Understanding the pulse of Gold Rate Today in Nagpur Maharashtra is akin to deciphering the rhythmic beats of economic health. The glimmer of gold, a traditional wealth reservoir, reflects economic fluctuations and investor sentiments. In the heart of India, Nagpur stands as a beacon, its gold rates echoing the vibrancy of its economic tapestry.

Factors Influencing Gold Rate Today in Nagpur Maharashtra

The tango of Gold Rate Today in Nagpur Maharashtra begins on the global stage, where economic indicators perform a delicate ballet. Inflation rates, the prima donna of economic metrics, sway gold prices, dictating whether it emerges as a shield against rising prices or succumbs to their impact. Currency fluctuations choreograph intricate patterns, while international trade dynamics form the backdrop, setting the stage for gold’s performance.

As the focus shifts to the national arena, Nagpur’s gold rates sway to the beat of government policies, import-export booms, and GDP expansion. Here, the city’s economic intricacies influence the local gold narrative. Nagpur’s streets throb with the tune of the Ahmedabad Gold 22k, reflecting regional demand and supply dynamics. The jewelry sector, a major actor, sways with customer tastes in Maharashtra, shaping the city’s gold market environment.

Real-Time Tracking and Analysis

As the gold market orchestrates its daily performance, real-time tracking becomes paramount. Online platforms, offer a symphony of information, bridging the gap between investors and the ever-shifting gold notes. Historical trends and patterns form the backdrop, revealing the intricate dance between supply, demand, and investor sentiment.

Nagpur’s gold rates step into the spotlight, inviting scrutiny against the national average. The performance is a nuanced art, influenced by factors ranging from regional demand to geopolitical shifts. The implications ripple through the city, affecting local buyers and investors alike. Local jewelers become storytellers, offering insights into market trends. Interviews with these artisans of gold unveil predictions for future rates, weaving a narrative that transcends numbers. Their perspectives, a testimony to the fusion of tradition and economic pragmatism, add depth to the gold chronicles of Nagpur.

Metals-API

The inaugural Metals-API was a modest, lightweight open-source API that provided historical and current values for bank-owned precious metals. The API delivers real-time precious metals data with two decimal places of accuracy and a frequency of up to sixty seconds. Some of the services include accessing time-series and fluctuation data, converting single currencies, calculating the day’s lowest and highest prices, and providing precious metal exchange rates.

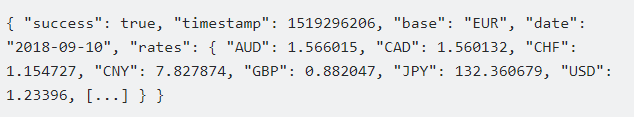

To proceed, you must first register with this website. Create an API request using the metals, currency, and base currency symbols from your search. Here is an example of an API response:

If the metal rates are using USD as the base currency (via the ‘base’ option, which defaults to USD if not specified), the API response must include 1/value. For example, using 1/0.0004831705 to determine the gold rate in USD based on the API response yields 2069.6627795 USD. If USD is the base currency, the price in USD will be provided in the API response; no further conversion is required.

To find this, use USDXAU (APPLIES TO THE LATEST ENDPOINT). It’s also worth noting that if you select a different base currency, such as EUR, the 1/value split becomes unneeded. Already, the price has changed.