A commodities exchange is a legal institution that sets and executes trading rules for regulated commodity contracts and related financial derivatives.

There are physical and online institutions around the world. The most common ones are in the United States (CME and NYMEX). On the other hand, ICE belongs to Europe and LME to London.

Last but not least, one of the biggest entities is MCX. This listed exchange from India trading exchange allows for online commodity derivatives trading and risk management.

MCX

The Multi Commodity Exchange of India Limited allows users to trade commodity derivative contracts in a variety of areas. For instance, there are bullion, industrial metals, and precious metals as well as indexes based on these contracts.

Whether you or your company are considering investing in gold, palladium, or any other precious metal, it’s priority number one to track prices.

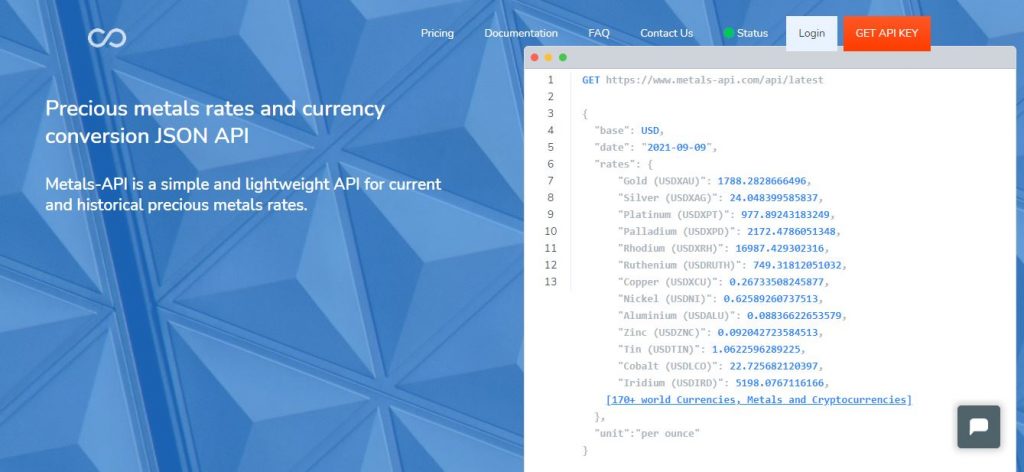

To summarize, there’s an online API at Metals-api.com that works with the entities mentioned before. Actually, having spot prices in many currencies and with historical data is highly useful to an appropriate investment.

Metals-API

Even so, Metals-API collects market data prices in a range of formats and frequencies from a variety of trade sources and global organizations. However, commercial sources, especially for major currencies and metals, are given a larger weighting since they more precisely reflect market exchange values.

Precise

The “validation and fallback” system assigns separate priorities to each data source and validates each metal/forex rate to reach the best level of coverage and correctness.

Also, if one source fails to provide a trustworthy quote for this currency pair, the next highest provider is evaluated. This helps to eliminate inconsistencies and provides accurate spot conversion rates to six decimal places for the great majority of currencies.

Main Advantages

- Get institutional-quality real-time precious metal values via an amazingly simple API by using a reliable Gold and Silver pricing API trusted by hundreds of industry companies.

- Real-time gold and other metals pricing might be easily integrated into spreadsheets, websites, mobile apps, and other commercial applications.

- Reduce the time it takes for apps that are dependent on precious metal prices to reach the market.

- You might be able to manage the problems and complications of old feeds by using cloud APIs.

Key Features

- Periodicity for real-time, history, and a tick-by-tick API

- Fresh precious and base metals pricing

- Real-time metal pricing for the platinum group and base metals API

- API graphs for present and previous APIs

- Spot and projected prices of gold, silver, palladium, and platinum throughout history