In the fast-paced world of finance and investment, staying ahead requires more than just intuition—it demands access to real-time data. Gold prices have long been a barometer of economic health, making their dynamic nature crucial for investors and businesses alike. This article delves into the multifaceted world of Gold Price Today Madurai, the factors influencing them, and the game-changing role of APIs in obtaining real-time data.

Significance of Real-Time Gold Price Today Madurai Tracking

Gold, a timeless symbol of wealth and stability, undergoes continuous price fluctuations influenced by a myriad of factors. Investors keen on optimizing their portfolios and businesses navigating market dynamics find real-time data indispensable. The heartbeat of Gold Price Today Madurai often synchronizes with global economic trends. As nations rise and fall in economic prominence, so too does the allure of gold. Understanding these macroeconomic shifts provides investors with valuable insights for strategic decision-making.

Gold prices do a careful ballet with inflation and interest rates. Precious metal acts as a hedge against declining currency values and tends to flourish during periods of low interest rates and inflation. It is critical to be aware of these economic indicators in real time. The financial markets are susceptible to shockwaves from the stormy sea that is the geopolitical scene. Abrupt increases or decreases in the price of gold can be attributed to wars, political unrest, and international disputes. With real-time tracking acting as a compass, investors can navigate these uncharted waters with ease.

API Integration

In the age of rapid technological development, APIs stand out as the unsung heroes who make it easy to access real-time data. Through the use of these APIs, which serve as gateways, investors and companies can monitor the movement of gold prices in real time.

APIs retrieve current data straight from reliable sources, ensuring data accuracy. Users are empowered to confidently make informed judgments due to the data stream’s dependability. APIs make the process of retrieving real-time data automated in a world where seconds count. Timely decision-making is made easier by this automation, which is important in the fast-paced world of gold dealing.

Metals-API

When Metals-API was first made available, it was an Open-Source, simple, lightweight API that provided the historical and present values of precious metals held by the banks. With a precision of two decimal places and a frequency of up to sixty seconds, the Metals-API offers real-time precious metals data. A few of the features include determining the day’s lowest and highest price, converting single currencies, acquiring time-series and fluctuation data, and providing exchange rates for precious metals.

Thousands of developers, SMBs, and large corporations utilize it daily. With more than six years of experience and trustworthy data sources, the API is the greatest place to find metals rates. Metals-API obtains its currency data from a number of banks and financial data providers, including the European Central Bank.

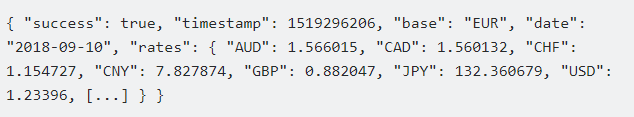

To continue, you must first register on our page. Next, use the symbols that match to your search to create an API request with your desired metals added to the symbols and your preferred currency added to the base currency. The following is an example of an API response:

The Metals-API provides exchange rates against the US dollar by default. Since the data is all returned in the same JSON format, parsing it in any computer language is easy.

When getting metal rates with USD selected as the base currency (using the ‘base’ option, which defaults to USD if not specified), the API response must have 1/value appended. For example, run 1/0.0004831705 to obtain the gold rate in USD based on the API response result; the result is 2069.6627795 USD. If USD is used as the basis, the price in USD will be included in the API response without requiring further conversion.

To find this, for example, one can use USDXAU (ONLY APPLIES FOR LATEST ENDPOINT). It’s also crucial to keep in mind that if you decide to use a different base currency, such as EUR, the 1/value split is not necessary. Already, the price has changed.