Is your company looking to get data, information, and trends in metals? Integrate this API and not a single piece of information will escape.

Next year (2023) is approaching and we have to start talking about it. It is no secret that 2022 was a year full of diversity. Lots of countries’ and industries’ economies have been affected due to worldwide factors. As a result, metal trends have varied, and prices have fallen, increased, changed, and more.

Therefore, businesses that invest or work in the buying and selling of metals; must be really aware of this. All business decisions must be done wisely and thoughtfully, after all this will have an immediate impact on the health of the company; and of course, we all aim for a healthy corporation, right?

Thankfully, even though we live in a world that is constantly changing, so are our technologies. We are at a place where we are continuously finding ways to create techs and innovations that blend with our needs. Hence, we have found that the metals market is one that fluctuates a lot; the tech industry has found a way how to keep track of it.

Thus, if your company can be affected by such fluctuations, you should be incorporating a metals API by now. This application programming interface can tell you all about metals trends, prices, records, and more. But before diving deep into which metals API is the best for you, let’s provide some context into what we’re expecting in 2023.

A Few Examples

- The conflict between Ukraine and Russia has some worldwide repercussions, and these, together with China’s economic slowdown, have made this year not very favorable for metal prices; particularly for the price of coal, which has fallen by about 20% in this first half.

- Due to inflation and concerns about a worldwide recession, the weakening of demand in recent months had an impact on the decline in prices of basic goods that had reached their peaks in the first few months of the year. It is anticipated that energy prices will decrease by 11% in 2023 and 12% in 2024 and that agricultural and metal prices will decrease by between 5 and 15% in 2023 before stabilizing in 2024.

- Evidence contributes to metal price fluctuations as a significant economic cycle in 2023. Thus, this info is crucial for countries that heavily rely on the export of goods made of metals like copper or aluminum as well as on tax revenues and economic activity.

This information can give you a better overview of what to expect. Evidently, just as was mentioned at the beginning of the article the controversies surrounding our world impacts directly in the metallurgical industry. Thus, it is key to have a precious metals API that will keep you aware of everything in 2023.

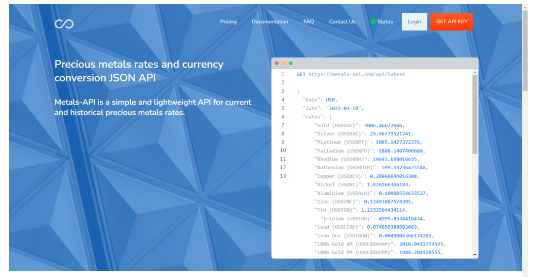

Metals-API: The Best API To Catch Trends

As we have made it really clear, evidence, numbers, and statics, show that 2023 will be full of changes and fluctuations. The key to success is not being afraid but aware, prepared, and ready to catch them. Thankfully, with the Metals-API all of this is possible and even more.

This metal application programming interface is a reliable and global API known and used by some of the biggest companies. Among some names you may know that use the API you can find:

- Chainlink

- Barrick

- Glencore

- Mansour

- And many more.

- Maybe you will be next?

With Metals-API your company will receive immediate and real-time information about metal prices. Also, it is possible to receive carat, latest, historical, and many other rates. All kinds of information imaginable you want to get about metals; the Metal-API will provide it.

Now be ahead of any trends and metal fluctuations. Be ready for 2023 and become the best of the bests. Good luck and start now here: https://www.metals-api.com/