Do you want to find the platinum spot price? You need to try this by incorporating an API like the one we suggest in this post. Get it at the moment!

In addition to its many commercial operations, platinum has a history as an asset material and is available in the form of ingots and medallions. Compared to traditional gold and silver buys, investing in platinum bullion or ornaments is more recent and less common. Combined with the limited stock of financial objects made of genuine platinum, this makes it extremely challenging for investors to perform their duties.

In addition, economic uncertainty and speculative activity have depressed the price of platinum during the previous 40 years. Because geophysical studies show that precious metal resources are not particularly common, their rarity has led to their price increase. When dealing with platinum, researchers think that platinum ingots are more profitable than coins since they can be bought for less money.

Platinum Forecast

There will be a 303,000-ounce supply deficit in the platinum market in 2023. This is because consumption for this valuable and commercial material is expected to climb by 19% worldwide, to 7.7 million ounces, relative to this year, while production is only expected to grow by 2%.

According to many specialists, China’s purchase rates were exceptionally high all through the third quarter of 2022. Regardless of the global glut, this situation continued to pressure the actual economy. These shipments, like earlier in the year, far outstripped the estimated Chinese need.

The consequence will be global platinum production by 2022. 10% YoY, and his results won’t get much better over the coming year. For all of this, it is projected to rise by just 2% to 5.7 million ounces.

The supply of platinum from the automobile sector will rise by 12% this year as a result of a mix of growth in passenger auto manufacturing, and stricter environmental legislation for elevated automobiles in China and India. In addition to elements like the increasing replacement of platinum for palladium, which will achieve 200,000 ounces this year and 500,000 in 2023.

In 2022 and 2023, it is expected that the demand for jewelry would be around 1.9 million ounces each year. The world’s supply will decrease by 14% in 2022 relative to the career-high demand levels in 2021. However, the mining investment for platinum in 2022 will be the third-highest in history at 2.1 million ounces.

This pattern can continue, making 2023 the second-strongest market consumption year ever with a 10% increase to 2.3 million ounces. Finally, the consumption of platinum bars and coins will rise by 2% to 340.00 in 2022. The insolvencies and delistings of ETFs will nonetheless result in a net sale of 525,000 ounces for the year.

Get The Platinum Spot Prices Via An API

You’ll find that trading in the metal industry is quite difficult. For this reason, individuals hunt for trustworthy sources of data day after day. To keep an eye on costs, they also search for recent data.

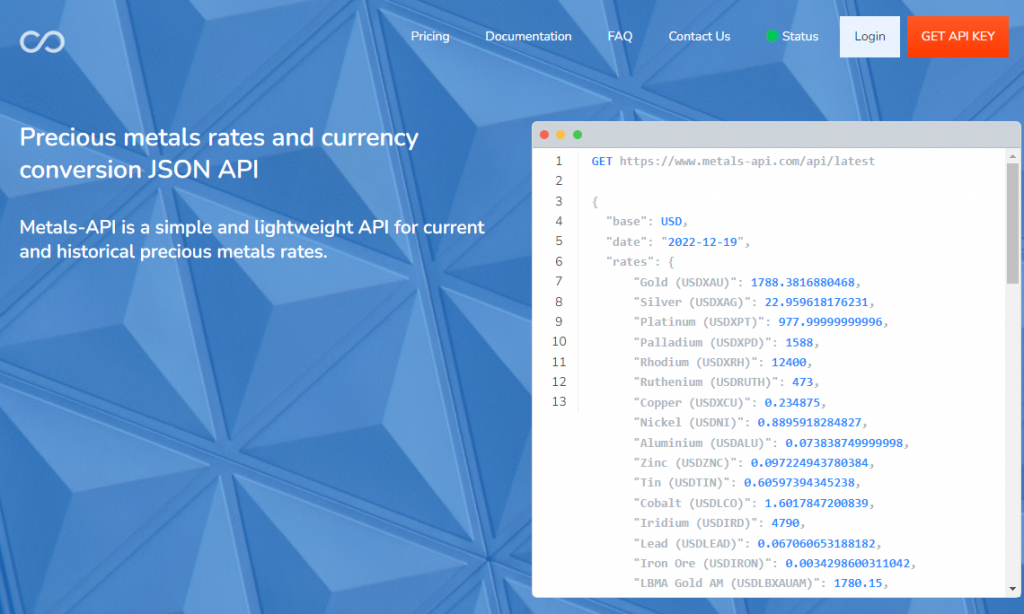

They are more able to plan when to spend as a result. You must thus incorporate this latest information in your new platforms if you are a trader or provide them with investment advice. Therefore, we wish to assist you with modern technology, namely an API. You may quickly obtain all current platinum prices using the Metals-API. Check out this example of a reply:

Why Metals-API

The Metals-API has a wealth of knowledge about various metal kinds. Both the most recent pricing and historical and fluctuation information are available. You may get considerably more knowledgeable about metal investing in this manner.

You may easily incorporate several types of data about this sector on your website. As a programmer, you may find the API’s integration with several programming languages to be quite helpful.