Are you aware of how fast the way we track rates is transforming? It’s because the use of an API for commodity data! In this article, our aim is to explain you how this technology can benefit your business by being able to track rates in the most accurate way!

Information on the production, exchange, and prices of agricultural, mineral, metal, energy, and manufactured goods is referred to as commodities data. Common commodities information should include exact prices for these items, any price increases or declines, the current health of the commodities market, and expected developments.

Information on exchange rates, trading characteristics, and bidding features should all be included in commodities data. All of these should help market participants for commodities make decisions that are more precise and well-informed. Commodity data is one type of financial market information. Several circumstances necessitate its application:

Building commodities portfolios with the least level of risk is known as portfolio optimization.

Increased yield: attempts to improve capital investment returns.

Trading is the process of selecting profitable trade commodities and executing trade procedures after conducting research.

Asset management: helping businesses handle or manage their wealth successfully.

Information about the commodity market: it is necessary for both academic and investment purposes.

How Data APIs can transform the tracking pocess

An api for commodities prices is transforming the way we track rates by allowing users to access real-time pricing information from a variety of sources. This means that traders, investors, and other market participants can quickly and easily access current market data and make more informed decisions.

With these APIs, users can access up-to-date pricing information for commodities such as metals, energy, and grains, as well as futures and options contracts. By providing a convenient and centralized source of market data, commodities data APIs make it easier for traders and investors to stay up-to-date on market trends and make more informed decisions.

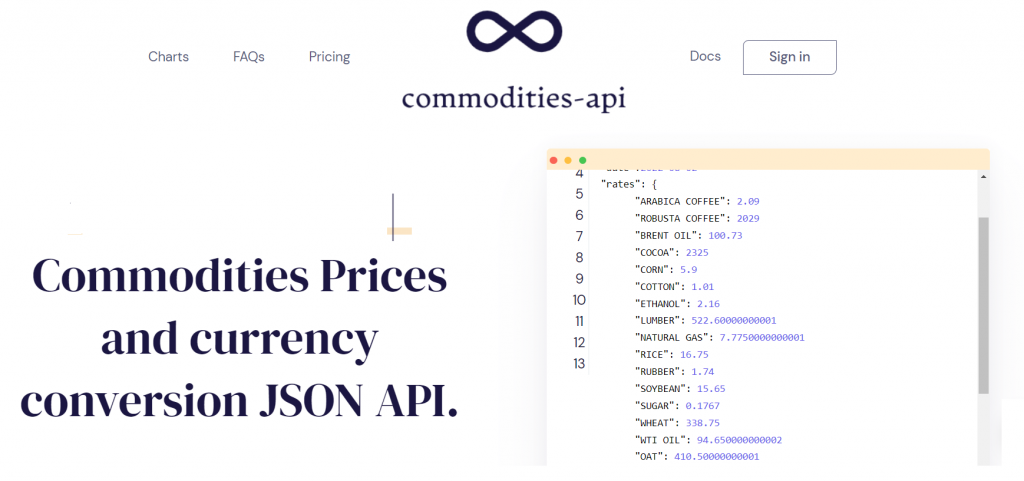

Commodities-API by Zyla Labs

Businesses that investigate the rates for agriculture, crude oil, metals and grains among many other commodities, employ the commodities API. This Data is gathered both recently and historically. This API contains the most precise technology for commodity pricing. The chosen value for methanol and other items is updated continuously. You can choose between JSON, PHP, Python, and more languages.

Additionally, you can compare various data types to assess them so that the client can decide on the ideal time to invest based on that example. You can contrast the price of methanol, for example, with the price of other products like gas or oil. You will also get information on futures contracts and current market pricing with this api for commodity data.

Commodities API by Zyla Labs is an API that provides real-time access to prices, news, and analysis of commodities and futures markets across the world. It offers a comprehensive set of APIs that make it easy for developers to quickly integrate commodities data into their applications.

This api for commodities prices supports a variety of data points, including live prices, historical prices, news, and analysis from leading sources. The platform allows users to quickly build and execute trading strategies and monitor the performance of their investments.