Do you invest in precious metals? Do you want to stay updated on movements and prices? Do it through a metal prices API!

Precious metals have a more stable value than stock options through shares or bonds since they are not affected by the turbulence of the financial markets and because they involve wagering on a physical object.

For instance, due to their many uses and high demand, both gold and silver have their unique characteristics when it comes to investment. Gold is the finest precious metal; it is mostly used in jewelry (48%) and is a malleable metal with little scope for modification.

In addition to being used in jewelry, silver is employed in industry (48%). Compared to other assets, these metals are low-risk investments that are disconnected from financial market fluctuations and are regarded as safe-haven values.

In addition to the actual metal, there are financial solutions that let you purchase the precious metal. In that regard, the raw material serves as an underlying asset for investment; specifically, they are:

- Gold ETFs: For investors who are more concerned with immediate returns, ETFs offer a viable alternative to purchasing the gold itself. In these scams, investors can make a deposit with a business, and that money will be utilized to buy actual gold.

- Investing resources: Because a manager will be in charge of purchasing mining shares and other businesses in the region of this metal’s extraction and will be able to invest it both in ETFs and in other derivatives, this is a diverse option to direct investment with this metal.

- Stocks: You can opt to invest in this metal by buying a publicly traded mining business, but you wouldn’t gamble directly on the precious metal; instead, you’d wager on the active mining futures and contracts of the firm.

- Share certificate: If you select this option, keep in mind that you will only get a certificate that certifies that you actually own a piece of gold. The benefit is that regulating the precious metal’s physical property is no longer an option.

- Futures and options: For investors that take a lot of risk with precious metals, this market offers liquidity and advantages. The earnings from the futures and options markets are bigger, but the losses are also substantial.

- Physical property: Depending on whether it is feasible or not, this is the choice to invest in a metal of the highest caliber since investors have total control over the asset.

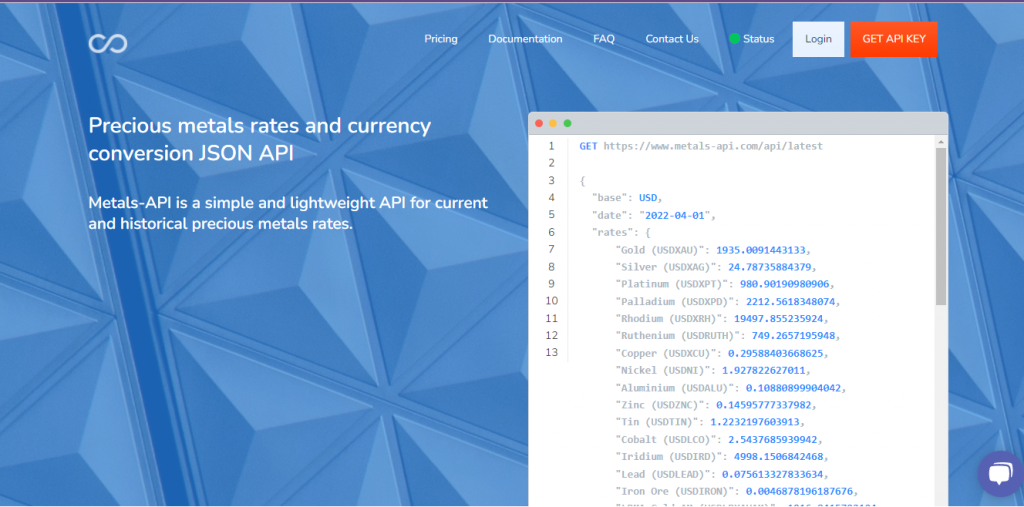

Some platforms are dedicated to obtaining from banks or financial entities, monetary data on the movements and prices of metals for those who are dedicated to the investment business in precious metals. An example and recommendation is the Metals-API platform.

Regarding Metals-API

When Metals-API originally launched, it was a simple, compact API for banks’ present and past precious metals pricing. With an accuracy of two decimal places and a frequency of up to every 60 seconds, the Metals-API API may provide real-time precious metals data through API. The capacity to convert between multiple currencies, provide time-series data, volatility statistics, and the lowest and highest price of each day are just a few of the features.

Methods of Use

Metals-API is easy to use. Now all you have to do is follow these instructions.

1. Start by making a profile.

2. Create an API Key.

3. Select the appropriate metal and currency.

4. Submit an API Request and watch for the system to provide an API in return.

A Successful Platform

Tens of thousands of programmers, small and medium-sized businesses, and big businesses use Metals-API.com every day. Due to its trustworthy data sources and more than six years of experience, Metals-API is the greatest source for up-to-date precious metals rates.

A Reliable Website for Their Customers

Metals-API obtains its currency information from banks and companies that supply financial information, such the European Central Bank. Bank-grade 256-bit SSL encryption is used to encrypt your connection to the Metals-API API.

Data or files are encrypted and decrypted using the 256-bit encryption method. After 128-bit and 192-bit encryption, it is the third-strongest encryption method employed by the majority of contemporary encryption algorithms, protocols, and technologies.