Are you seeking an NYMEX platinum pricing API? This is a post dedicated to you!

In 2021, the worldwide platinum market was massively oversupplied. Due to the situation in Ukraine, palladium prices have skyrocketed, prompting automakers to switch to cheaper platinum to save money, boosting demand. Russia produces around a quarter of the world’s palladium and about a tenth of the world’s platinum.

In 2021, however, massive platinum imports into China, much of it by speculators taking advantage of cheap prices, devoured the market excess. As a backlog of semi-processed material in South Africa runs out, platinum supply is expected to dip by 1% in 2022.

Since the largest of these products’ investors are based in New York, being up to date on NYMEX prices is critical. With all of this in mind, you should be up to date with current metal pricing if you’re considering investing in platinum or similar enterprises. And, if you become a part of the investor stage, you must keep an eye on the business’s heart. As a result, keeping a watch on NYMEX prices is crucial.

What Is NYMEX?

The New York Mercantile Exchange gets to buy billions of dollars worth of oil, energy carriers, metals, and other commodities for future delivery on the trading floor and through overnight electronic trading computer systems. Market rates are used to determine the prices that consumers pay for a range of goods all across the world.

To acquire this knowledge, you’ll need the right tools. For this goal, we strongly recommend using an API that provides current platinum rates as well as historical rates that contain NYMEX data. You really should choose one that provides fluctuation data so that you can take into account all of the factors when determining the best moment to buy.

About API’s

A platform that allows two devices or programs to communicate with one another is known as an application programming interface (API). While a few services may be useful, keep in mind that not all of them are functioning or give the same information.

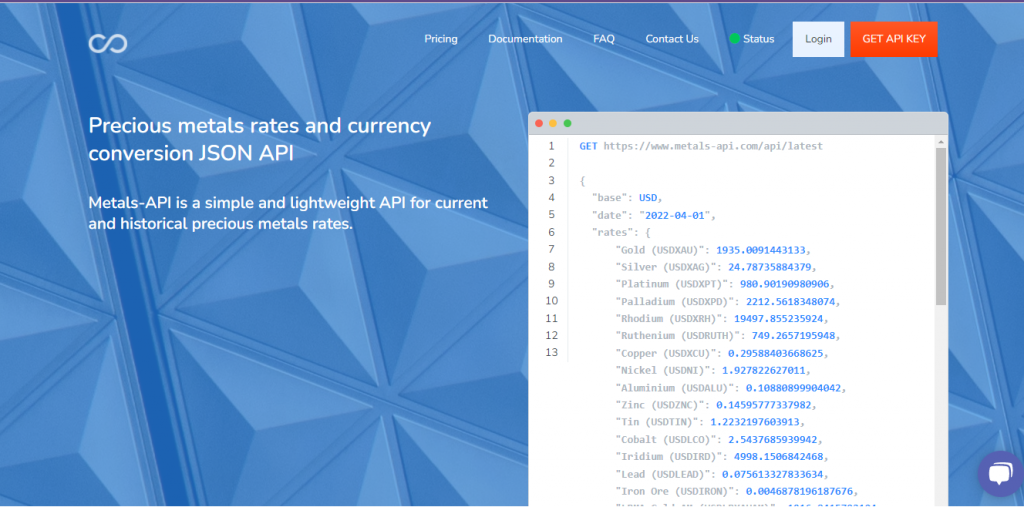

Finding an API is straightforward, but finding one that delivers platinum price in NYMEX values is more difficult. Metals-API is one of the world’s most comprehensive precious metals inventories, and it gathers this information. You may also use the API to integrate it into your website or app and utilize the plugins on the page to gather current and historical rates.

To obtain it, follow these steps:

- Fill complete the form at www.metals-api.com to obtain an API key.

- In the dictionary, look up the symbols you’ll be employing. You can use either your platinum (XPT) or your NYMEX values.

- Use these indicators to add metal and currency to the list before making the API call.

- The transaction is completed when you press the “run” button.

Why Metals-API?

Metals-API is an API that allows you to get real-time metals pricing information. Approximately 170 currencies, including the US dollar, euro, and cryptocurrencies, are accessible at these exchange rates. Regardless matter whether real numbers or historical rates are acquired, this data is recognized.

Price fluctuations may also be utilized to identify the most important reasons for change and the best time to buy. Banks and financial organizations give this information, making it a reliable source. This API is simple to incorporate into websites and apps, and it can be used in PHP, JSON, and Python by developers.