Do you know the uses of Nickel? Did you know that there is an entity that is in charge of measuring Nickel merchants? Learn all about nickel and how to invest smartly through a metals rates API!

Nickel is a silvery-white metal that occurs naturally in the crust of the planet. Nickel is a transition metal, which means it lies in the center of the periodic table. It is the world’s 24th most plentiful element. This means it possesses chemical capabilities that allow it to generate a variety of chemical compounds, some of which are dangerous. Nickel is utilized as a reinforcing component in metal alloys because it is hard but ductile and malleable. It’s also a good heat and electrical conductor.

Baron Axel Frederick Cronstedt accidentally discovered the element in 1751 while extracting it from the mineral niccolite. The Baron’s efforts to extract copper resulted in a white substance rather than the crimson stuff he expected.

Nickel may be found in abundance in the environment, although only in trace proportions. Nickel concentrations in drinking water in the United States, for example, are typically 2 parts per billion (ppb) – that is, 2 parts nickel per billion parts of water (2 micrograms per liter).

Nickel sulfides, oxides, and silicates, for example, are abundant in soil and may be found in larger quantities in a variety of mineral ores. The majority of nickel in soil is strongly linked to other minerals, preventing direct absorption by plants and animals. As a result, it has little impact on human health or ecosystems.

To invest in Nickel, you could use LME which is the London Metal Exchange (LME) is one of the world’s most important commodities exchanges, allowing traders to trade metals options and futures contracts. It also has futures contracts listed on its London Metal Exchange Index (LMEX), which measures the prices of metals traded on the exchange.

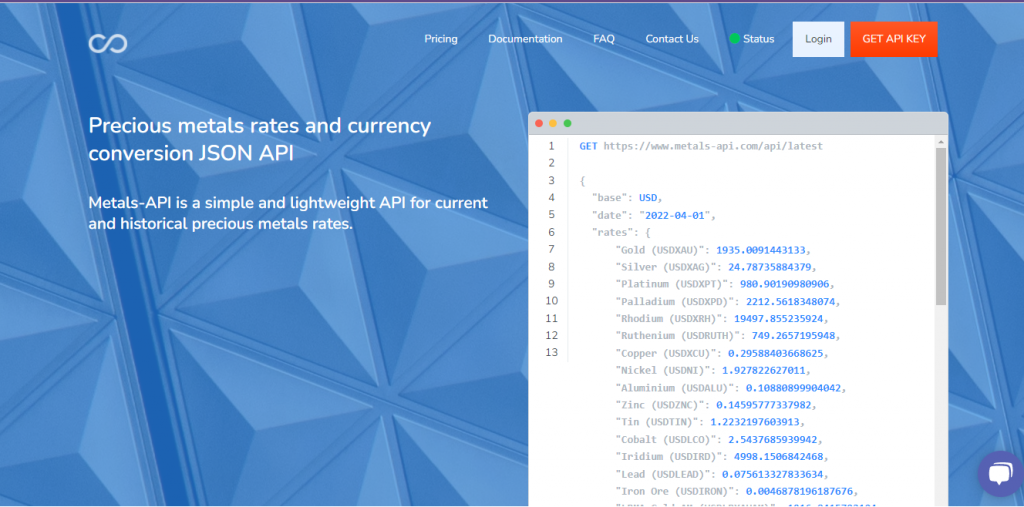

Aluminium, copper, tin, nickel, zinc, lead, aluminum alloys, and premiums are all available for trading and delivery on the LME. The worldwide reference price is based on nonferrous prices identified on our platforms. For the record, 2.5 million tonnes are produced annually, and due to these numbers and the amount of movement of nickel in the market, many traders take refuge in the use of Metals-API.

A Summary Of Metals-API

It’s a handy plugin that allows you see historical and contemporary precious metals prices from banks. The Metals-API is built on a strong back-end architecture and can provide precious metals rate of exchange, shared currency conversions, as well as Time-Series and Fluctuation data.

Registrations Steps

Metals-API It’s a treat to work with. All you have to do is follow the procedures outlined below:

- Create an account and generate an API Key; this code must be kept private because it is needed to make an API request.

- Select your preferred currency and metal.

- Make an API request from the dashboard, and the app will respond with an API response.

Previous Reports

The Metals-API platform allows users to get reports from the year 2019. Between the hours of 5 a.m. and 12 a.m., this must be done. The EOD must be used to enter the data.

Secure Website

To protect the connection from one side of the internet to the other, Metals-API employs 256-bit SSL encryption. Financial institutions frequently employ this type of encrypted communication. By encrypting data transmission between a web browser and a website, this approach secures the connection (or between two web servers).