If you are seeking gold prices from the Dubai Gold & Commodities Exchange, you gotta read this page!

In its purest form, gold is a brilliant, somewhat orange-yellow metal that is dense, soft, malleable, and ductile. Although it is resistant to most acids, it does disintegrate in aqua regia (a mixture of nitric acid and hydrochloric acid). The intractable nature of gold in nitric acid, which dissolves silver and base metals, has long been used to purify gold and prove the existence of gold in metallic compounds, giving origin to the name acid test. Gold dissolves in alkaline cyanide solutions, which are employed in mining and electroplating. Gold dissolves in mercury, generating amalgam alloys, and this is not a chemical reaction because the gold is just acting as a solute.

Dubai, one of the seven Emirates that make up the United Arab Emirates (UAE), has evolved as a key regional physical gold import, export, and redistribution hub, as well as a gold trading center. The local gold market is made up of considerable gold refining, gold wholesalers and distributors, a sizable gold retail sector, and the advent of gold trading and brokering businesses.

Most gold trading in Dubai is still over-the-counter (OTC), however, the Dubai Gold and Commodities Exchange currently has three gold contracts: a newly established Spot Gold contract, a recently introduced Indian Rupee Gold Futures contract, and a bigger Gold Futures contract that was launched in 2005.

What Is Dubai Gold & Commodities Exchange?

Because Dubai has long been a global hub for the physical trading of not just gold, but also a variety of other commodities, the establishment of the Dubai Gold & Commodities Exchange (DGCX) was the logical next step for the country and its economy. DGCX began operating as the region’s first commodities futures contract in November 2005 and has since evolved to become the Middle East’s leading derivatives exchange.

DGCX’s futures contracts offer sophisticated price risk hedging to physical commodities market participants such as producers, manufacturers, and end-users. Previously, Middle Eastern manufacturers had no mechanism for mitigating pricing risk. Furthermore, DGCX offers trading opportunities to financial institutions and investment organizations in the Middle East and throughout the world who wish to participate in the growing asset class of commodities and currency derivatives.

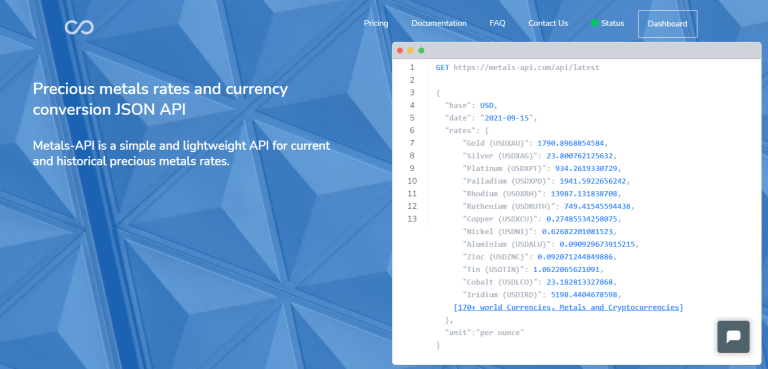

To gain information from this provider, an API might be utilized. It is a gadget that allows two devices to interact and exchange data (cellphones, ATMs, laptops, etc.). However, not all of them provide serious, accurate data, therefore if you want to participate in the gold market, you must use Metals-API.

Why Metals-API?

Metals-API contains information on a wide range of metals, including zinc, gold, palladium, and steel rebar. You may also track the value of these metals in over 170 different currencies, such as USD, EUR, and BTC. It gathers information from well-known financial institutions. COMEX/NYMEX rates are also available. It is also utilized by organizations of all sizes, like Barrick Gold, a worldwide mining company.

This API delivers real-time precious metals statistics with an accuracy of 2 decimal points and a periodicity of 1 minute. Using current and historical prices, you may examine indicators and determine the optimum time to invest. Metals-API may also be used to identify data variances for this purpose.