We recommend using a free top API to get gold prices from New Delhi, one of the most dependable sources.

It is quite rare to come across someone unaware of gold’s intrinsic worth, not only as a piece of jewelry or because of its auspiciousness, but as a powerful asset that may potentially offer substantial returns, especially in times of economic turmoil. As a result of this, it is critical to comprehend what truly drives gold prices in India.

Let’s begin with some simple yet important statistics and data. India is one of the world’s major gold users. The yearly demand for gold in India is about equal to 25% of the worldwide physical demand. This emphasizes the importance of understanding what influences gold prices in India.

Gold prices tend to be inversely related to interest levels. The explanation for this might be that when interest rates fall, individuals don’t obtain satisfactory returns on whatever deposits they have, and they assume that investing in gold would give higher returns, leading to an increase in demand for gold and, as a result, an increase in its price.

When interest rates rise, individuals tend to sell their gold and instead place their money in deposits in the hopes of earning more interest, resulting in a decrease in demand for gold and, as a result, a decrease in its price. However, there has never been a direct association between gold prices and inflation.

Because of the value systems of the Indian population, one cannot ignore the influence of the Indian jewelry industry on gold prices, therefore let us try to comprehend the link between them. We are all aware of how important gold is in Indian families, especially during the festival and wedding seasons.

Prices rise as a result of increased consumer demand for gold over the holiday season. In 2019, Indian families collected almost 25,000 tonnes of gold, essentially making India the world’s largest gold hoarder.

How To Invest In Gold Industry

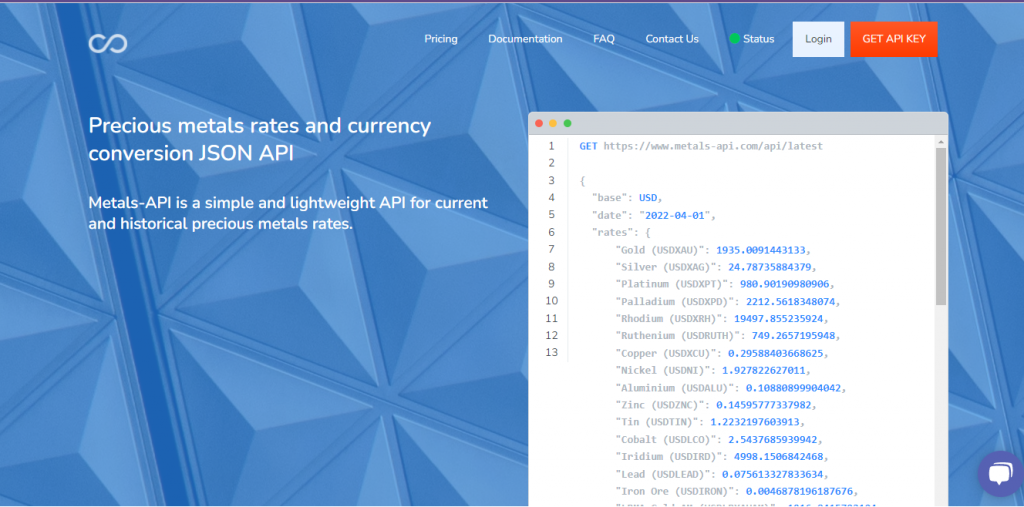

To participate in this industry, you must use an API. It is software that connects with a variety of devices. Several of these may be found on the internet. Unfortunately, not all of them operate or supply data in the same way.

To operate in the gold sector, you must supply the most reliable information to analyze price swings over time and stay up to date on pricing. As a result, you may select one that provides both historical and current gold prices from credible New Delhi sources. Metals-API is an excellent choice for this. It collects data from the most credible sources and important trade hubs to give real-time information on a wide variety of commodities.

This data will be highly beneficial in determining the best time to buy by analyzing price fluctuations caused by various occurrences throughout time. You may also monitor and report spot pricing using your network. Use Metals-API, which gets data from the most reliable sources, for this aim.

Why Metals-API?

Every minute, the Metals-API collects currency rate data from over 15 trustworthy sources, including the LME, New York Rates, and ICE. Metals-API only provides information on average currency swings. Metals-API provides precise Precious Metal exchange rate data in over 170 different foreign currencies. There is no need for you to wait for answers because it is the most exact and rapid API.