Would you like to know how a Taxes API works? Well, believe it or not, using it is very easy and simple. This digital tool can calculate anyone’s taxes with just a few clicks. You will find all the details of this API and much more in this post. It is a very interesting tool!

Taxes in the US are mandatory payments imposed by the government on individuals and businesses. They fund public services, infrastructure, and social welfare programs. Calculating taxes correctly is crucial to avoid penalties and comply with the law. Accurate tax calculations ensure fair contributions and a functional society. Taxes support essential sectors like education, healthcare, and defense.

Responsible tax management promotes economic growth and reduces income inequality. It empowers the government to address national challenges and invest in the country’s future. Incorrect tax calculations can lead to financial losses and legal consequences. Understanding tax obligations allows citizens and businesses to fulfill their civic duties and contribute to the nation’s well-being. Paying taxes fairly is a cornerstone of a democratic society and shared responsibility.

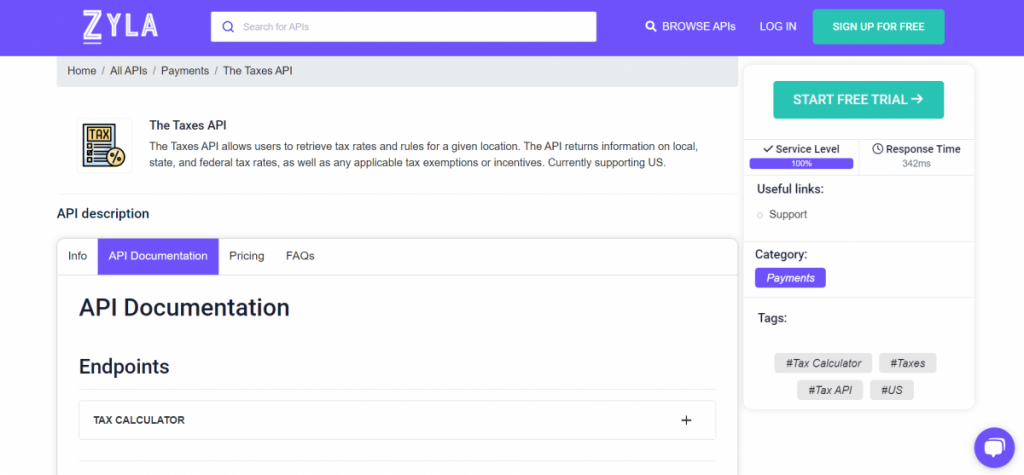

To avoid tax miscalculations, many individuals and businesses hire accountants. However, in recent years, APIs have appeared to calculate taxes. They are easy-to-use products. For example, The Taxes API from Zyla Labs is world-famous for providing the best tax calculation service. But also, it is famous for being easy to use.

How Does The Taxes API Work?

The Taxes API from Zyla Labs is a powerful tool designed to simplify tax-related tasks for American citizens and companies. It offers a range of benefits that can streamline tax processes and improve financial management. For citizens, the API enables easy access to essential tax information and updates in real-time. It empowers them to stay informed about their tax obligations and deadlines, avoiding potential penalties.

Companies can leverage The Taxes API to automate tax calculations and ensure compliance with the ever-changing tax regulations. This minimizes the risk of errors and potential legal issues. The API’s user-friendly interface makes it effortless for users to integrate tax-related functionalities into their existing systems. This leads to enhanced efficiency and reduced administrative burden.

How To Use The Taxes API?

1: Create an account on the Zyla API Hub.

2: Select the API you want to use, in this case, The Taxes API.

3: Choose one of the 5 available plans and make the payment.

4: Select the endpoint “TAX CALCULATOR” and complete the required data.

5: When you’re done, click the “test endpoint” button and in just a few seconds, you’ll get the taxes data!

We also offer you to watch this video where we ourselves use this API to calculate our taxes:

In conclusion, The Taxes API From Zyla Labs is a valuable asset for American citizens and companies. By simplifying tax-related tasks, improving accuracy, and promoting compliance, it enhances financial management and empowers users to make informed decisions. Embracing this technology can lead to more efficient tax processes, reduced stress, and greater financial control.

Read this post: The Taxes API: Usage Cases In 2024