We recommend using a free API if you want to get gold rates from Mercantile Exchange Nepal Limited, one of the most trusted sources.

Gold is one of the hardest metals on the planet, accounting for between 0.001 and 0.006 parts per million of the earth’s mantle. Global gold mine output in 2020 was 3,478.1 tonnes (122.7 million ounces), a little decline for the second year in a row after consistently increasing for several years. The Covid-19 may have had a part in the delay, but we may also be seeing the impacts of ever-dwindling exploration expenditures.

This raises the question of whether gold has finally achieved its peak. Take, for example, South Africa. The nation was formerly the global leader in gold extraction, extracting nearly 1,000 tonnes in 1970, but its output has since dropped considerably. It was completely removed from the top ten gold-producing rankings last year.

The top 10 gold-producing countries in 2020, beginning with China, the world’s largest producer, and consumer. In alphabetical order, Russia, Australia, the United States, Canada, Ghana, Brazil, Ubekistán, Mexico, and Indonesia are included.

If you want to invest in this metal, you must keep up with gold prices, which are quite erratic. As a consequence, you can’t trust every source on the internet. MEX Nepal is one of the most reputable metals market data sources but is tough to find.

What Exactly Is Mex Nepal?

The Mercantile Exchange Nepal Limited (MEX) is Nepal’s sole exchange that receives technical and business support from market participants. Since its inception, MEX has constantly contributed to the strengthening and extension of Nepal’s commodities ecosystem. The Exchange’s day-to-day operations are overseen by experienced and trained people who have unwavering integrity and expertise. They are all disinterested in doing business.

MEX’s uniqueness may be discovered in many ways. As a zero-debt company, it has adopted globally approved accounting and compliance standards. MEX began trading futures and spot contracts in precious metals, energy, base metals, and agricultural commodities using just order matching technology.

Furthermore, MEX’s research desk is constantly identifying the commodities economy’s hedging demands, and the basket of things is projected to grow even more in the coming days. MEX has also made substantial efforts to raise awareness and influence regulatory changes in the commodities business.

You can use an API to gain access to this information. It is a system that links two or more devices to exchange data. The most significant companies utilize it since they incorporate APIs into their apps or websites. You’ll need one with gold values in this scenario.

This data will be very helpful to you in determining the best time to invest by analyzing price fluctuations caused by a variety of factors over time. You may also monitor spot pricing and share the information with your network. Use Metals-API for this task.

Why Metals-API?

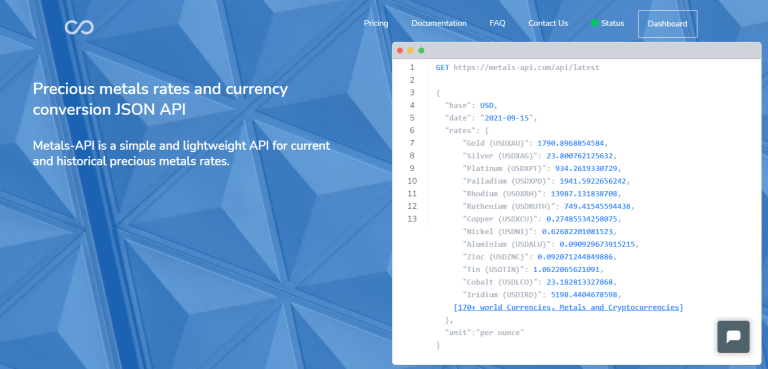

Per-minute, the Metals-API collects exchange rate data from over 15 credible datasets such as the LME or New York Rates. Metals-API only provides midpoint exchange rate data. The Metals-API API can provide precise exchange rate data for Precious Metals in 170 different international currencies.

Metals-API began as a straightforward, lightweight Open-Source API for current and historical precious metals rates supplied by banks. The Metals-API API can offer real-time precious metals data through API with a precision of 2 single-precision and a frequency of up to 60 seconds. Providing exchange rates for precious metals, converting single currencies, providing Time-Series data, fluctuation data, and the highest and lowest price of each day are all possibilities.