metals is only feasible if you have access to up-to-date information. As a consequence, they must stay up to date on its pricing and market activity to choose the optimum moment to invest. To obtain this information on the Nasdaq, which is one of the world’s largest trade platforms for metals and technology, we propose using the Metals-API service.

Why Metals-API?

Metals-API is the finest API accessible (Application Programming Interface). This is because it can provide metal rates fast, safely, and conveniently. Its system incorporates many precious and non-precious metals, including lithium, gold, platinum, palladium, copper, and silver. All of this with precise numbers and update speeds of less than a minute!

That is, based on its characteristics, you will be able to determine the best moment to invest in this metal. Metals-API, for example, will provide statistics from the preceding 19 years, such as the fact that palladium prices declined by 17.12 percent in 2021. This type of knowledge might help you save a lot of money.