In the ever-evolving landscape of the financial industry, effective risk management is paramount for businesses to safeguard their operations, maintain regulatory compliance, and protect their stakeholders. This highlights the importance of leveraging Banking Information APIs to elevate risk management practices, enabling businesses to stay ahead of potential risks and make informed decisions in an increasingly complex and dynamic industry.

As technology continues to advance, developers in the financial sector are constantly seeking innovative solutions to bolster their risk management efforts. The utilization of a Banking Information API emerges as a game-changer. By integrating these APIs into their systems, developers optimize risk assessment and mitigation strategies.

Elevate Your Risk Management: Unleashing The Power Of The Banking Information API

A Banking Information API enhances your risk management efforts in several ways: identifying and preventing fraud and complying with regulations as well as improving your customers’ experience. By making it easier for customers to make payments and access their accounts, you can increase customer satisfaction and loyalty. Let’s see how.

Identify Fraudulent Transactions

By verifying the validity of SWIFT, IBAN, and routing numbers, you can help to identify fraudulent transactions. For example, if a SWIFT number is not associated with a valid bank, the transaction is likely fraudulent.

Prevent Money Laundering

By verifying the identity of the sender and recipient of a payment, you can help to prevent money laundering. For example, if the sender and recipient are not known to each other, it is more likely that the transaction is being used to launder money.

Comply With Regulations

By using Banking information API, you can ensure that you are complying with regulations, such as the Bank Secrecy Act (BSA) and the USA PATRIOT Act. These regulations require businesses to verify the identity of their customers and to take steps to prevent money laundering and terrorist financing.

Overall, the API is a valuable tool for businesses that are looking to improve their risk management efforts. Some additional benefits of using this API are:

Reduce Costs – Cost associated with fraud and other financial crimes. For example, businesses can save money on chargebacks and investigations.

Improve Customer Experience – Make it easier and faster for customers to make payments. This can help businesses improve customer satisfaction and loyalty.

Increase Efficiency – Increase the efficiency of payment processing operations. This can help businesses save time and money.

The Most Effective Banking Information API

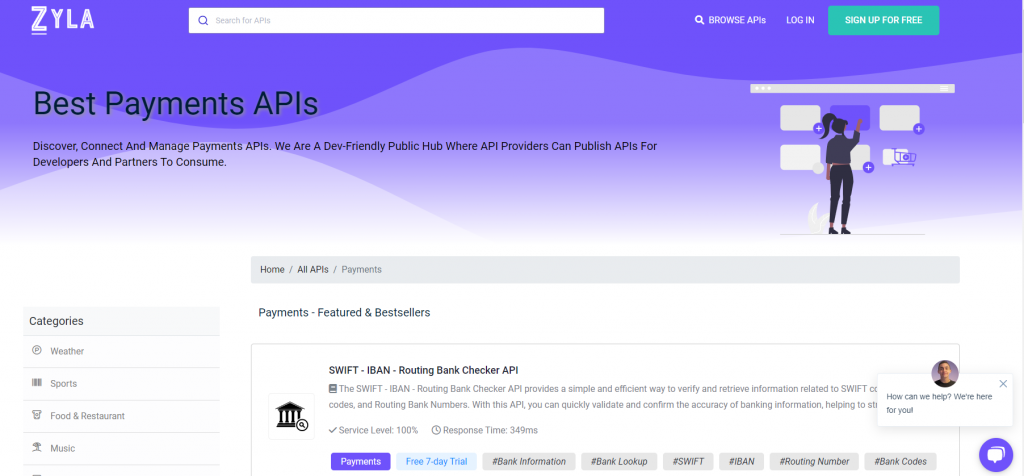

If you are looking for a way to improve your risk management efforts, then you should consider using the SWIFT – IBAN – Routing Bank Checker API for your next project. A user-friendly tool to retrieve information on bank accounts worldwide. This Banking Information API has gained significant popularity due to its effectiveness, and you can find it on the reputable API marketplace, Zyla API Hub.

To explore the API, visit www.zylalabs.com and navigate to the Categories menu, select the Payments option, this will take you to the page featuring the Best Payment APIs, where this API is located. Clicking on the API, you will be directed to the API’s dedicated page, where you can access detailed information and documentation. This documentation provides a list of available endpoints.

To get started, take advantage of the free 7-day trial, allowing you to experience the API’s functionality. Additionally, you can choose a suitable plan based on your monthly call requirements from the available options.

How To Use The API

To start using the API, you need to navigate to the API dedicated page as described above. Then by clicking on the start free trial option on the upper right side of the screen, clicking on the option you can start your free trial by providing some additional information, you’ll receive an API key that will allow you to send API requests using the endpoint of your interest.

Example

INPUT

Selected endpoint – SWIFT code Checker.

Pass SWIFT code – MUCBPKKA

(Check-out you are not a bot )

RUN TEST!

OUTPUT

API Response

{

"status": 200,

"success": true,

"message": "SWIFT code MUCBPKKA is valid",

"data": {

"swift_code": "MUCBPKKA",

"bank": "MCB BANK LIMITED",

"city": "KARACHI",

"branch": "",

"address": "MCB TOWER FLOOR 3 I. I. CHUNDRIGAR ROAD",

"post_code": "74000",

"country": "Pakistan",

"country_code": "PK",

"breakdown": {

"swift_code": "MUCBPKKA or MUCBPKKAXXX",

"bank_code": "MUCB - code assigned to MCB BANK LIMITED",

"country_code": "PK - code belongs to Pakistan",

"location_code": "KA - represents location, second digit 'A' means active code",

"code_status": "Active",

"branch_code": "XXX or not assigned, indicating this is a head office"

}

}

}