As stakeholders brace themselves for the uncertainties of the Corn May 2024 market, strategic preparation becomes paramount. Navigating through unpredictable weather, shifting demands, and evolving trade dynamics requires foresight and a well-laid plan.

How To Be Prepared For Corn May 2024 Prices

Here’s a guide on how to effectively prepare for Corn May 2024 prices:

Stay Informed

- Market Monitoring: Keep a close eye on corn market news, expert analyses, and current trends to anticipate potential developments.

- Data Analysis: Utilize government reports, industry data, and commodity price forecasts for tracking production, demand, and inventory levels.

- Subscribe to Updates: Stay informed by signing up for alerts from reliable sources regarding news, policy changes, and weather forecasts impacting the corn market.

Strategize

- Diversify: Producers can consider planting complementary crops to reduce dependence on volatile corn prices, while buyers can explore alternative sourcing options.

- Risk Management: Employ tools like hedging, options contracts, and insurance to protect against significant price swings.

- Scenario Planning: Develop adaptable strategies for various price scenarios (high, low, moderate) to adjust production, sourcing, or inventory management accordingly.

Stay Agile

- Flexibility: Be ready to adjust plans based on evolving market conditions, such as altering planting schedules, sourcing arrangements, or sales contracts.

- Constant Evaluation: Continuously monitor market updates, reassess strategies, and ensure they align with the changing landscape.

- Networking: Collaborate with other market participants, gain insights, and adapt collectively to market shifts.

Additional Tips

- Focus on Efficiency: Streamline operations to reduce production costs, enhancing resilience to price fluctuations.

- Invest in Technology: Leverage tech tools for data analysis, precision agriculture, and risk management to optimize decisions and yields.

- Seek Expert Advice: Consult with agricultural economists, financial advisors, or industry professionals for tailored guidance and strategic planning.

Preparing for the complexities of the May 2024 corn market requires proactiveness, adaptability, and a sound understanding of potential influencing factors. By staying informed, strategizing effectively, and remaining agile, stakeholders can significantly enhance their chances of navigating the market successfully.

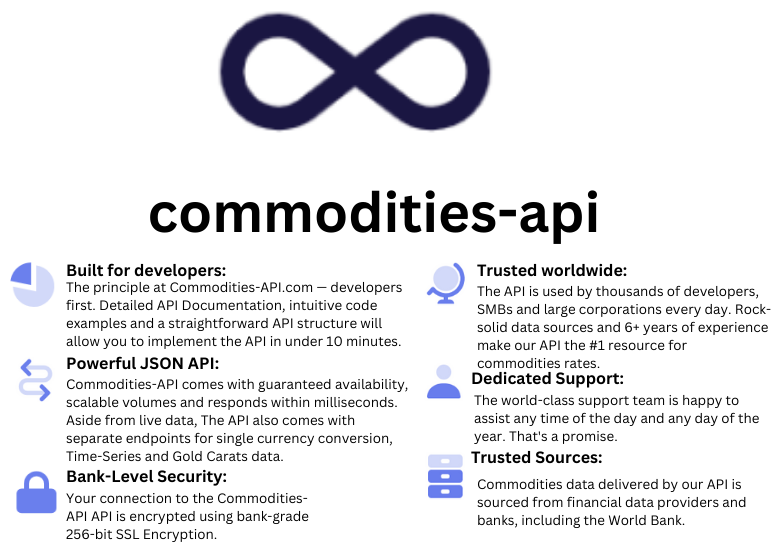

Unlocking Solutions With Commodities-API

In the realm of commodity trading, where timely and accurate data is the key to making informed decisions, Commodities-API emerges as a game-changer. Offering millisecond response times, scalable volumes, and high availability, this API provides real-time data through distinct endpoints, making it a valuable tool for stakeholders in the corn market.

Onboarding Steps With Commodities-API

- Obtain Your API Key:

- Log in to your account and secure your API Key from the “Get Your API Access Key” tab.

- Explore the 5 Key API Endpoints:

- Latest

- Historical

- Convert

- Time-Series

- Fluctuation

- Decipher the API Response:

- Understand Commodities Prices by dividing values by 1, with returns based on the chosen base currency.

- Integration into Your Application:

- Conclude the integration into your application by following the detailed guides and code examples in the API’s Documentation.

Example

Endpoint: Latest [request the most recent commodities rates data] – Corn May 2024

- INPUT:

- Base Currency: USD

- Symbols (Code): CK24

- API Response:

{"data":{"success":true,"timestamp":1704988740,"date":"2024-01-11","base":"USD","rates":["CK24":0.002128791910591],"unit":{}}}Conclusion

With Commodities-API, stakeholders can access a wealth of information effortlessly, ensuring they are well-equipped to tackle the complexities of the Corn May 2024 market.

For more information read my blog: How Can We Prepare For Corn Mar 2024?