A promising prospect in the complex world of commodities trading is Feeder Cattle Jan 2024 Futures. This piece serves as a guide, explaining the fundamentals and nuances of these futures, the effectiveness of APIs in commodities trading, and practical advice for profitable trading.

Recognizing Feeder Cattle Jan 2024 Futures

Standardized contracts known as Feeder Cattle Jan 2024 Futures specify the future purchase and delivery of a given amount of feeder cattle at a predetermined price. The commodities market is a complicated but interesting place.

Feeder cattle play a key role in the livestock supply chain, their importance extending widely throughout the agricultural markets. To understand the dynamics of commodities trade, one must grasp their role.

Advantages of Integrating An API

The world of commodities has witnessed a change in data access and utilization thanks to APIs. They provide market insights, access to real-time information, and decision-making power. Let’s examine how commodities trading has changed as a result of this technological advancement.

One cannot emphasize the significance of APIs for data access. They act as the entry point for traders of commodities to get real-time data and analysis. Data that is current is essential to successful trading. It helps traders to respond quickly to developments in the market and make well-informed choices. Trustworthy sources of data are essential. Understanding the source and dependability of your data can make or break your trading methods.

For individuals who are prepared to embrace data-driven trading and learn how to negotiate the complexities of the agricultural markets, these Futures offer up a world of potential. As you go out on your Feeder Cattle Jan 2024 Futures adventure, keep in mind that success necessitates a trifecta of strategy, knowledge, and methodical execution.

Commodities API

Using the same API endpoints, any quantity can be converted between currencies, commodities, and currencies as well as between the values of each. Every minute, the API gathers data on commodity prices from more than 15 dependable sources. Banks and providers of financial data are some of the sources.

This documentation provides information on the API’s structure, potential problems, and code samples. Please get in touch with their support team if you have any additional questions; they will be pleased to assist you.

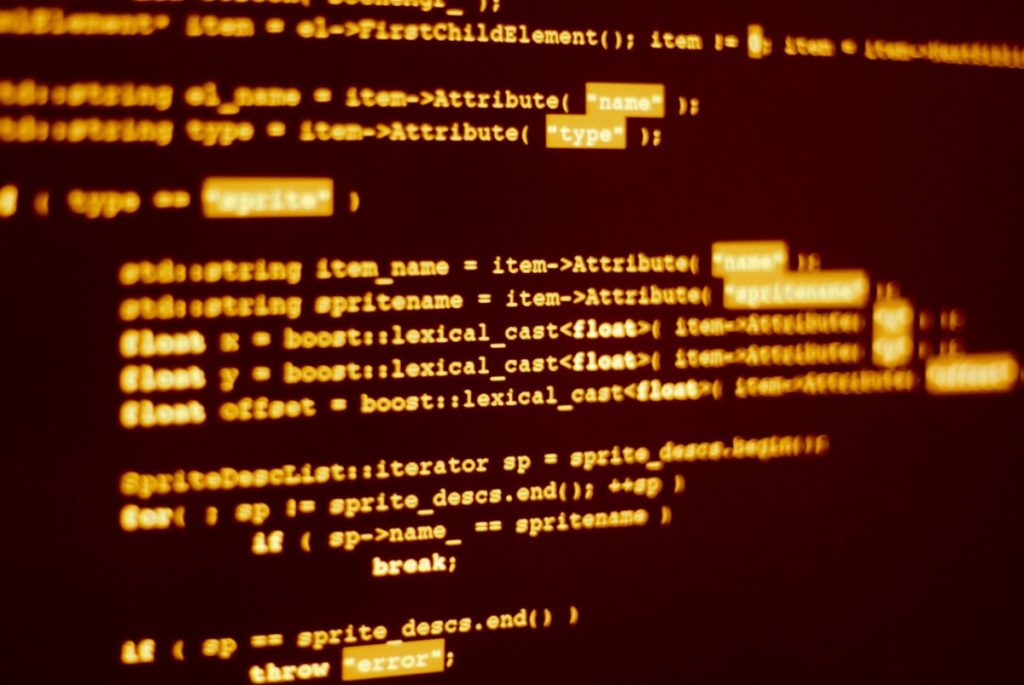

Just providing your unique Access Key as a query argument to one of the five main API Endpoints will get you access to a wealth of data. The following is an illustration of the type of response you would receive from the “Latest Rates” endpoint:

{"data":{"success":true,"timestamp":1698519420,"date":"2023-10-28","base":"USD","rates":{"FCF24":0.0042458337756077},"unit":{}}}

To access this API, you must first register on the website. To begin, select “START FREE TRIAL” from the menu. For now, API calls are required. After your inputs have been processed, you will receive a file in one or more formats that contains the necessary data.

Numerous SMBs, large businesses, and thousands of developers use the API on a daily basis. This API is the finest resource for learning about commodity prices because of its reliable data sources and more than six years of experience. The commodities data that the API provides is sourced from the World Bank, various organizations, and financial data suppliers.