This post will demonstrate how to get copper prices from the world’s most important exchange markets, in this case, Fastmarkets, using an API.

Copper is employed as a heat and electricity conductor, a construction material, and a component of different metal alloys such as sterling silver in jewelry, cupronickel in marine equipment and money, and constantan in temperature measurements strain gauges and thermocouples.

Copper is one of the few metals that may be found in nature in a metallic state and used immediately away (native metals). Copper oxidizes and becomes green when used in structures, most notably on roofs (or patina). Copper is used in ornamental art on occasion, both as elemental metal and as a color in compounds. Compounds derived are used to create powerful antibacterial agents, fungicides, and wood preservatives.

As a consequence of the COVID-19 epidemic, industrial closures and blackouts occurred all across the world. As a result, several countries have put temporary prohibitions on the production of electronic devices.

In conclusion, whether you want to participate in the copper business or your firm needs copper to function, you must be aware of current oil costs. However, there are other alternative internet funds available. This is vital to note since comprehending the forces influencing copper needs data from credible sources. Keep an eye on the prices of Fastmarkets.

Why Fastmarkets?

Fastmarkets is the most trustworthy cross-commodity price reporting agency (PRA) in the agribusiness, forest resources, metals and mining, and energy transition markets. Their price data, predictions, and market analysis provide their customers with a competitive advantage in complex, volatile, and often opaque marketplaces. Fastmarkets is owned by Euromoney Institutional Investor PLC, which is listed on the London Stock Exchange. The institutional shareholders of Euromoney are diverse.

To get this information, you’ll need the necessary tools. As a result, we strongly recommend that you use an API that provides both current metal prices and historical rates based on Fastmarkets data. Choose one that provides volatility data so that you may evaluate all of the factors when deciding whether to buy.

What Is An API?

An application programming interface (API) allows various devices or programs to communicate with one another. While a few services may be beneficial, keep in mind that not all are available or provide the same information.

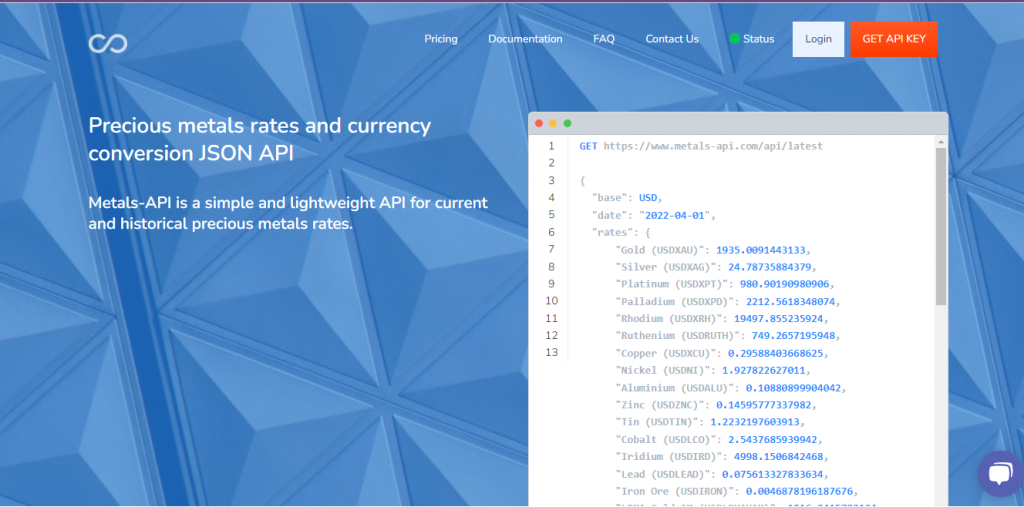

It is simple to discover an API, but it is more difficult to find one that offers copper prices in Fastmarkets values. Metals-API, one of the world’s largest precious metals stocks, collects the data. You may also utilize the API to incorporate it into your website or app, and the plugins on the page provide current and historical prices.

To receive it, follow these steps:

- To obtain an API key, go to www.metals-api.com and fill out the form.

- Look up the symbols you’ll be using in the dictionary. Copper is an “XCU” symbol.

- Use these indicators to add metal and currency to the list before sending the API call.

- Finish by clicking the “execute” button.

About Metals-API

Metals-API is software that gives real-time metal pricing information. Over 170 currencies, including the US dollar, euro, and digital currencies, are accessible at these conversion rates. You may see both historical and current rates. There is also an API for New York rates, as well as rates from other institutions. You may incorporate the data into your website or app using many computer technologies, such as PHP, JSON, and Python.