Is lithium a product for investment in Pakistan? Find out through our post

Lithium is totally recyclable, unlike oil, which is a non-renewable raw resource. In the mineral production cycle, this opens up a new field. At the moment, no attempts have been undertaken by the recycling sector to recover lithium from batteries that have reached the end of their useful life. The recycling industry’s cost-benefit analysis is still insufficient to attract investment.

According to a report published by Waste Management World, the economic expense of recycling batteries outweighs the potential advantages, since recovered lithium costs up to five times as much as lithium generated using the least costly brine-based technology. However, as with practically everything linked to lithium, everything is in the works, and this pricing connection might shift if more affordable recycling solutions emerge.

Tesla constructed a lithium battery manufacturing plant in 2016 and began operations in 2017. By 2020, the facility intends to treble the present global output of lithium-ion batteries, lowering their cost by more than 30%. According to a survey released by Allied Market Research, the worldwide lithium-ion battery market would produce revenue of $46.21 billion in 2022.

According to the report The world market for lithium-ion batteries: potential and predictions 2015-2022, the automotive industry will increase at an annual pace of 11% throughout this time. China, for example, has set a target of five million electric cars by 2020, with Austria, India, the Netherlands, and Norway following closely after.

Lithium metal is gaining a lot of traction in the future, thanks to its use in the battery business for electric automobiles and cellphones. Just look at the market’s wild price swings, which may reach $20,000 per tonne. Its deposit is regarded one of the best in the world in Afghanistan, and it is located in the Chitral area’s Kafristan valley. Some people were successful in extending it into Pakistan.

The lithium-ion battery market in Pakistan is consolidated. Zhejiang Narada Power Source Co., Ltd., Atlas Battery Limited, Phoenix Battery Ltd., and Exide Pakistan Limited are some of the prominent companies. For that, we should tell you to stay really informed about Lithium in Pakistani currency. To stay updated, we could mention you Metals-API.

What Is Metals-API?

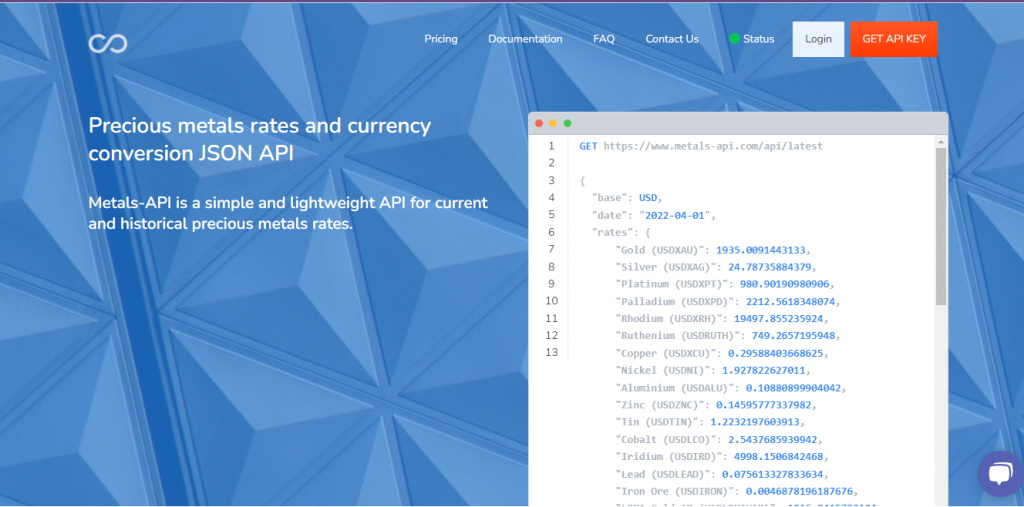

Metals-API It’s a platform that pulls information from roughly 15 reliable sources. Among them are banks and financial data providers. As a result, you’ll obtain a very precise price. This website is the most complete resource available to investors, traders, and anyone else interested in buying, selling, or trading metals since it allows you to locate current global market prices for any metal quickly and efficiently (including lead and gold).

How Does It Work?

Metals-API is unique in that it is quite simple to use. The following requirements must be satisfied in order to do so:

– Register on the site

– Look for product symbols that correspond to the information you want.

– Creates an API based on the currency and product you provide.

Is A Safe Platform?

Metals-API uses 256-bit SSL encryption to safeguard the connection from one side of the internet to the other. This sort of encrypted communication is commonly used by financial organizations. This technique protects the connection by encrypting data transit between a web browser and a website (or between two web servers).

Can You Get Previous Informs?

Users can retrieve reports from the year 2019 using the Metals-API. This must be performed between the hours of 5 a.m. and 12 a.m. The data must be entered using the EOD.