The London bullion market is an over-the-counter wholesale market for gold and silver transactions. The London Bullion Market Association (LBMA), which is informally supervised by the Bank of England, conducts trading among its members. Major multinational banks, bullion dealers, and refiners make up the majority of the members.

The Good Delivery standard, which is a collection of regulations established by the LBMA, describes the physical qualities of gold and silver bars used in market settlement. It also establishes criteria for refineries to be listed on the LBMA Good Delivery List of authorized refineries.

The over-the-counter (OTC) market accounts for the majority of worldwide gold and silver trade. London is by far the most important worldwide hub for OTC trades, with New York, Zurich, and Tokyo following closely after. In recent years, exchange-based trading has risen in popularity, with the Comex in New York and Tocom in Tokyo accounting for the majority of the activity. On the London, New York, Johannesburg, and Australian stock markets, gold is also traded in the form of securities such as exchange-traded funds (ETFs).

Unlike many commodities markets, the gold forward market, like foreign exchange markets, is driven by spot prices and interest rate differentials rather than underlying supply and demand fundamentals. This is because gold, like currencies, is borrowed and traded in the interbank market by central banks.

This motivates central banks to borrow gold in order to earn interest on their vast gold reserves. The gold market is in positive contango, which means the future price of gold is greater than the spot price, unless in unusual situations. This has historically made it an appealing market for gold miners to sell forward and contributed to an active and reasonably liquid derivatives market.

Due to the netting of deals in the preparation of Clearing Statistics, the Gold Anti-Trust Action Committee claims that clearing data significantly understates the total amount of gold moved.

Each year, the LBMA estimates the high, low, and average dollar fixing price per troy ounce for gold, silver, platinum, and palladium, based on the opinions of chosen bankers, traders, and analysts who monitor the precious metals markets. The goal of the LBMA prediction is to reliably anticipate the average, high, and low price for each metal. As a result, we advocate using Metals-API to keep current.

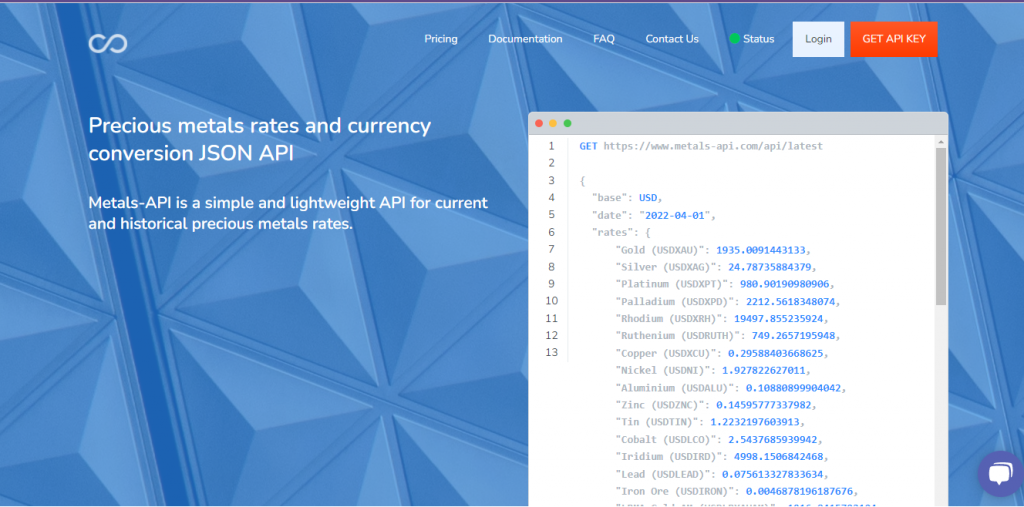

About Metals-API

Metals-API It’s a lightweight program with a basic UI that offers you access to current and historical precious metals pricing from banks. The Metals-API, which is developed on top of a strong back-end architecture, can deliver precious metals exchange rates, convert single currencies, and provide Time-Series and Fluctuation data.

A Simple Platform To Use

Metals-API It’s quite simple to put into action. Follow the steps in this guide to register.

1 – Sign up for an account on the website.

2 – Search for symbols that match what you’ve spoken.

3 – Make an API request with your chosen metals as symbols and the base currency you want to use.

4 – The software will give you a responses; copy and paste the code to get different prices of metals.

Data On Which You Can Rely

Indeed, the Metals-API API may deliver real-time precious metals data with a precision of 2 decimal points and a frequency of every 60 seconds through an API.

Benefits For The Subscription

Metals-API gives you unfettered access to a team of experts who are completely responsible for any errors or issues you face when building or using the API. If you’re still not sure if the Metals-API API is right for you, check out the following resources:

- Features & Plans

- API Customer Service

- Sales Documentation