In today’s fast-paced financial world, stock market data is crucial for decision-making and investment strategies. Stock index solutions help investors track performance, making accurate, real-time data essential for traders and developers. Indices-API stands out as the leading Global Indices API, offering comprehensive market data that powers modern financial applications.

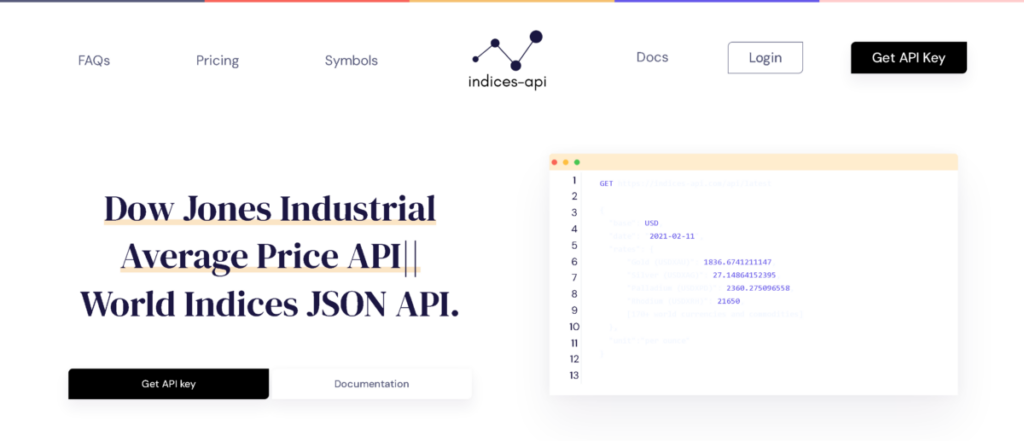

Indices-API: The Leading Global Indices API for Stock Index Solutions

When it comes to selecting the right Global Indices API, developers are seeking more than just basic functionality. They need a solution that offers both breadth and depth in terms of the stock index data it provides, and Indices-API has proven itself to be the frontrunner in this area. With a rich catalog of global stock indices, spanning multiple markets and industries, this API delivers all the data necessary to create dynamic and responsive applications.

Unlike many competitors, Indices-API prides itself on offering a wide range of market data, covering everything from major global indices to more niche markets. Whether you’re looking for data on the Dow Jones Industrial Average, the FTSE 100, or the CAC 40, it ensures seamless access. This extensive selection allows businesses to build versatile applications that can cater to a broad user base or focus on specific market segments.

In addition to its comprehensive data offerings, Indices-API is lauded for its user-friendly integration. Developers can quickly and easily plug into the API, accessing stock index data with minimal friction. The documentation is well-detailed, and the API is designed to integrate with various programming languages, making it suitable for both small development teams and large financial institutions. This ease of integration empowers developers to focus on building their product rather than getting bogged down by technical complications.

But, What is a Global Indices API and How Does It Work?

At its core, a Global Indices API is a software interface that allows developers to access a wide range of stock indices from different markets across the world. These APIs provide a direct pipeline to essential financial data, pulling stock index values from multiple sources and delivering them in real time to developers who can integrate this data into their applications.

This streamlining of data access is where the true power of a Global Indices API lies. Instead of developers needing to manually source data from different exchanges and process it themselves, they can rely on the API to handle all the heavy lifting. The API not only fetches data but also ensures that it’s accurate and timely, thanks to its connections with reputable financial sources. This creates an essential tool that powers everything from personal investment apps to professional trading platforms.

Enter Indices-API, offering developers a solution that guarantees the reliability and precision they need. By providing access to a broad array of reliable global indices, it ensures that developers can tap into a continuous stream of fresh data. Bolstered by its strong partnerships with top financial data sources!

How Indices-API is Transforming the Development and Stock Market Landscape

In an increasingly interconnected global economy, access to reliable, accurate stock market data is indispensable for developers and businesses alike. Indices-API has proven itself to be an invaluable tool, providing real-time, comprehensive market data that powers stock index solutions for a wide range of applications. Its rich features, global market coverage, and seamless integration make it the leading choice for developers aiming to build powerful financial applications.

Related Post: Image Search for Online Stores API For Accurate Product Matching