Are you interested in investing in precious metals? Did you know what fluctuation data is? I learned what it is by reading in the article?

The first point I’d want to touch on is the distinction between strategic and tactical thinking. Not every measure is appropriate for every degree of investigation. Some analytics, like metals, can provide information that changes whole company models, while others simply tell you if your new subject line style is more engaging.

As we talk about this, we refer to the latter sorts of measurements as tactical metrics since they give tactical information. These indicators can help you improve your present operations. Email open rate and click rate are examples of tactical metrics that may be used to improve email marketing campaigns.

Strategic metrics provide information, in this case, for precious metals that may be used to build a marketing strategy or a company plan. Customer Lifetime Value (CLV) and Customer Acquisition Cost are two examples of strategic metrics (CAC). Strategic metrics will be the focus of our talk because they are more difficult to master.

Because of how unpredictable the data is, we may do practically everything correctly in our approach and analysis of this data and yet come up with lousy suggestions. Instead than focusing on the extremes, we should investigate the underlying tendencies.

These swings are a natural result of most major economies’ use of floating exchange rates. A country’s economic performance, inflation expectations, interest rate differentials, capital flows, and other variables all impact in the metals exchange rates.

The strength or weakness of the underlying economy usually determines the exchange rate of a currency. As a result, the value of a currency might change from one moment to the next. As a outcome, investors in metals such as lithium, which is one of the most produced metals in the last year. use services like Metals-API to receive the most up-to-date monetary exchange.

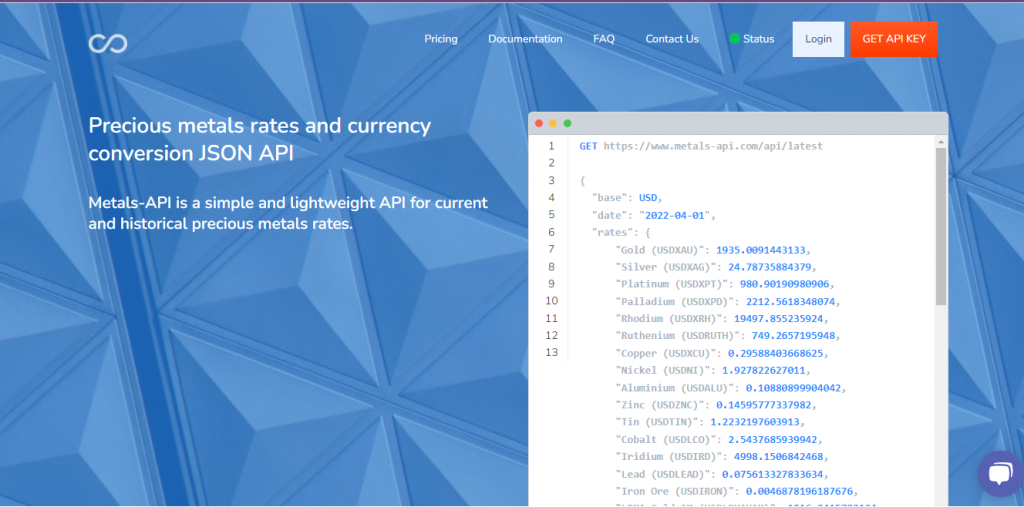

What Is Metals-API?

Metals-API it´s a platform that receives data from roughly 15 reliable data sources. Among them are banks and financial data providers. As a result, your price will be quite accurate. This website is the most complete tool available for investors, traders, and anyone else interested in buying, selling, or trading metals since it allows you to quickly and easily discover current global market prices for any metal (including lead and gold).

How Does The Platform Work?

Simply follow the on-screen directions to get started.

- You may get your own API key by visiting www.metals-API.com.

- Look for the currency and metal symbols.

- Add metal and currency to the list before ending the API call with these symbols. You can choose between programming languages and price ranges.

- You simply press the “run” button after that. The program will display the exchange rates in lithium.

Is It A Safe Site?

Yes, Metals-API employs 256-bit SSL encryption, which is a standardized way for encrypting data transfer between a web browser and a website (or between two web servers) and thereby safeguarding the connection. Metals-security APIs are indisputable since their connection is so close to that employed in banking identification sites.

Are Any Benefits From The Subscription?

Metals-API gives you unfettered access to a team of experts who are completely responsible for any errors or issues you face when building or using the API. If you’re still not sure if the Metals-API API is right for you, check out the following resources:

- Features and Plans

- Customer Service Sales

- API Documentation