Are you looking for technology that will allow you to guarantee accurate transactions? What can API do for the banking industry, do you know? Would you like to use these tools in your company? You can find some tips on how to use a bank information API in the article that follows.

Application programming interfaces (APIs) allow for inter-program communication. The majority of internet activities, such as using social networking apps, checking the weather, and making purchases, are supported by APIs. These devices made routine business tasks easier and more automated.

In the banking industry, there are several platforms and participants. These are involved in financial transactions, information exchange, and the exchange of commodities and services. Open access to banking APIs and services are becoming more common as the world transitions to an open financial system. While maintaining data security, the use of APIs dramatically enhances the seamless user experience. In the banking sector, APIs serve as a secure data transmission channel that keeps outside parties out of the process.

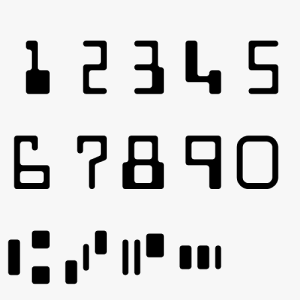

Using bank information APIs, you can control your bank accounts and ensure quick, secure payments. Verifying account information and other specifications is expedited by automating the recognition of a common identity. This identifier is often a nine-digit number known as a routing number. During a transaction, this is used to specify a bank or credit union. It attempts to quicken and streamline banking industry business procedures. There is a highly precise number for each bank. Despite having identical names, banks can be easily distinguished from one another thanks to their unique routing codes.

A routing number’s validity has a significant impact on the success of transactions. These might be helpful for setting up direct deposit, recurring loan payments, or routine transfers like bill payments. It is quicker and easier to use an API to apply a data checker than to manually encode the data. So, without having to wait for the banks to formally respond, you can acquire this information securely and reliably.

The process of integrating these potent technologies into your business is not as difficult as it may seem. The majority of APIs have a protocol attached to each endpoint that outlines the required inputs and the output you will get. API documentation typically includes instructions on how to successfully communicate with endpoints. The Routing Number Bank Lookup API , on the other hand, is a user-friendly bank information API that we recommend.

Setting up direct deposit, automatically deducting loan installments, and recurring transfers like bill payments all require outgoing numbers. A data checker can be provided using an API more quickly and easily than by manually encoding the data. As a result, you don’t have to wait for the banks to officially respond in order to receive this information right away.

Since ZylaLabs believes that automation is the key to today’s business process optimization, it was important to keep things simple when developing the service. With just a few lines of code, you can use the Bank Information API to validate your bank details at each step of your business process. To immediately begin using the API, make use of the code samples that our developers have written.

The importance of a routing number is closely related to the requirement for a routing transit number API. Numerous financial processes use the latest recent. Here is a brief synopsis to demonstrate their significance. Your business will be able to automate the adoption of direct deposit for government benefits like Social Security, the payment of bills online, international money transfers, wire transfers of funds, my wish for an immediate transfer of my paycheck, and other scenarios.