If you are a business owner, you surely know how important time and money are. That’s why you should read this article and find out how a VAT validation API can save you time and money.

VAT is a tax that businesses have to pay when they sell their products or services to their customers. This tax is paid to the government, and it is calculated based on the amount of money that the customer pays. The VAT tax is usually paid by the customer, but it can also be part of the cost of the product or service.

If a company sells its products or services in other countries, it has to pay taxes in those countries as well. This means that businesses have to keep track of all of their sales in order to know how much money they have to pay in taxes.

In order to keep track of all of this information, many companies use APIs. APIs are software tools that connect different systems together. This means that an API allows two different systems to communicate with each other and exchange data. There are many types of APIs, but one of the most useful for businesses is a VAT validation API.

What Is A VAT Validation API?

A VAT validation API is an application programming interface that helps businesses validate VAT numbers. This means that the API checks if a VAT number is valid or not. If it is not valid, then the business will not be able to accept payments from that customer.

This can be very useful for businesses because it can save them time and money. Time because they won’t have to accept payments from customers who don’t have a valid VAT number. And money because they won’t have to pay taxes on sales from customers who don’t have a valid VAT number.

Uses Cases

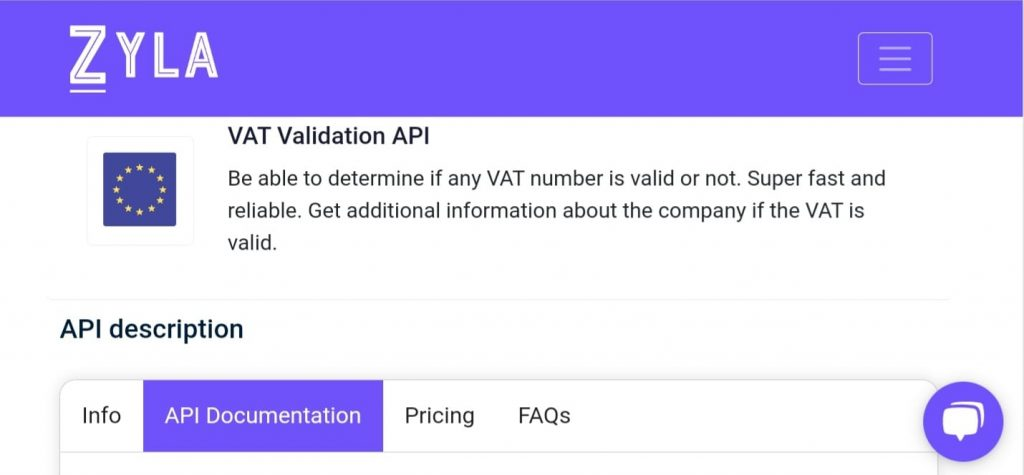

This way, businesses will be able to focus on their main activities, which is providing good products or services to their customers. Now that you know what a VAT validation API is and how it can help your business, you may be wondering which one is the best one available right now. We recommend using VAT Validation API, which is available on Zyla API Hub.

How To Use This API To Validate VAT Numbers

VAT Validation API is very easy to use. All you need to do is provide the VAT number and then you will receive information about whether or not it is valid. You can get this information by visiting Zyla API Hub and then subscribing to this API. You will receive an API key, which you can use to call any of the APIs available on Zyla Hub.

Once you have this unique combination of letters and numbers, you can start making calls to any of the APIs available on Zyla Hub. In this case, use VAT Validation API and make an API call by entering the VAT number. Then, make an API call by entering the VAT number.

After making the API call, wait a few seconds for the response. In this case, you will receive two pieces of information: country code and B2B status.

You must select the “VALIDATE” endpoint type, and you may investigate the following responses:

API Responses:

{

"valid": true,

"countryCode": "GB",

"vatNumber": "947785557",

"companyName": "BLUECLIFFE SERVICES LTD",

"companyAddress": "58-60 COLNEY ROAD",

"companyCity": "DARTFORD",

"companyPostCode": "DA1 1UH"

}So, why not try VAT Validation API right now? You’ll be glad you did!