In this article, we’ll explore a VAT number validation API and say how to get a company postcode using it.

Each business registered for VAT is given a unique identification number known as a VAT number. Only businesses that have registered for VAT are issued a VAT number, which is used for taxation. A VAT number is thus also frequently referred to as a VAT registration number or VRN.

It is possible to have more than one of these numbers because a VAT number is unrelated to a Unique Taxpayer Reference or a Company Registration Number. A VRN is used to assist in locating VAT-registered firms. Consequently, a VAT number may be required in a range of different tax-related circumstances.

If you have registered for VAT, you must periodically during the tax year disclose your VAT. Your VAT registration number must be included on your VAT return so that the authorities may verify the periods for which you need to disclose VAT and if you have complied with your VAT declaration responsibilities.

You will receive a VAT number when you register for VAT. A VAT registration certificate verifying your VAT number, the date of your first VAT return, and your “effective registration date” will be given to you when the VAT registration procedure is complete. Later issues with your VAT returns might result from using the incorrect VAT number.

Consequently, it is wise to confirm that the VAT number is correct and valid each time you sell to a client who has submitted their VAT number, include their VAT number on an invoice, or give them their VAT number.

Why Verify Postcode?

Postcodes are more than simply a location-specific set of digits. They have evolved into social IDs that provide data on the demographics of a community’s residents. Businesses utilize Postcodes as significant data structures because they provide them with a visual depiction of their audience.

Postcodes that are incorrect or incomplete provide the largest problem for data quality. Address data is frequently inaccurate, insufficient, or incorrect in a time when businesses acquire data from several sources.

Human input is typically the cause of mistakes, typos, punctuation marks, misspelled or erroneous postcodes, etc. Not to mention that some individuals may submit fictitious addresses, resulting in erroneous and invalid information. Therefore, businesses must double-check the accuracy of their address data source before doing any statistical analysis.

Use An API

In this sense, to guarantee a good tax process, it is necessary to validate the VATs associated with certain postal codes. In this sense, you can do it with a work team, although this can take a long time. For this, it is necessary to use resources such as APIs.

An API is a programming interface that allows you to combine different software to develop functionalities. For example, with the VAT Validation number API, you can pass each VAT number and it will return different company data if it is correct and if not, it will indicate its falsehood.

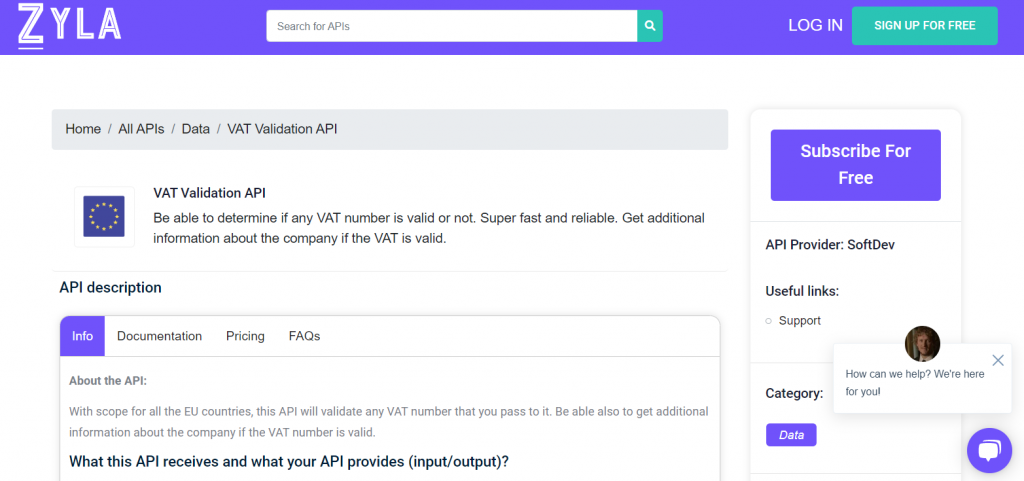

About VAT Validation API

VAT Validation API is one of the most useful you can find on the internet as it works with a wide range of programming languages. It also returns different data to be able to check that the taxes of a company are being paid correctly.